Quickbooks inventory asset: The basics

Despite our best efforts, little accounting mistakes can slip in when managing inventory. QuickBooks gives manufacturers a tool that can help them track their finances and manage other areas of their business. This is why many manufacturers opt to use solutions such as QuickBooks for their accounting and inventory needs.

If you’re a manufacturer that uses QuickBooks for inventory management, you might have already stumbled across QuickBooks inventory assets and might be wondering what it is. This article will explain what is an inventory asset and how you can set up and use them in QuickBooks Online.

Terminology: Inventory and COGS in QuickBooks Online

First, let’s go over some terminology used in relation to inventory assets in QuickBooks Online.

Inventory

Inventory is simply the physical (or, in some cases, digital) goods you have on hand, available for sale to customers.

Cost of goods sold

Cost of goods sold (COGS) is the cost of goods you’ve already sold to your customers. Your gross profit line shows the difference in the value of your total COGS amount and total income amount.

Basically, inventory refers to the goods you haven’t sold yet, and COGS is the cost of goods you’ve already sold.

Current assets

Current assets are short-term assets that a company expects to sell (or otherwise use up, convert into cash, etc.) within a period of one year. Inventory assets are considered to be current assets.

What is a QuickBooks inventory asset?

In QuickBooks Online, inventory assets refer to the inventory items you have at hand and ready to sell. Let’s say that you’re a manufacturer that produces microphones. The number of microphones you currently have prepared and ready for sale would be considered inventory assets.

As inventory assets can be converted into cash through sales (in fact, that’s basically their purpose), they are considered current assets.

You can see the value of your current inventory assets on your balance sheet. You should find your inventory asset accounts under “other current assets.” The value of an inventory asset account is the total value of the inventory assets you have on hand. In other words, if each of your microphones was worth $100, and you had five available at hand, the value of your inventory asset account would be $500.

What is the difference between inventory and inventory assets in QuickBooks Online?

There might be some confusion between the terms inventory and inventory asset as they are often used interchangeably. Both terms refer to the goods a business has available for sale. However, “QuickBooks inventory asset” can also refer to the value of the inventory items in QuickBooks and how they are tracked in the accounting system.

How do I enter an inventory asset in QuickBooks Online?

You can set up QuickBooks Online inventory assets if you have QuickBooks Online Advanced or Plus. Here’s a step-by-step guide on how to do it:

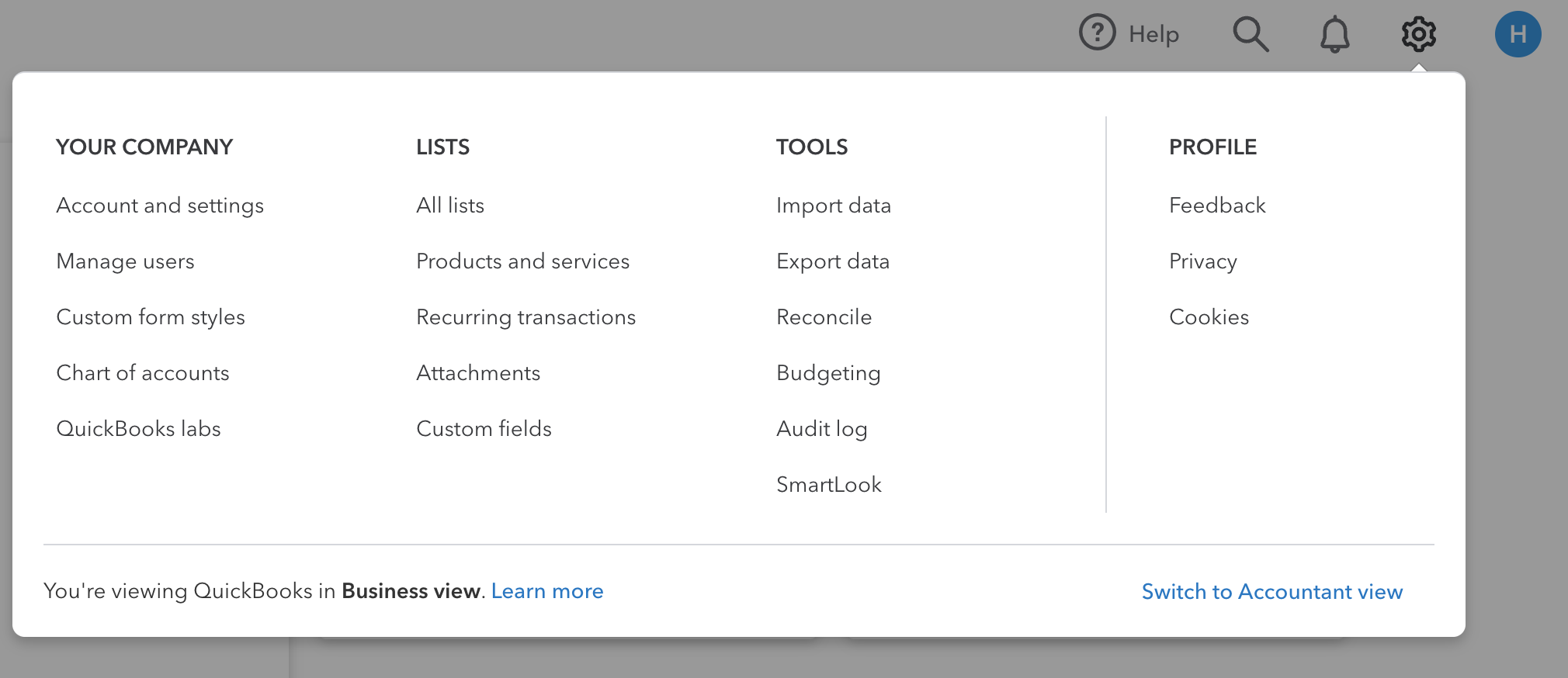

- Navigate to either the gear icon, then Products and Services, or alternatively, select Get paid & pay from the left-hand menu.

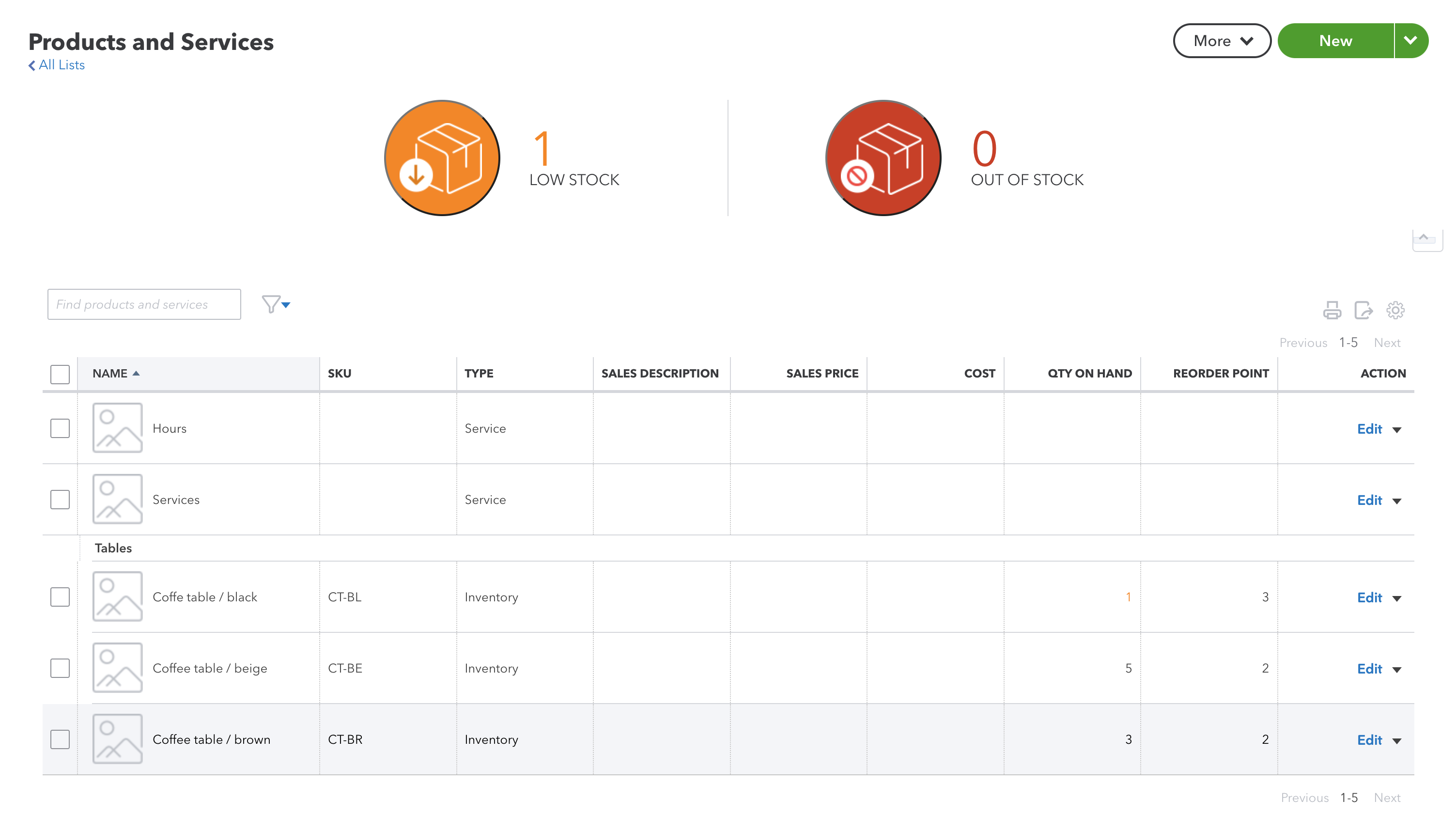

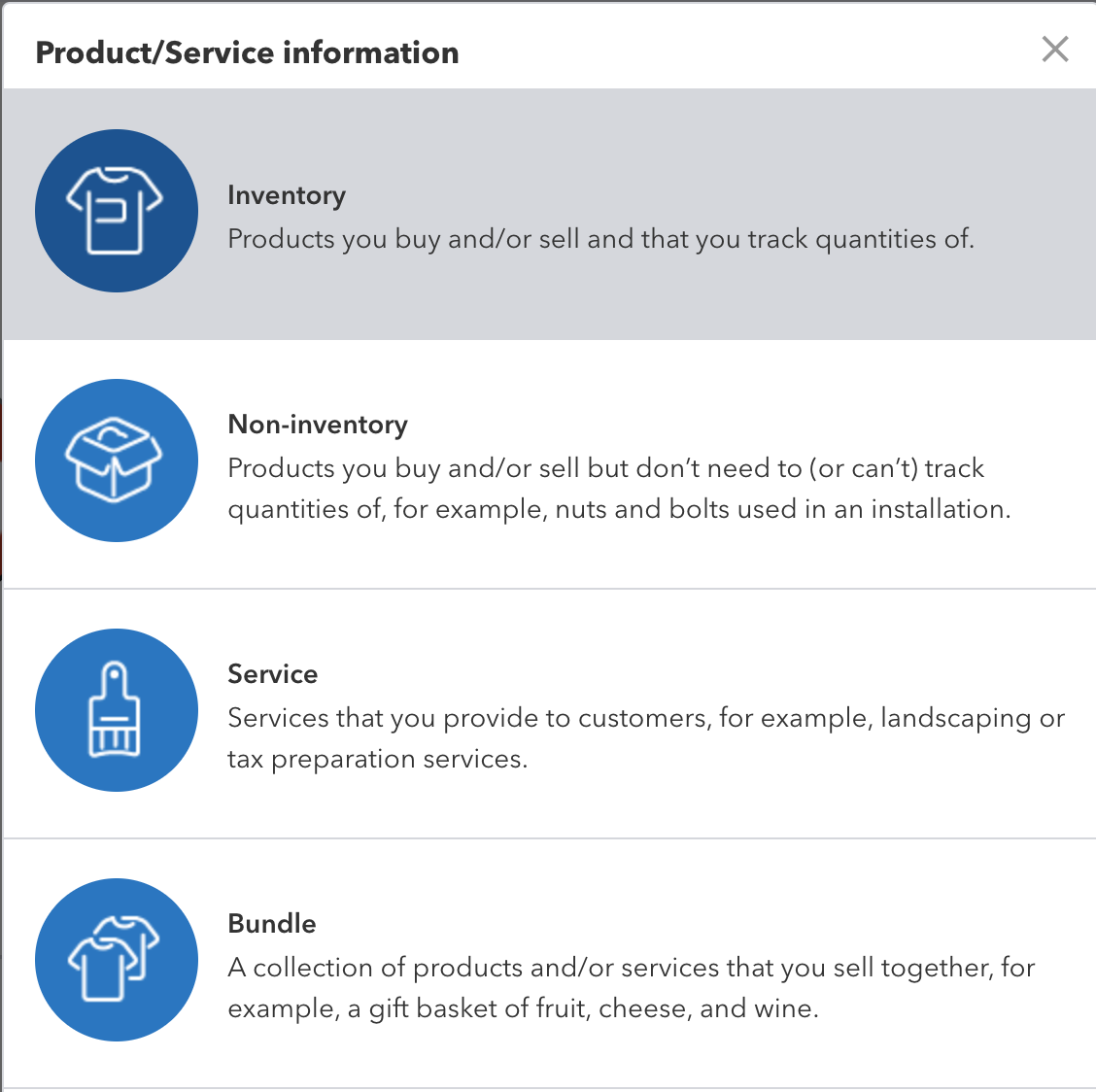

- Select New and then Inventory (note that this option will not appear if you do not have QuickBooks Online Advanced or Plus)

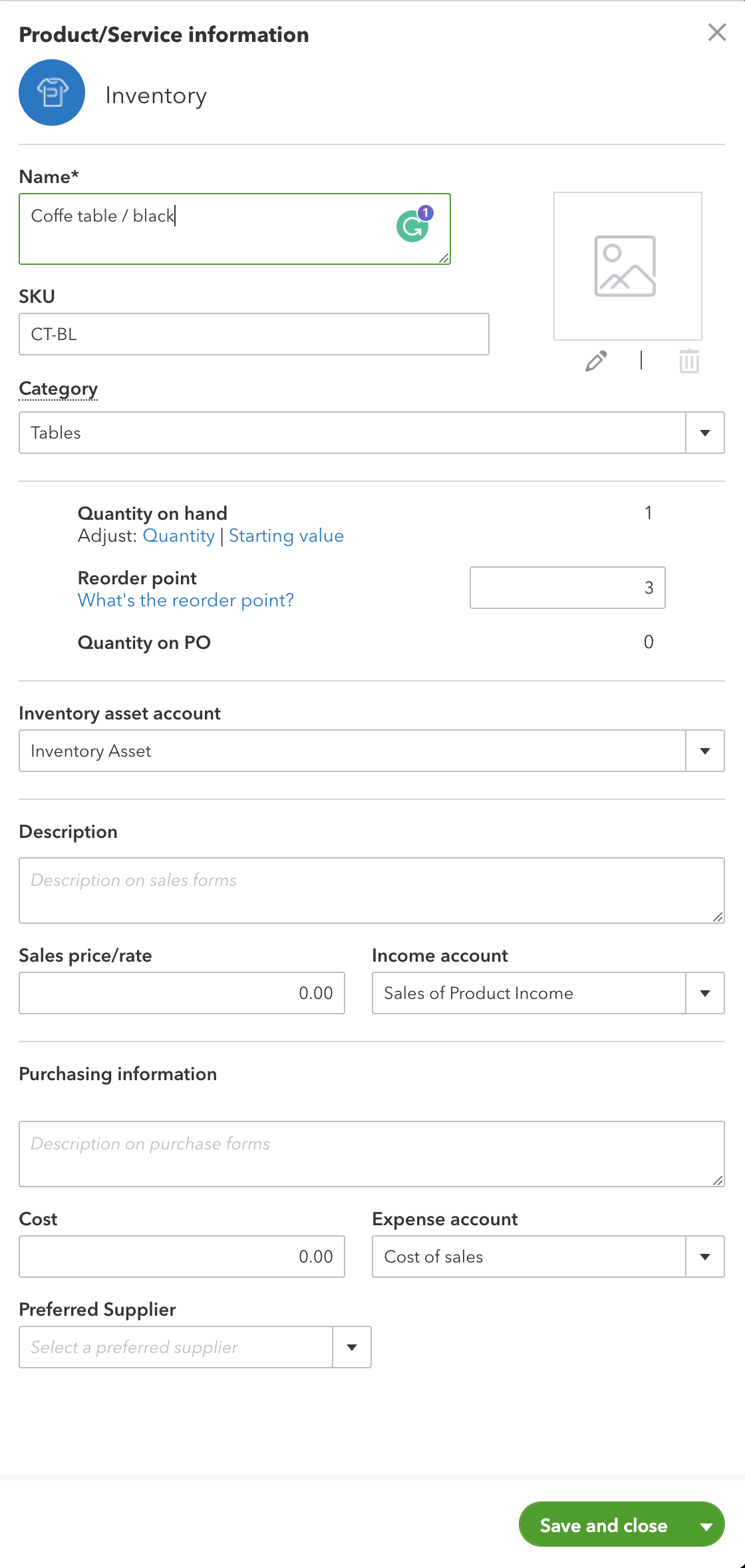

- Enter the name of your product. You can also set the SKU (stock keeping unit) code for your product to help you track your product later on.

- Go to the Unit dropdown menu and select the unit.

- Select the category from the Category dropdown menu.

- Fill in the Quantity at Hand for your product (note: you should do a physical count of your inventory before this, as changing the initial quantity later can cause some accounting errors).

- Add a reorder point. The number you enter here will serve as the lowest number of an inventory item you want to have on hand before you wish to order more. QuickBooks will send you a warning to order more if the quantity of your inventory item falls to the reorder point.

- Go to Inventory Asset Account and set it to Inventory Asset. This account is set up by QuickBooks for you automatically, but if you want to, you can change it.

After this is done, you can continue setting up your product’s description, sales and purchasing info, and tax. You can do this by following the steps below:

- Enter your product description in the Description field. This will show up on forms you send to customers, such as sales receipts and invoices.

- Fill in the Sales price/rate. This is what you will charge the customers when you sell the item.

- Select your income account from the dropdown menu. This will be the account QuickBooks uses to track the income from the items whenever you sell them. QuickBooks will set up an income account for you, but you can change it if you wish.

- Fill in your product description in the Purchasing information field. The information you fill in here will show up on forms and invoices you send to suppliers.

- Fill in what you normally pay for the item in the Cost section. You can change this later if you need when buying supplies.

- Select Cost of Sales from the Expense account dropdown menu.

- You can also select your Preferred supplier for the item if you have one. This can make reordering a little easier in the future.

- Save and close.

And you’re set! Just repeat the steps for your other inventory items to set them up.

How to fix common QuickBooks inventory asset account problems

Let’s quickly go over some of the common QuickBooks inventory asset account problems you might encounter and see how to fix them.

1. Incorrect inventory asset account

Double-check that the Income account used for the item has the account type Other Current Asset, as well as the detail type Inventory.

2. Negative inventory

Negative inventory can occur when you sell more products than you actually have available in your inventory.

You can usually fix negative inventory in QuickBooks by converting open purchase orders to bills. This tells QuickBooks that the items are on the way. It’s also a good idea to double-check your inventory, in this case, to see if you need to reorder anything.

3. Incorrect cost of goods sold

You might get an incorrect value on your COGS account for a few different reasons. Double-check that you’ve entered the correct cost for your goods. If that doesn’t work, make sure you’ve linked the correct COGS account to your inventory item.

If you receive items in bulk, make sure they’re received and sold in the same quantity (for example, if you receive 1 kilogram of bananas, but you sell them as 1 pound).

4. Inaccurate inventory reports

You might find inaccuracies in your inventory reports if you have transactions in your inventory asset account that aren’t linked to any of your inventory items. It can also occur if you have inactive inventory items but still have a non-zero value.

You can run an inventory valuation report to help find any items that might be causing issues.

5. Difficulty tracking stock levels

QuickBooks Online has some limitations when it comes to tracking stock levels in inventory. QuickBooks Online on its own does not come with features such as lot tracking and advanced inventory management. You can read more about the limitations of tracking stock in this article: QuickBooks Online serial number tracking.

To benefit from all the advanced inventory management features, you can integrate QuickBooks Online with an inventory management system.

Complete inventory control with Katana

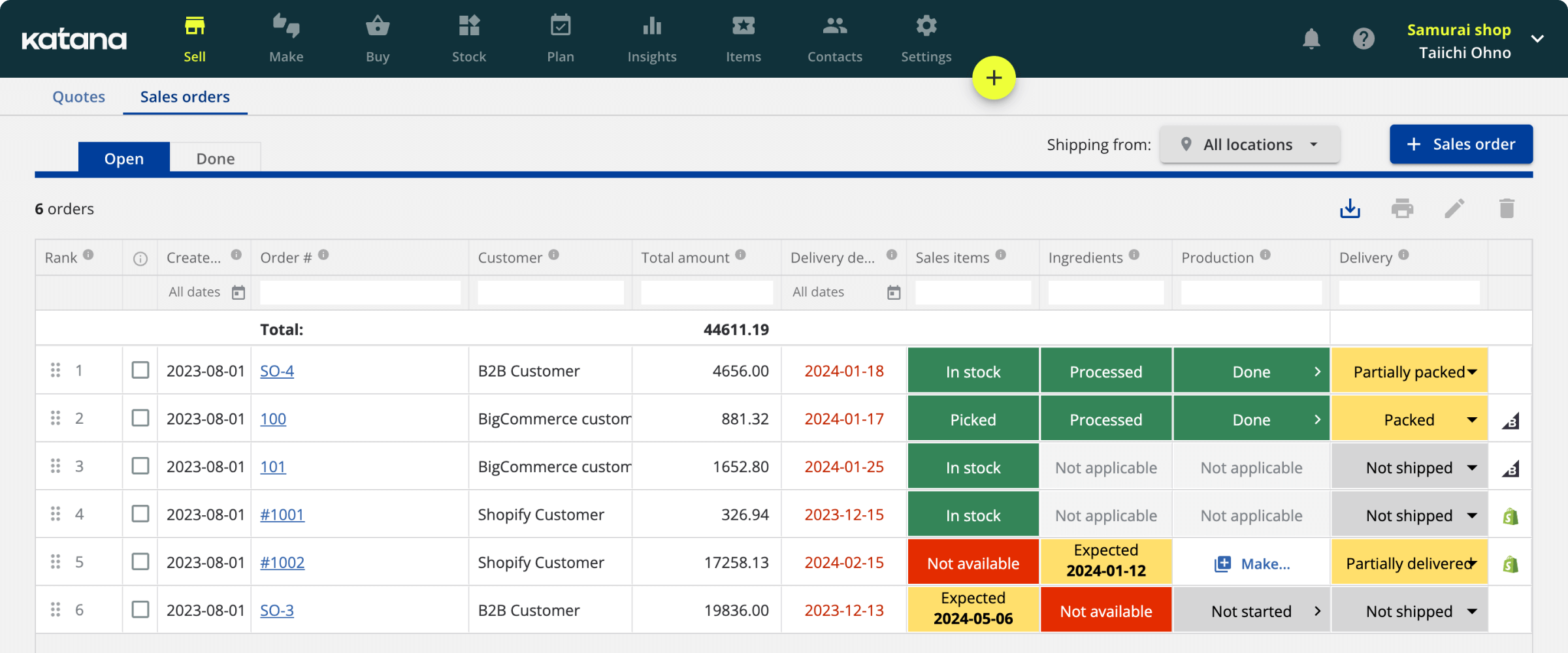

Katana’s cloud inventory platforms integrates seamlessly with QuickBooks Online, giving you all the features you need to handle your inventory and finances.

Katana + QuickBooks Online

If you’re using QuickBooks Online for your accounting and bookkeeping needs, there’s some good news for you.

You can integrate Katana’s cloud-based inventory management software with QuickBooks Online. Features such as converting your raw materials into finished goods are only available in QuickBooks Desktop. By syncing your QuickBooks and Katana accounts, you can gain access to features such as:

- Improved inventory management

- Streamlined financial management

- Better forecasting and planning

- Better production control

- Better reporting

If you aren’t convinced yet, talk with us to learn more about Katana by getting a demo before making a commitment.

QuickBooks inventory asset FAQs

What is an inventory asset?

An inventory asset refers to the total value of a company’s unsold products or materials that are held in stock, awaiting sale, or use. It is considered an asset on the balance sheet because these items have value and can generate revenue when sold.

How does QuickBooks calculate inventory asset?

QuickBooks calculates the inventory asset by tracking the cost of the items you purchase for resale or use in your business. It uses the method you choose (FiFo, LiFo, MAC) to assign costs to the items in your inventory. As you buy and sell items, QuickBooks automatically adjusts the inventory asset value to reflect the cost of the items on hand.

How do I set up inventory assets in QuickBooks?

To set up inventory assets in QuickBooks, follow these general steps:

- Sign in to your QuickBooks account

- Click on the Gear icon and select Products and Services.

- Choose New to add a product or service

- Select the Inventory type and provide details like name, description, SKU, cost, sales price, and more

- Click Save and Close to save the product in your inventory list.

What is an example of an inventory asset?

An example of an inventory asset could be a retail store’s stock of smartphones. If the store has purchased a quantity of smartphones to sell to customers, the cost of these unsold smartphones is recorded as an inventory asset on the balance sheet until they are sold. Once sold, the cost of the sold smartphones is recognized as an expense, and the value of the inventory asset decreases accordingly.

Table of contents

Accounting Guide

Readers also liked

Get visibility over your sales and stock

Wave goodbye to uncertainty by using Katana Cloud Inventory for total inventory control