A guide to days inventory outstanding (DIO)

Inventory management is one of the most critical things to get right for any manufacturing business. Maintaining the proper level of inventory ensures that production can continue uninterrupted while also avoiding the high costs associated with housing finished goods far longer than necessary.

Keeping track of all the different acronyms and initialisms can be extremely difficult for some. While live inventory management software can help sort things out, it’s even more useful for owners and operators to understand these key terms. One such term is days inventory outstanding, or DIO, as it is often called.

If you’ve never heard of DIO before, don’t worry. In this guide, we’ll break down everything you need to know about this helpful metric, including:

- What does DIO mean?

- What is the DIO formula?

- How do you interpret DIO?

- What is a good DIO number?

- How can you create a low DIO ratio?

Read on to learn all there is to know about days inventory outstanding.

What is days inventory outstanding?

Days inventory outstanding (DIO), also known as days in inventory, is a metric used to measure the average number of days that a company’s inventory remains unsold. In other words, it tells you how long a product sits on shelves before a customer buys it.

Understanding the days inventory outstanding definition is important for a few reasons:

- It can be used to assess how well a company is managing inventory processing. If the inventory is turning over quickly, that’s usually a good sign. However, if products are sitting on shelves for too long, it could be an indication that the company is overproducing or that demand has decreased.

- DIO can also be used to compare a company’s performance to that of its competitors. A lower DIO ratio usually indicates that a company is doing a better job of managing inventory.

- Finally, DIO can be a helpful tool for forecasting future sales. If the DIO trend is increasing, that might be an indication that future sales will decrease.

Importantly, DIO should not be confused with days sales outstanding (DSO), which is a similar metric that measures the number of days it takes a company to collect payment after making a sale, or days payables outstanding (DPO), which measures the number of days it takes a company to pay invoices or creditors.

Both DSO and DPO are important metrics, but they provide different information.

Inventory turnover vs days inventory outstanding

Another term, inventory turnover, is also often conflated with days inventory outstanding. However, these two terms are not the same.

Inventory turnover is a metric that measures the number of times a company’s inventory is sold and replaced over a given period. In other words, it tells you how often inventory levels are replenished.

A high inventory turnover is generally seen as being good since it indicates that products are selling quickly and that not too much cash is tied up.

In contrast, a low inventory turnover might be an indication that products aren’t selling as quickly as they could be or that the company is carrying too much inventory.

It’s important to remember that days inventory outstanding and inventory turnover are two different metrics that provide different information. DIO measures how long it takes to sell inventory, while turnover measures how often inventory is sold.

Thus, you want a high inventory turnover ratio and a low DIO.

How to calculate days inventory outstanding

If you’re wondering how to find days inventory outstanding for your own business, it’s quite easy.

Days inventory outstanding (DIO) formula

The formula for days inventory outstanding is pretty simple:

DIO = (Average Inventory/Cost of Goods Sold) x Days in Period

Where:

- Average Inventory — Measure the average inventory value throughout the given period by adding the beginning and ending inventory, then dividing by two

- Cost of Goods Sold (COGS) — The cost associated with producing the items that a company sells during a given period

- Days in Period — The number of days in the time period being measured (usually a month or a year)

It’s important to note that the DIO formula only works if you use consistent accounting methods and period lengths. For example, if you’re measuring DIO for a month, you need to make sure that both your ending inventory and cost of goods sold numbers are for that same month.

Days inventory outstanding example

Let’s look at an example.

Welcome to ThriftyShoes, our discount shoe manufacturing company. We make and sell shoes for both men and women.

We just completed our first month of operations, and we need our days inventory outstanding calculation. Here are the relevant numbers.

- Beginning inventory: $12,000

- Ending inventory: $8,000

- Cost of goods sold: $30,000

- Days in period (month): 30 days

We must first find our average inventory:

Average inventory = ($12,000 + $8,000) / 2 = $10,000

Plugging those numbers into the formula, we get:

DIO = ($10,000 / $30,000) * 30 days = 10 days

So, in our first month of operations, our DIO was 10 days.

How to use the days inventory outstanding ratio

Now that we know how to calculate DIO, what can we do with this information?

Generally speaking, the lower a company’s DIO, the better. A low DIO number means that a company is able to sell through its inventory quickly and efficiently. This is good for two reasons:

- It minimizes the costs associated with carrying inventory (e.g., storage costs).

- It maximizes sales and profit margins because customers are more likely to buy a product that is available now than one that will be available in the future.

That said, there are a few things to keep in mind when conducting a ratio analysis:

- The industry average DIO can vary widely — For example, companies that sell perishable goods (e.g., food) will have a very different DIO than companies that sell durable goods (e.g., cars). As such, it’s important to compare a company’s DIO to the average DIO for its specific industry.

- The goal should be to have a DIO lower than the industry average — However, it is also important to make sure that you don’t have an excessively low DIO, as this can indicate that the company is not keeping enough inventory on hand to meet customer demand.

- A company’s DIO can vary over time — This is to be expected. As a company grows, or its supply chain is affected, inventory needs will change. As such, it’s important to compare a company’s DIO to its historical data, along with that of competitors.

How to improve days inventory outstanding for your business

Part of the challenge many small and mid-size enterprises face is that they lack visibility into their larger businesses’ inventory. This can make it difficult to know where to start when trying to manage outstanding inventory.

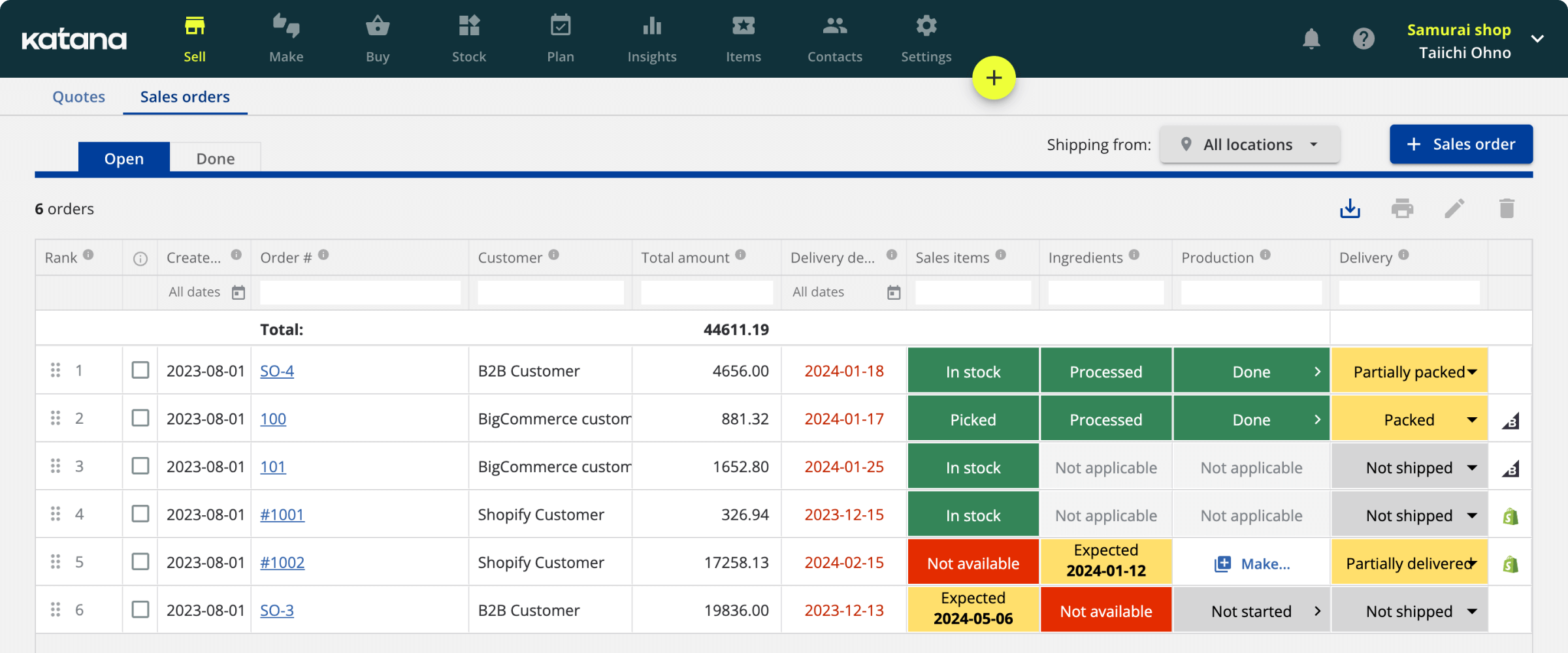

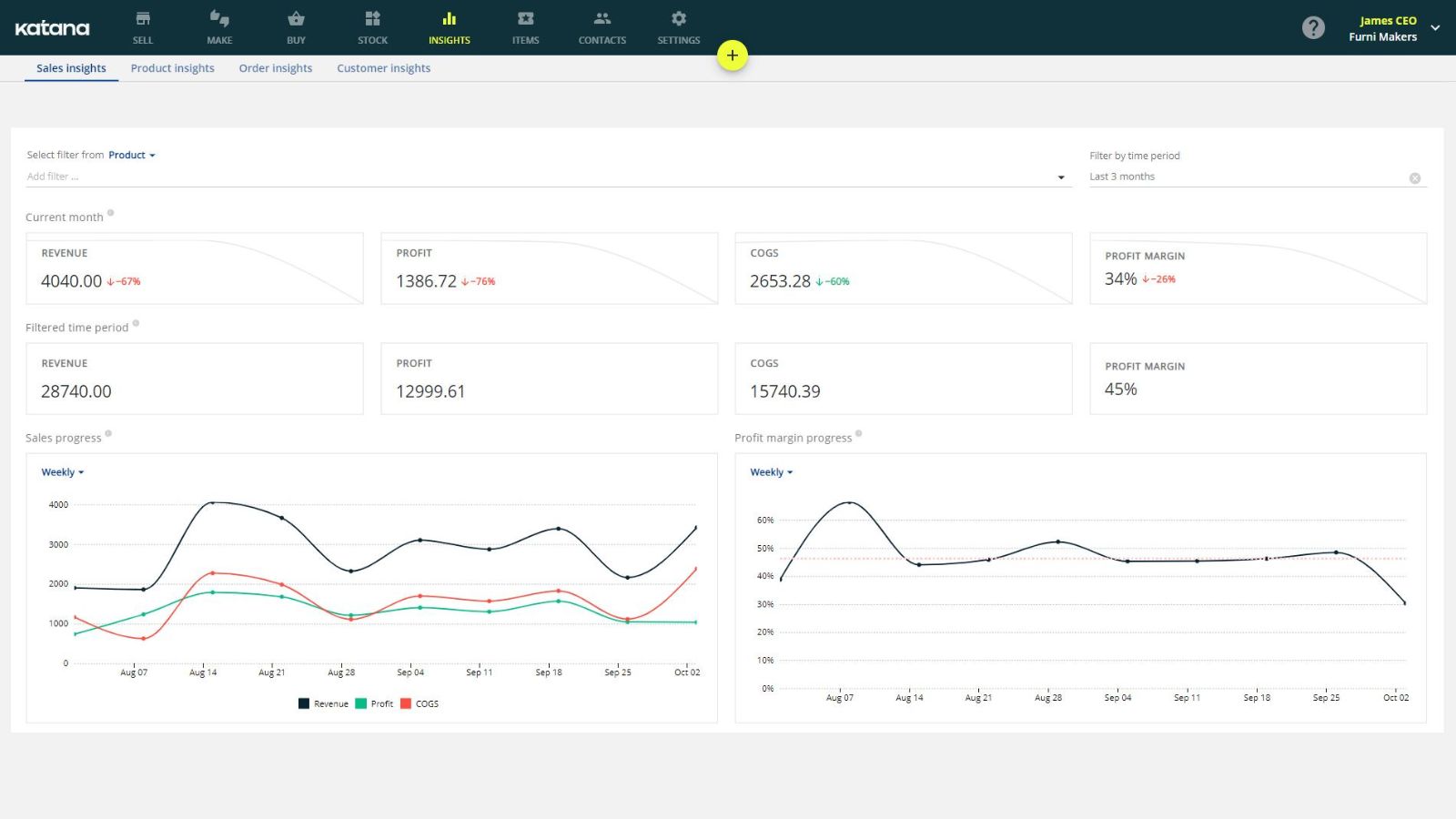

With an ERP software solution like Katana, you can get full visibility into your inventory at all times. This means that you’ll always know exactly how much you have on hand, what’s selling quickly and what’s not selling at all.

Armed with this knowledge, you can make changes to your inventory management strategy to improve DIO.

If you want to start optimizing today while also integrating financial accounting, reports, and statement analysis, book a demo with us and see how our software can help you take control of your inventory.

Table of contents

Inventory management guide

More on inventory management:

Get visibility over your sales and stock

Wave goodbye to uncertainty by using Katana Cloud Inventory for total inventory control