Inventory valuation methods: The best tool for checking inventory

Inventory valuation methods are essential to inventory management, allowing you to calculate the cost of goods sold (COGS) and put a value on your remaining inventory levels.

Counting your inventory at the end of a period is no fun task, especially when there are some 10 methods of inventory valuation. No one wants to do it, and there’s no enjoyment in it, but as once said in an inspirational YouTube video:

You got to make your bed.

Some former Navy SEAL

So, in this article, we’re going to look at what are inventory valuation methods, some of the inventory valuation methods examples, and the best tool for making them work.

What is inventory valuation?

Inventory valuation is the process of determining the cost of goods on hand at the end of an accounting period. The cost is then used to report the value of a company’s inventory on its balance sheet.

Inventory valuation is done periodically, usually at the end of each accounting period. The inventory must be valued using the method that best reflects a company’s cost structure and is most commonly based on the first-in, first-out (FIFO), last-in, first-out (LIFO), or moving average cost (MAC) methods.

Why is inventory valuation important?

Inventory valuation is important because the cost of goods sold for the period is based on the value of the inventory at the beginning of the period. So the accuracy of the inventory valuation affects the accuracy of the cost of goods sold, which in turn affects the gross profit reported for the period.

It’s also worth noting that production costs change over time due to inflation or bottlenecks on your shop floor, and these methods allow you to work out the actual value of your products.

What are the methods of inventory valuation?

Inventory valuation methods are an essential inventory management practice of applying a monetary value to a manufacturer’s products that make up their inventory at the end of a reporting period.

The idea is that the costs to manufacture products change over time. Performing one of the many inventory valuation methods allows you to allocate costs correctly to your sales and your remaining inventory.

So, when looking at the purpose of inventory valuation methods, you need to understand how these are calculated.

The key aspect of the inventory method is calculating your cost of goods sold and your current inventory levels at the end of a reporting period.

Regardless of which inventory method you decide to use, it doesn’t include the administrative or selling costs of inventory.

However, the costs that are associated with inventory valuation methods are:

- Manufacturing costs

- Raw materials

- Manufacturing overheads

- Transportation

- Handling

- Any import duties

So, you know the purpose of inventory valuation methods but now comes the difficult part: actually choosing a method. Let’s look at some more popular methods of inventory valuation with examples, along with their advantages and disadvantages.

(FIFO)First-in-first-out

First in, first out is probably one of the most utilized inventory valuation methods used by modern product-making businesses, especially ones that handle perishable goods.

When practicing FIFO, a business aims to sell the products they manufacture in the order they were created. To simplify the process, your oldest products in stock are the first to be sold.

Tracking the finances of FIFO means that you simply charge the older inventory to the cost of goods sold as soon as it’s sold and calculate the remaining costs of inventory left on the shelf at the end of a reporting period.

An Example of FIFO

There’s an entrepreneur who makes T-shirts with some post-modern slogan that they believe will sell like hotcakes.

The maker manufactures 100 T-shirts that cost $10 to produce. At the end of the month, the trendy designer sold 34 shirts.

Using FIFO, the calculation would look like this:

COGS = (34 T-shirts x $10 FIFO cost) = $340

Then the business will need to calculate the cost of inventory that wasn’t sold and is carried over to the next month:

Remaining Inventory Value = (66 shirts x $10 cost to make) = $660

Advantages and disadvantages of using FIFO

The four distinct advantages of using inventory valuation methods such as FIFO are:

- It’s effortless to apply

- The flow of costs corresponds with the actual physical flow of goods

- It eliminates the chance of manipulating income

- The balance sheet is more likely to approximate the current market value

FIFO removes the cost from the oldest units in inventory as soon as the company sells them.

These advantages experienced from using FIFO to manage inventory mean any products produced toward the end of a period don’t affect the COGS or net income.

However, a disadvantage to using FIFO includes the recognition of paper profits and a bigger tax burden if used for tax purposes in a period of inflation.

Last-in-first-out (LIFO)

Last in, first out is the complete opposite of FIFO. When using the LIFO method, the newest inventory is sold first, with the older inventory sticking around on your shelves.

So, as the costs of manufacturing increase, the COGS in the LIFO inventory method assumes that the cost of the latest units purchased is higher and the ending inventory balance is lower.

But, before we move on, FIFO vs. LIFO, a rule of thumb is that if you’re going to practice one of these inventory valuation methods, FIFO is perfect for those who have a short expiry date on their products and inventory with a long life is better suited for LIFO.

An example of the LIFO method

Let’s use the above genius entrepreneur who repurposes memes by printing them on T-shirts for financial gain. Using the same example, the T-shirt maker has decided to use the LIFO method instead.

The protagonist again produces 100 T-shirts at $10 each. But this time, they make additional 100 T-shirts. However, due to inflation, the second batch costs $12 per shirt.

Again, the T-shirt maker is only able to sell 34 T-shirts. The formula for the LIFO method would look something like this:

COGS = (34 shirts x $12 LIFO cost) = $408

The maker has 166 shirts in stock, 100 shirts at $10 and 66 shirts at $12, meaning:

Remaining Inventory Value = (100 shirts at $10) + (66 shirts at $12) = $1,792

Advantages and disadvantages of using the LIFO method

You might be wondering why someone would use this method of inventory valuation. The biggest advantage to using LIFO, especially during periods of inflation, is that the newest costs charged to COGS are also the highest costs.

Companies who like to use the LIFO method believe it leads to a better matching of costs and revenues. This is because the income statement reports both the sales revenue and COGS in the current value of the selling price.

However, the disadvantage of using the LIFO method is that if you’re a manufacturer who handles perishable goods, this method isn’t viable.

The other issue manufacturers will face is that selling your newest inventory will potentially generate dead stock and increase your carrying costs.

Confirm with your accountant

Before you change your valuation methods, be sure to confirm everything with your accountant, so you wouldn’t accidentally get to the wrong side of local tax authorities.

International Financial Reporting Standards (IFRS) and The Accounting Standards for Private Enterprises (ASPE) prohibit the use of LIFO, as it can distort the company’s profitability. Though, LIFO is allowed under generally accepted accounting principles (GAAP).

Moving average cost (MAC)

Moving average cost is a costing method used under the perpetual inventory system. When using MAC, you essentially work out the costs of your inventory in real time. So, when you finish production on an item or purchase more material, the value of the new order is added to your inventory, then divided by your current inventory levels.

An Example of Moving Average Inventory Costs

For old times’ sake, let’s once again use the example of the T-shirt maker and their final inventory level when finishing the two batches during one period.

Instead, this time, the T-shirt maker has sold 34 shirts from their first batch of 100 (valued at $10) and just finished their second batch (which cost $12).

Once you have your new inventory levels, you use your new total stock value and divide it by the total amount of inventory to get the total average cost of your inventory.

So, using the MAC method, the theory will look something like this:

COGS = (66 T-shirts at $10) + (100 T-shirts at $12) ÷ 166 T-shirts = $11.20

Advantages and Disadvantages of Using MAC

The biggest advantage of using MAC is that it’s a straightforward way to track inventory expenses compared to other inventory costing methods.

You can store inventory regardless of which batch it belongs to. Once you’ve taken units out of inventory, you don’t need to track their original costs before pricing them. Using MAC, you simply mark up the average price of the units, making picking and pricing your inventory hassle-free.

However, an issue with using inventory valuation methods, like moving average inventory cost, is that it assumes that your products are identical, which for the most part, is not the case.

To use MAC appropriately, you will need to track the average costs of your entire inventory and the different types of tools you use.

Want to see Katana in action?

Book a demo to get all your questions answered regarding Katana’s features, integrations, pricing, and more.

What inventory valuation method should I use for my business?

After all this in-depth analysis of these inventory valuation methods for manufacturing companies, you’re probably scratching your head and wondering which inventory valuation method is the best.

And we have the answer — it depends. There is no best inventory valuation method, but there is one that best fits your business.

MAC is the middle-ground approach for a lot of companies looking to implement one of the inventory valuation methods. Though, for many manufacturers, it boils down to one of the two methods, FIFO vs. LIFO.

But the thing is, outside of regulations, when picking between FIFO vs. LIFO, it all depends on the type of products you manufacture.

If your company handles things such as auto parts, construction equipment, farm equipment, alcohol, hardware, apparel, furniture, and basically any product that can hang around on your shelf, then the LIFO method is a good way of valuing your current assets.

But, you should also consider that your inventory costs are likely to increase because your higher-cost items are sold first, meaning some items could become stuck in your warehouse’s inventory.

If your business handles perishable goods, anything with a short shelf life, or products that can quickly become archaic inventories, then FIFO is the way to go.

However, with FIFO, you’re more likely to get an accurate cost because it assumes your older less-costly items are sold first.

Though there are regulations that you need to follow depending on your trade, and you’ll need to check before implementing one of the methods. Therefore, you need to ensure your financial reporting standards allow you to practice whichever inventory valuation method you intend to use.

Once you know which one you’re going to rock and roll with, you’re going to need to find a platform that can help you keep your inventory under control.

Using Katana to manage inventory valuation

Regardless of which inventory valuation method you choose, finding the right tool which can help you track and monitor your inventory levels is the key to making it work. Otherwise, you may get stuck counting your inventory by hand and using inefficient Excel spreadsheets to make your calculations.

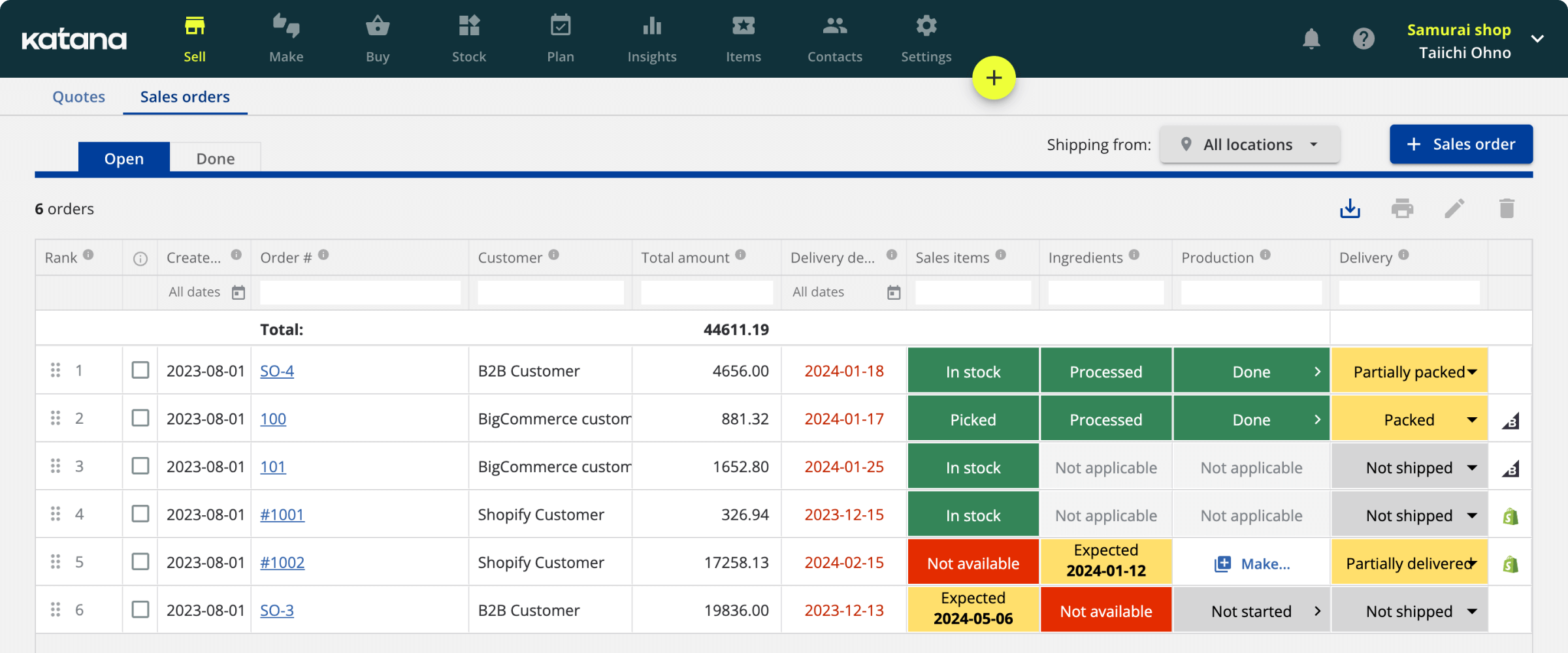

Katana’s manufacturing ERP software has been designed for scaling manufacturers. Katana uses the MAC method and has been built to aid any maker regardless of their manufacturing processes. This allows you to get the most current valuation on your inventory levels for each product type.

Katana comes equipped with the following features:

- Real-time master planner — Katana monitors your inventory movements in real-time, meaning your available raw materials and finished goods are automatically allocated to open orders as soon as they’re generated

- Live view of inventory and costs — Katana gives you a breakdown of manufacturing costs, COGS, and the value of remaining products in stock to help you understand your inventory levels at the end of a reporting period

- Visual and modern interface — The intuitive user interface helps you easily navigate your entire business, from selling to manufacturing, to get an overview of your company from one centralized point

- Integrations — Katana integrates with the best business tools like QuickBooks Online, Xero, Shopify, and BigCommerce, to name a few, keeps everything synchronized, and allows you to run your business from a centralized platform

Want to see how Katana can simplify your inventory valuation? Request a demo and see the power of automation firsthand and learn for yourself why Katana is perfect for your business when getting more control over your inventory.

Table of contents

Inventory management guide

More on inventory management

Get visibility over your sales and stock

Wave goodbye to uncertainty by using Katana Cloud Inventory for total inventory control