FIFO vs LIFO: What are they, and when should you use them?

FIFO vs LIFO: the two heavyweights in the inventory valuation world.

In the red corner, we have First In, First Out, aka FIFO. In the blue corner, we have Last In, First Out, aka LIFO.

Both approaches have their strengths and weaknesses, and the best inventory method for your business depends on several factors, changing over time. This guide will explain the FIFO and LIFO methods and explore when you might want to use each while providing some examples.

Let’s get ready to rumble.

What is FIFO and LIFO?

FIFO is one of the most used inventory valuation methods where businesses try to sell manufactured products in the order they were created.

Companies sell the oldest products first, and the new products shall wait for their turn.

LIFO, on the other hand, is when you first sell the newer products in your inventory while older products remain on warehouse shelves.

FIFO is the standard method modern manufacturing companies use, especially ones that manage perishable goods.

Companies use FIFO and LIFO to calculate the cost of goods sold (COGS).

Tracking the finances while using FIFO means that you charge the older inventory to the cost of goods sold as soon as it’s sold while assessing the remaining expenses of stock left on the shelf at the end of a reporting period.

Meanwhile, the COGS in the LIFO inventory method presumes that the cost of the latest purchased units is higher and the ending inventory balance is lower. Also, if item prices surge, the company will first sell the higher-cost products.

Knowing when to use FIFO vs. LIFO

Knowing when to use LIFO or FIFO gives you a significant advantage in managing your stock and grasping the value of inventory.

In manufacturing, industries that use FIFO generally handle perishables. LIFO is often used in industries where the product has a more extended expiration date, like retail, apparel, or heavy machinery.

In terms of investing in accounting inventory, FIFO is usually a better method for inventory when prices are rising, and LIFO accounting is better when prices fall because more expensive products are sold first.

In terms of tax purposes, FIFO usually results in a higher tax bill because the inventory that is sold first is usually the most expensive. US companies may prefer LIFO when prices rise because it gives them the highest cost of goods sold and the lowest taxable income.

It’s important to note that LIFO is banned under the International Financial Reporting Standards, which are the accounting rules followed in the European Union, Japan, Russia, Canada, India, and many other countries. The United States of America is the only country that allows LIFO because it adheres to Generally Accepted Accounting Principles (GAAP).

FIFO vs LIFO advantages and disadvantages

There are advantages and disadvantages to FIFO (First In, First Out) and LIFO (Last In, First Out) inventory management methods. The key is understanding when each method is appropriate and how it will impact your business’s bottom line.

FIFO advantages:

- Theoretically, the prices of goods sold are closer to the current market price since the first items are usually the first. As a result, this gives you a more accurate portrayal of your inventory costs. That accuracy is important for businesses with rapidly changing prices, such as those in the food industry

- Easier to implement and monitor than LIFO

- When prices are rising, FIFO results in lower taxes because the cost of goods sold is based on the older, lower-cost inventory that’s still on hand

Disadvantages:

- FIFO can lead to distortions in your financial calculations and statements, especially if there are large swings in prices

LIFO advantages:

- It’s easier to value ending inventory using LIFO since you use the most recent costs. That is important if you have a lot of inventory turnover or if prices fluctuate frequently

- In periods of inflation, LIFO costing results in a lower cost of goods sold and, therefore, higher net income. This is because the newest inventory, which costs more, is not recognized as an expense until you’ve sold it

Disadvantages:

- Although LIFO provides a more accurate picture of your current inventory costs, it doesn’t match up well with the physical flow of goods. In other words, the items you purchased most recently are not always the items you sell first. As a result, LIFO can lead to supply shortages and lost sales

- LIFO can be challenging to manage and monitor, particularly if you have a lot of SKUs

- LIFO can only be used in the USA

Get the ultimate guide to inventory management

A comprehensive ebook that covers everything you need to know about inventory management.

Inventory turnover ratio for FIFO vs. LIFO

When we discuss LIFO and FIFO, we should also talk about the inventory turnover ratio.

The inventory turnover ratio is a crucial metric for measuring business performance, and the method you use to value inventory (FIFO or LIFO) can significantly impact your ratio.

The inventory turnover ratio is calculated by dividing the cost of goods sold by the average inventory. The average inventory is calculated by adding the beginning stock to the ending inventory and dividing it in two.

An example of calculating the inventory turnover ratio would look like this:

Let’s say your cost of goods sold for the year is $100,000, your beginning inventory is $10,000, and your ending stock is $15,000.

Your average inventory would be:

$12,500 ($10,000 + $15,000)/2

Your inventory turnover ratio would be: 8 ($100,000/$12,500)

Let’s say you use LIFO instead of FIFO to value your inventory.

If we assume all other factors stay the same, your cost of goods sold would increase because the most recent, and therefore most expensive, items are included in the calculation. This change would result in a lower inventory turnover ratio.

In this example, if your cost of goods sold increased to $105,000, your inventory turnover ratio would be:

8.4 ($105,000/$12,500)

As you can see, the inventory valuation method you choose can significantly impact your inventory turnover ratio.

An example of the FIFO inventory method

Now that you have grasped the basics of FIFO vs. LIFO inventory, let’s move on to practical examples.

Say a manufacturer makes handcrafted vitamin-infused yogurt, a trendy food product for the fitness crowd.

The maker manufactures 4000 yogurts that cost two dollars to produce. At the end of the month, the yogurt company manages to sell 3000 yogurts.

With FIFO, the calculation looks like this:

COGS = (3000 yogurts x $2 FIFO cost) = $6000

The yogurt maker then calculates the cost of inventory that wasn’t sold and is therefore carried over to the next month:

Remaining Inventory Value = (1000 yogurts x $2 cost to make) = $2000

An example of the LIFO inventory method

What happens if the yogurt maker uses the LIFO method instead to gauge inventory value?

The rules are the same. Four thousand yogurts are produced at $2.

This time, the fitness-dairy genius produces another 4000 yogurts. However, the cost of the additional batch is $2.1 per yogurt due to the extra hours the staff put in.

Again, 3000 yogurt units are sold. Calculating cost would look something like this:

COGS = (3000 yogurts x $2.1 LIFO cost) = $6300

The maker still has 5000 yogurt products in stock, 4000 yogurts at $2 and 1000 yogurts at $2.1.

Math says:

Remaining inventory value = (4000 x $2) + (1000 x $2.1) = $10100

FIFO vs LIFO vs weighted average cost

The weighted average cost (WAC) is like the average cost, but with one key difference.

The cost of each item in your inventory is weighted — according to the units in your ending stock.

The formula for calculating WAC looks like this:

WAC per unit = COGS/units available for sale

The weighted average is generally used when prices are stable or changing gradually over time, as is the average cost. You can also use this method to iron out the spikes in inventory costs caused by seasonal sales or disruptions in the supply chain.

However, it’s difficult to calculate since the numbers depend on whether your company has a perpetual or periodic inventory system.

LIFO vs FIFO vs average cost

With average cost, you value inventory and calculate the cost of goods sold using the average price of all the items in your stock.

For example, let’s say you have 100 fidget spinners in your inventory. The first 50 spinners cost $1 each to produce, while the second batch of 50 cost $2 because of a rent increase.

The average cost of each spinner is:

Average cost = ($1 x 50)+($2 x 50)/100 = $1.50

So, the total value of your inventory is:

Total inventory value = (100 x $1.50) = $150

The average cost is generally used when prices are stable or change gradually over time. This method can also smooth out fluctuations in inventory costs caused by seasonal changes or other factors.

The main advantage of an average cost is that it provides a more accurate portrayal of your current inventory costs than either FIFO or LIFO. However, it can be difficult to calculate and manage, particularly if you have a lot of SKUs.

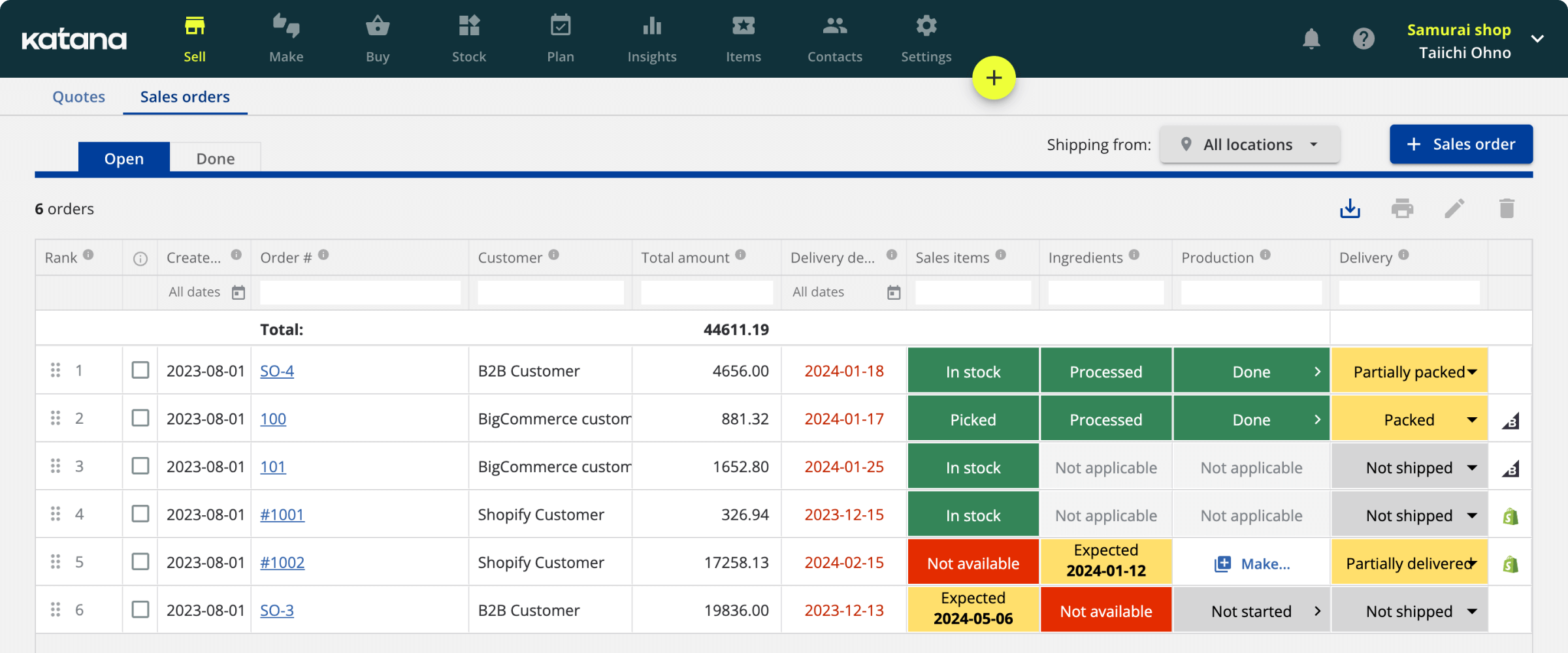

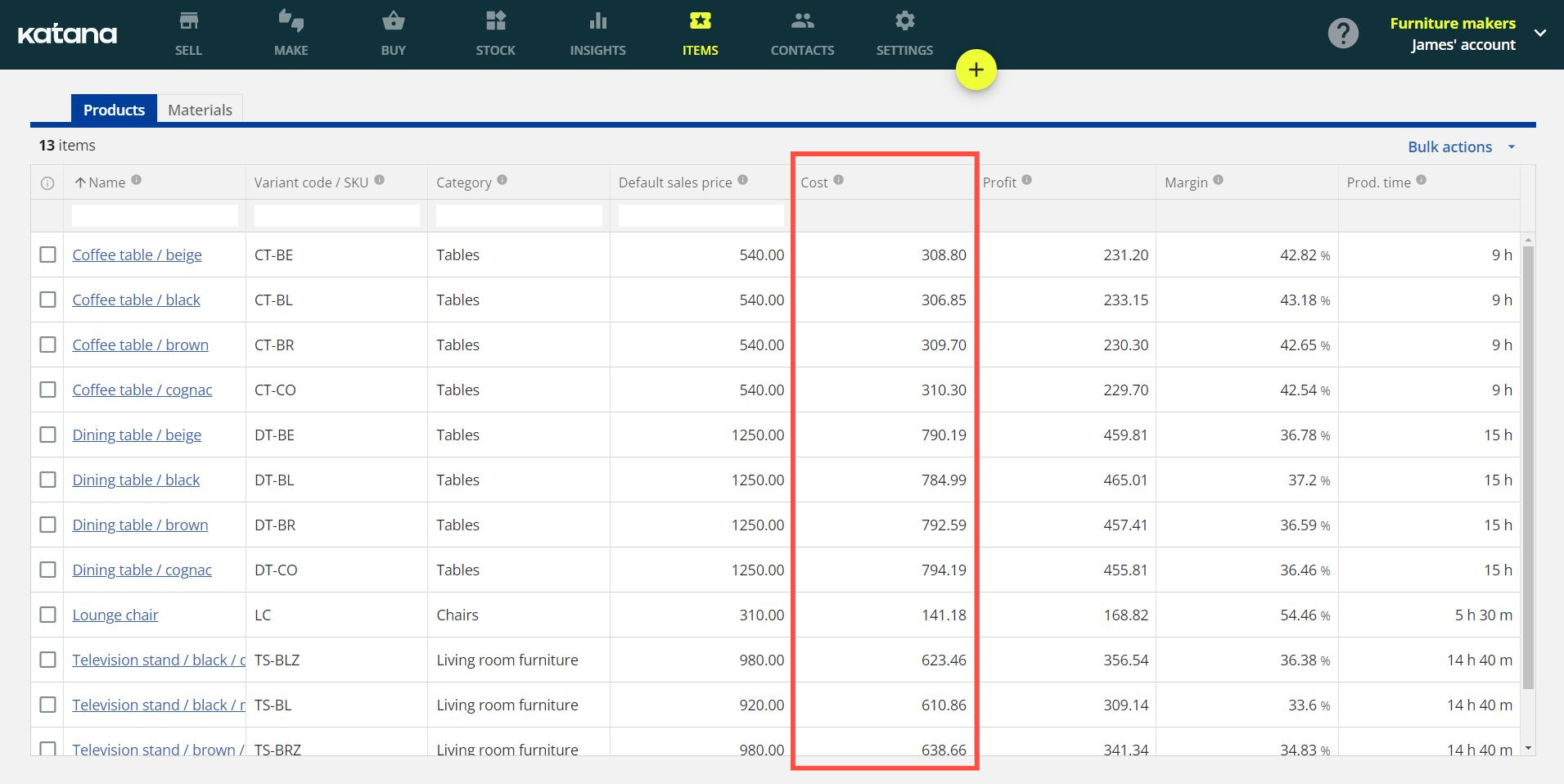

Get inventory valuations without the stress

Katana’s cloud inventory platform is a perpetual inventory valuation solution that uses the moving average cost method for inventory costing. Sign-up and see for yourself how it works.

Are you looking for a tool that does it all for you?

Katana manufacturing ERP is a platform for managing everything related to inventory management and inventory control.

It should be noted that Katana uses the Moving Average Cost (MAC) method for inventory costing.

MAC of products is automatically calculated based on location. This means that the same material or product can have a different moving average cost for each location.

These differences come from various reasons, such as differing purchase prices for materials, varying manufacturing costs, and other motives. Keeping the MAC auto calculation separate means that each location or warehouse you’ve marked down in Katana can maintain independent accounting numbers.

Get started by booking a demo with Katana, and see for yourself how it can give you more visibility into your inventory.

Table of contents

Inventory management guide

More on inventory management

Get visibility over your sales and stock

Wave goodbye to uncertainty by using Katana Cloud Inventory for total inventory control