Inventory accounting: A guide to an efficient warehouse

Welcome to inventory accounting, where the art of balancing numbers meets the intricate network of warehouses and stockpiles. Picture a maze of towering shelves, filled to the brim with products waiting to be accounted for.

Prepare to unravel the secrets of inventory management while we guide you through the twists and turns of this complex world. Sharpen your accounting skills and equip yourself with the tools needed to conquer this labyrinth as we illuminate the path to accurate inventory records, optimized stock levels, and financial success.

What is inventory accounting?

Inventory accounting means tracking and valuing a company’s inventory, consisting of goods held for sale, raw materials used in production, and work-in-progress items. It involves recording, monitoring, and reporting the quantity, cost, and value of inventory items held by a business at any given time.

Accounting for inventory has a few main objectives.

Valuation

Determining the monetary value of inventory on hand is essential for accurate financial reporting. This involves assigning costs to products, including purchase and production costs as well as any additional expenses incurred by bringing the inventory to its present condition and location.

Cost of Goods Sold (COGS)

Calculating COGS is crucial for determining the profitability of a company. Inventory bookkeeping helps determine the cost of inventory sold during a specific period by subtracting the value of ending inventory from the sum of beginning inventory and purchases or production costs.

Financial statements

Inventory accounting provides the necessary information to prepare financial documents, such as income statements and balance sheets. Balance sheets show how much the inventory is worth as an asset, while the income statement includes COGS, affecting your company’s profitability.

Decision-making

Proper inventory accounting allows management to make informed decisions regarding stock levels, purchasing, pricing, and production. Having accurate and up-to-date information on inventory quantities and values helps companies optimize their inventory management and costs.

Download a free manufacturing inventory Excel template

Not ready for cloud inventory software? Download a manufacturing inventory Excel and manage your stock in one powerful spreadsheet.

How to do inventory accounting?

Accounting for inventory is done by tracking and recording the flow of goods in and out of a company.

Here’s a general overview of the process:

- Establish an inventory system — Implement a system to track and record inventory transactions. This can be a manual system using spreadsheets or live inventory management software.

- Determine inventory categories — Categorize inventory based on its nature, such as finished goods, raw materials, or work-in-progress. This helps in organizing and analyzing inventory data effectively.

- Set valuation method — Select a suitable valuation method for your inventory. Common methods include First-In, First-Out (FIFO), Last-In, First-Out (LIFO), or Weighted Average Cost (WAC). The chosen method should be consistently applied for accuracy and comparability.

- Record purchases — When buying inventory, record the transaction by debiting the inventory account and crediting either the accounts payable or a cash account, depending on how you made the payment. Remember to include the cost of the inventory, transportation, and any other relevant expenses.

- Track production costs — If your company produces its own goods, track all manufacturing costs associated with the inventory. This includes direct materials, direct labor, and manufacturing overhead. Accumulate these costs as the items are produced.

- Periodic physical counts — Conduct regular physical inventory counts to verify the quantities on hand. This helps identify any discrepancies between recorded and actual inventory levels. Adjust the inventory records based on the results of the physical count.

- Calculate cost of goods sold — Determine COGS during a specific period. This is typically done by subtracting the value of ending inventory from the sum of beginning inventory and purchases or production costs. Apply the chosen valuation method to calculate COGS accurately.

- Financial reporting — Use inventory data to prepare financial statements, including balance sheets and income statements. The balance sheet reflects the inventory value as an asset, while the income statement affects the company’s profitability.

- Regular audits — Make sure the inventory records match the financial statements and fix any mistakes right away. This ensures that the inventory amount shown in the financial statements is correct.

It’s worth noting that inventory bookkeeping practices may vary depending on the specific industry, accounting standards, and company size. Consulting with a qualified accountant or using inventory management software ensures accurate and efficient inventory accounting processes.

The benefits of inventory accounting

Inventory accounting provides numerous benefits and advantages that can greatly impact businesses in a positive way.

Here are some key advantages.

Accurate financial reporting

Inventory management accounting ensures inventory value is recorded correctly on the company’s balance sheet. This accurate representation of inventory as an asset is crucial for providing a clear and comprehensive view of the company’s financial position.

Cost of goods sold (COGS) calculation

Inventory accounting enables the accurate calculation of COGS. By tracking inventory costs and quantities, businesses can determine the direct expenses associated with producing or purchasing goods for sale. This information is vital for calculating profitability and creating better price points.

Effective inventory management

Inventory accounting provides valuable insights into stock levels, turnover rates, and the overall health of your inventory. By monitoring data, businesses can identify slow-moving items, avoid overstocking or stockouts, optimize reorder points, and make informed decisions about inventory actions.

Decision-making and planning

Accurate inventory bookkeeping data allows businesses to make informed decisions and plan effectively. With a clear understanding of stock levels and costs, companies can adjust production schedules, create purchasing strategies, optimize storage space, and align inventory levels with customer demand.

Cost control and reduction

By closely monitoring inventory costs, businesses can identify areas of inefficiency and implement cost-saving measures. Accounting for inventory management helps identify excessive carrying costs, minimize expired or obsolete inventory, and reduce the risk of stock losses or theft.

Compliance and taxation

Proper inventory accounting ensures compliance with accounting standards and regulations. It provides the necessary data for preparing financial statements, tax filings, and audit requirements. Accurate inventory records also assist in complying with specific industry regulations and requirements.

Enhanced forecasting and budgeting

Inventory accounting data helps forecast demand and inventory needs, sales projections, and budgeting. By analyzing historical inventory data, businesses can make more accurate predictions about future trends, plan for seasonal fluctuations, and allocate resources effectively.

Investor and stakeholder confidence

Accurate and transparent inventory accounting practices enhance investor and stakeholder confidence. Precise and reliable information about inventory values and turnover demonstrates good financial management, which can positively impact investor decisions and relationships with stakeholders and partners.

Inventory accounting methods

The most common inventory accounting methods used by businesses are:

- First-In, First-Out (FIFO)

- Last-In, First-Out (LIFO)

- Weighted Average Cost (WAC)

- Specific identification

The choice of inventory management accounting method can significantly impact a company’s financial statements, tax obligations, and profitability. Selecting a specific method depends on various factors, such as:

- Industry norms

- Regulatory requirements

- Tax regulations

- Inventory characteristics

- Management preferences

It’s good to consult an accountant or financial professional to determine the most suitable method for a specific business.

1. First-In, First-Out (FIFO)

The FIFO method assumes that the oldest or first inventory items purchased or produced are the first ones to be sold. In other words, COGS is calculated using the earliest costs, while the ending inventory is valued using the most recent costs. FIFO is often preferred when inventory turnover is high or when dealing with perishable products, most common in the food and beverage, cosmetics, and pharmaceutical industries.

2. Last-In, First-Out (LIFO)

LIFO works on the assumption that the last inventory items purchased or produced are the first ones to be sold. COGS is calculated using the most recent costs, while the ending inventory is valued using the oldest costs. LIFO is often used to minimize taxable income in periods of rising prices, as it assigns higher COGS, resulting in lower reported profits and tax liabilities.

3. Weighted Average Cost (WAC)

The weighted average cost method determines the average cost of all inventory items available for sale during a specific period. It considers both the quantities and costs of each purchase or production. The average cost is then used to determine COGS and the value of the ending inventory.

4. Specific identification

This method involves assigning a particular cost to each individual inventory item. It is commonly used when the inventory items have unique serial numbers or can be easily identified and tracked. Specific identification provides the most accurate cost measurement but may be impractical or time-consuming for businesses with a large number of items in stock.

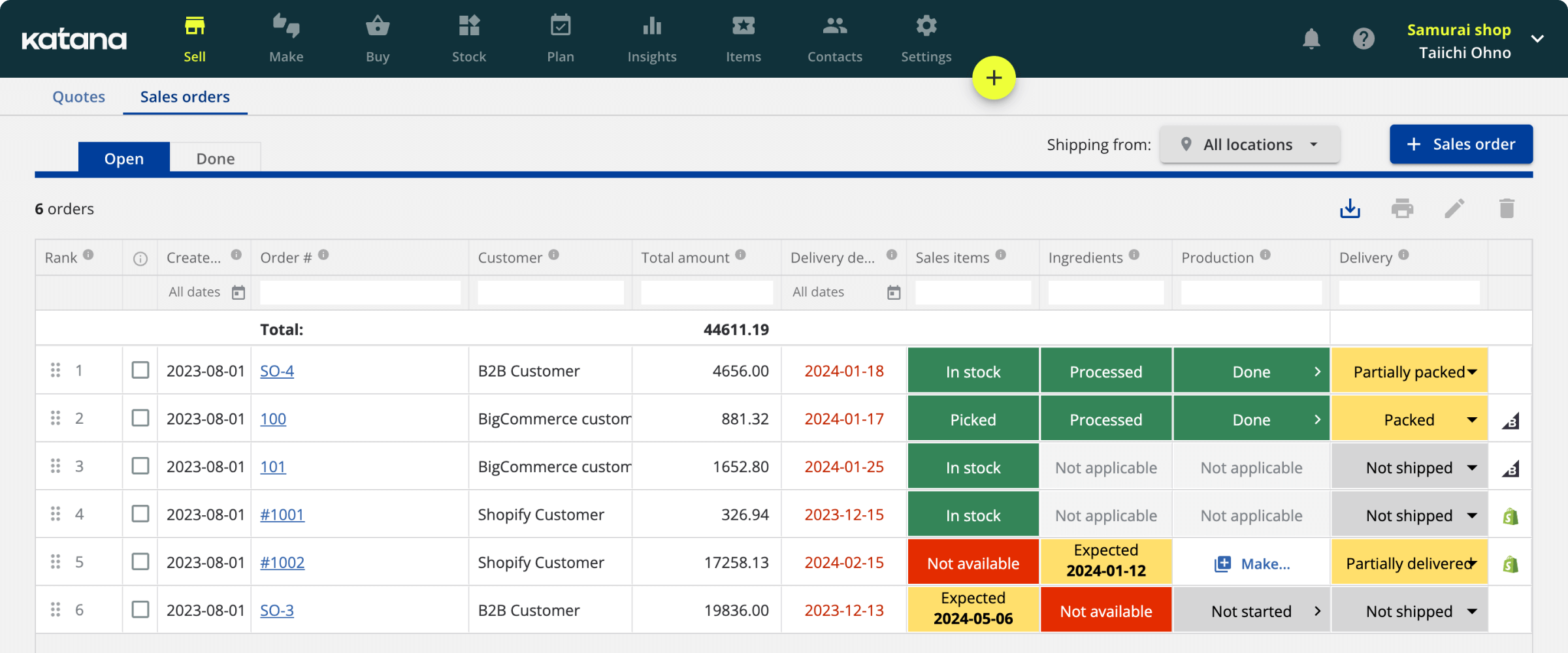

Inventory management accounting with Katana Cloud Inventory Software

Katana is a cloud-based manufacturing and inventory management software for small and medium-sized businesses. Inventory accounting with Katana helps businesses efficiently manage their inventory and streamline their accounting processes.

Katana can help your business in many ways, even beyond accounting for inventory management.

- Effortless integrations with popular accounting software, such as QuickBooks Online and Xero

- Automated recording of inventory purchases, sales, and production activities

- Cost tracking for accurate COGS calculation

- Live inventory updates and synchronization with your preferred accounting software

- Real-time inventory valuation based on accurate and live data

- Reporting and analytics tools for inventory performance analysis and financial insights

- Streamlined inventory accounting processes, reducing manual data entry and potential errors

- Automatic reorder points to alert you when stock on supplies or products is running low

- Inventory and financial data provide a comprehensive understanding of the company’s finances

- Generate accurate financial statements, including balance sheets and income statements

- Improved inventory management through data-driven decision-making

Katana empowers efficient inventory accounting, allowing businesses to maintain accurate inventory records, track costs effectively, and generate reliable financial reports.

And now, armed with all this newfound knowledge, you’re ready to conquer the maze of inventory management. Happy accounting, and may the books be ever in your favor.

Table of contents

Accounting Guide

Get visibility over your sales and stock

Wave goodbye to uncertainty by using Katana Cloud Inventory for total inventory control