How to calculate selling price for your products

Discovering that sweet spot between calculating a selling price and making a decent profit can be quite daunting. This article will help you tackle this challenge and find the best pricing strategy for your manufacturing business.

James Humphreys

Calculating the right selling price is one of the hardest things to get right in any business.

You’ve worked hard manufacturing your goods, and your items are ready to hit the market. But, when it comes to the price you’ve set, are you undervaluing your goods? Or are you way overpricing them?

Failing to get your pricing right can drive away customers and conversions on your e-commerce site.

That’s why we’re sharing a selling price formula in this article so you can learn how to price a product.

The longer you leave this question unanswered, the longer you’ll be losing money. Setting the right price is essential since your efforts will be undone by not focusing on this. By the end of this article, you’ll be able to calculate your selling prices and know all the best techniques for implementing them.

1. What is the selling price?

The selling price, whether of a product or service, is what the customer or client is charged. It’s the price tag on an item you see in a store or the amount you pay when you purchase something online. Beyond just being a number, the selling price is a crucial aspect of the business world.

It’s extremely important to know how to calculate a selling price because if you don’t make a profit while also securing a position in the market, your business won’t survive.

In short, successfully utilizing the selling price formula is a win-win for you and your customer. If done correctly — they get a good deal, and you get a fair price.

For direct-to-consumer brands, you may be able to charge more if your brand image is in high demand, which is what many brands dealing with apparel inventory do, like Adidas or Nike.

Still, you’ll need a solid portfolio of great quality products and a powerful marketing campaign to justify your prices. To ensure high-quality products, take a look at the production quality control checklist.

2. What is the average selling price?

The average selling price (ASP for short) is the price you charge your clients for goods or services.

It’s a key metric that businesses use to evaluate their pricing strategy and performance. It refers to the average price at which a product or service is sold over a specific period of time, usually calculated by dividing the total revenue generated from sales by the total number of units sold.

Understanding the average selling price is essential for businesses because it provides valuable insights into the effectiveness of their pricing decisions.

How to calculate average selling price?

It’s critical to calculate your ASP as it allows you to monitor trends and make predictions on the marketplace. If you’re a start-up manufacturer, it can be a great way to determine a pricing strategy.

To find the average selling price, follow this formula:

Average Selling Price = Total Revenue / Number of Units Sold

Total revenue — Add up the total amount of money generated from all sales of the product or service during a specific period. This figure represents the combined sales value.

Number of units sold — Count the total number of units (products or services) sold during the same period. This number represents the total quantity of items sold.

Divide the total revenue by the total number of units sold. The result will be the average selling price.

For example, let’s say you run an online store that sells T-shirts. During a month, you sold 200 T-shirts, generating a total revenue of $4,000. To calculate the average selling price we divide the total revenue of $4,000 by 200 T-shirts, getting an ASP of $20 per T-shirt.

The average selling price of the T-shirts for that month is $20. This means that, on average, each T-shirt was sold for $20 during that specific period.

Cost Price Vs. Selling Price

Cost Price: The price 3rd party sellers pay and incur for purchasing items from a manufacturer.

Selling Price: The amount at which the 3rd party sells the item to their customers.

NOTE: If you sell directly to consumers, you’ll be looking at the selling price too.

3. How to calculate the selling price of a product — the formula

To cut a long story short, you’re always aiming to make a profit. Otherwise, your business won’t grow.

Now, the longer version. As a manufacturer calculating selling price, you’re going to need first to calculate your cost price, otherwise known as manufacturing cost, using this formula:

Cost price = Raw Materials + Direct Labor + Allocated Manufacturing Overhead

Let’s say the cost price of an item is $50.

You need to charge more than this figure to make a profit. However, a rule of thumb is to add a 25% mark-up — a technique known as cost-plus or mark-up pricing. Your selling price formula will look something like this:

Selling price = Cost price x 1.25

SP = 50 x 1.25

In this case, the selling price would be $62.50. However, you need to consider other factors, such as:

- Competitors prices

- Are you selling premium or value products

- Your marketing tactics

Overall, balancing these elements will lead you to success and increased profitability.

Pro tip: There’s also an alternative way how to calculate the selling price using your profit margin.

Selling Price = Cost of Goods + (Margin Percentage x Cost of Goods)

With this formula, you can easily determine the selling price for your products while ensuring you achieve the desired profit margin on each sale.

4. Types of selling price calculations

1. Planned profit pricing

Planned profit pricing combines your cost per unit with the projected output for your business.

You can use it to work out if your business will be profitable at your current pricing strategy. If not, you can increase prices or increase output. The flexibility makes it suitable for all manufacturing businesses.

2. What the market will bear (WTMWB)

This pricing charges the maximum (or very close to the maximum) for what the market allows.

If an item costs $100 to manufacture, and the most a customer will pay for it is $500 — this is the market limit. This is a pricing strategy that can lead to the highest profit margins. But beware — this is not a sustainable strategy — charging at the upper limits of what the market can bear leaves the field open for a wily competitor to undercut your prices easily.

In short, it leaves you vulnerable to your competitors’ pricing strategy.

3. Gross profit margin target (GPMT)

After you know how to determine the selling price, you can work out the GPMT of your business.

Say a company has $10,000 in revenue, and the cost of goods sold (COGS) is $6,000. $10,000 minus $6,000 leaves you with a $4,000 gross profit. Dividing this with the original $10,000 leaves you with a gross profit margin of 0.4 or 40%.

Many manufacturing businesses aim for a GPMT of at least 20%, but this depends on your industry and costs. You can use this metric to analyze progress to your ideal gross profit margin and adjust your pricing strategy accordingly.

Gross Profit = Total Revenue – Cost of Goods Sold

Gross Profit Margin = Gross Profit / Revenue

4. Most significant digit pricing

This is why a retailer is more likely to price a product at $19.99 rather than $20.00.

Customers are more likely to make a purchase when it is $19.99 because our brains tell us — “Less than $20.00? It’s a bargain.” Other industries tend to use this technique, such as those in real estate. You can try it yourself.

Take the previous price of $62.50. Would $59.95 be the more enticing price that leads to higher profits?

5. How to find the best pricing strategy

If your pricing strategy is the same as your competitor’s, then it’s like missing out on utilizing a helpful tool.

Like it or not, customers infer a lot of information about your business from your prices. Another thing — the results of price changes are not always linear. For example, a company could raise its prices by 1% and see overall profits increase by far more than that, even if demand remained the same.

The best strategy you can apply is a flexible one.

For example, WTMWB (What the Market Will Bear) is better during short periods when you need to recoup costs quickly, such as releasing a new SKU after a period of research and development. Cost-plus pricing is how to find the selling price per unit. In contrast, GPMT helps you decide if this approach can scale up.

Once you come up with a suitable price, you can apply the most significant digit pricing.

Commit to changing your price for a set minimum time and stick to that plan. Don’t keep changing prices, as this could reduce your customers’ trust in you.

6. Pricing strategy case study

Let’s use the example of furniture manufacturers to illustrate the steps to finding a pricing strategy.

You know your manufacturing costs and resources spent, but is this enough to add a markup and call it a day? Definitely not. Pricing is contingent on the current state of the marketplace and where your products fit into it.

First, you need to understand your market.

Do all the research you can on the criteria of furniture pricing. These could be:

- Direct-to-consumer prices

- Wholesale prices

- Consignment prices

- Any area that deals with selling furniture inventory

You need to figure out how your product fits into the current landscape.

It’s good to set a minimum price that you will not go below. If you think of boundaries like this, it helps you think clearly in the stressful tasks of pricing and negotiation. Don’t undersell yourself or go below your minimum price.

7. Pricing strategy quickfire tips

- Have a strategy, and stick to it

- Use pricing analytics to record manufacturing trends and predict future market changes

- Look at the whole picture, not just on a transaction-by-transaction basis

- Adopt a value-based approach to customer satisfaction

- Don’t use a one-size-fits-all approach to pricing. Be adaptable. Create pricing plans and product variations for customers with different needs

With these tips and some flexibility, you can steer your business straight to greater profits and customer satisfaction.

8. How to calculate the selling price with Excel

Now you know why finding the right pricing strategy for your business is so important.

But it’s just as important to find the best software to figure out how to determine the price of your products. Solutions like Excel can be an incredibly valuable tool for businesses when it comes to calculating the selling price. It offers various functions and features that make the process more efficient and accurate.

Here are some ways Excel can assist with calculating the selling price:

- Easy formulas — Basic arithmetic operations in Excel allow users to create custom formulas. It’s simple to set up a formula to calculate the selling price based on factors like COGS, overhead costs, and desired profit margin.

- Flexibility — Excel offers the flexibility to change input values quickly. Adjust your costs or profit margins and instantly see how it affects the selling price. This way, you can explore different pricing scenarios and find the most suitable option for your business.

- Time efficiency — Save time and effort compared to manual calculations with Excel’s automatic calculations. Once the formula is set, it can be applied to multiple products or services.

- What-If Analysis — Using Excel’s “What-If Analysis” tools allows you to project outcomes based on various input values. This helps assess how changes in costs or profit margins impact the selling price and overall business profitability.

- Data visualization — Excel offers charting and graphing options to visualize pricing data. These visuals help compare selling prices, track customer trends, or analyze the value of different products.

- Precision and accuracy — Excel handles large quantities of data and complex calculations, accurately determining selling prices.

- Trend and demand analysis — By organizing past selling prices and sales data, Excel facilitates analysis of historical trends and patterns, aiding data-driven pricing decisions.

- Availability — Excel is widely available and commonly used across industries, making it a convenient choice for selling price calculations for any business.

9. Combine a great selling price strategy with manufacturing software

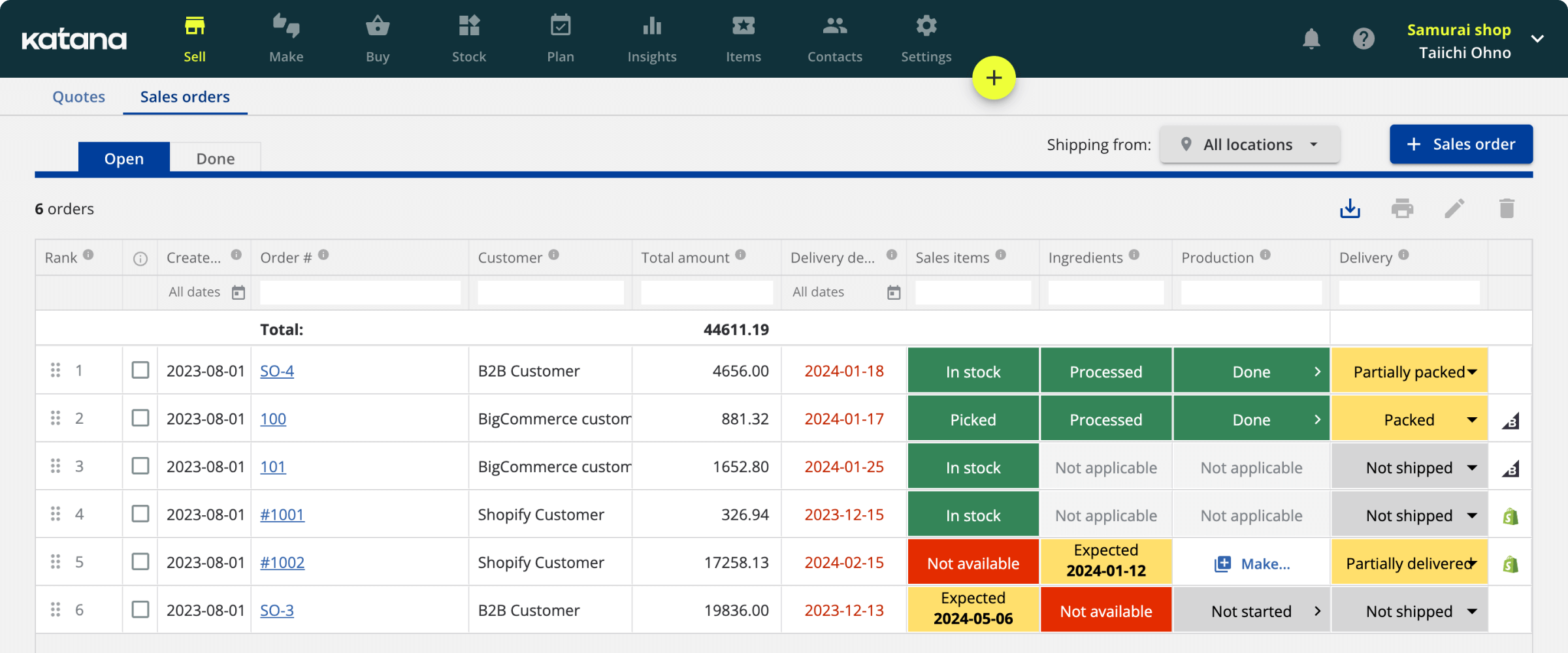

Performing audits manually or in a spreadsheet that needs regular updating can slow down your business or even reveal that you’ve been pricing your items incorrectly. The best solution to determining how to calculate the selling price is to adopt a cloud-based manufacturing system with real-time monitoring and automatic cost price calculations, such as Katana.

Katana helps manufacturers take control over their production, carrying costs, and work-in-progress costs, but also helps with calculating selling prices by looking into:

- Your material costs

- Production operation costs

This will allow you to quickly get a better overview of your costs and make better pricing decisions.

You can check out the video below for a better understanding of how to track the costs of materials and products in Katana.

Surely, by now, you’ve figured out a few tips and tricks on how to skyrocket your business and profits. So go, grab that calculator, and put the formulas to good use. Just don’t forget us when you’re a hot-shot enterprise with billboards around the world.

James Humphreys

Table of contents

Get inventory trends, news, and tips every month

Get visibility over your sales and stock

Wave goodbye to uncertainty by using Katana Cloud Inventory for total inventory control