Costing methods and the importance of choosing the correct one

Setting the right price for a product is vital for any manufacturer. Price your item too high, and you could drive potential customers straight to your competitors. But price the item too low, and your accountant may experience heart palpitations whenever they look at the balance sheet.

By applying the appropriate costing method for your business, you can strike a balance between delivering the best value for your customers and ensuring financial stability, saving your accountant from stress-related trips to the doctor.

This blog post will explore different costing methods and their implications, empowering you to make informed decisions that optimize your pricing strategy and boost your bottom line. So, let’s dive in and discover the right costing method to help your business thrive.

What is a costing method?

A costing method refers to the approach or technique used by businesses to determine the costs associated with producing a product or providing a service. It involves analyzing various cost elements such as raw materials, labor, overhead expenses, and other factors to accurately calculate the total cost per unit or service.

Different costing methods exist, and each has its own advantages and applicability depending on the nature of the business.

Correct terminology

Sometimes people use the term costing methods when talking about the value of remaining inventory. However, that’s not entirely correct. The right term to use when talking about inventory is inventory valuation methods

In this article, we’ll focus on the accounting method used to determine the cost of a product.

Choosing the right costing method is crucial as it impacts pricing decisions, profit margins, and financial performance. By selecting the most appropriate method for their business, companies can achieve optimal cost control and make informed pricing strategies.

Before we jump to specific costing methods, let’s go over some hidden costs businesses need to be aware of.

Indirect costs

When discussing production costs, it’s easy to focus solely on direct costs like raw materials and labor. However, overlooking indirect costs can lead to inaccurate pricing. Businesses, especially those starting out, often forget to consider these hidden expenses when determining product prices.

Indirect costs encompass all the necessary expenses to keep your business running smoothly, even if they are not directly tied to the production process. Examples of indirect costs include:

- Rent or mortgage payments for your facilities

- Utilities such as electricity, water, and gas

- Equipment maintenance and repairs

- Administrative expenses like accounting and HR

- Marketing and advertising costs

Factoring in indirect expenses provides a more comprehensive understanding of your production costs. However, this calculation can be time-consuming and complex. It’s important to weigh the benefits of precision against the costs associated with investing significant time and resources in this exercise.

For instance, consider a scenario where one costing method is 7% more accurate but would require three times longer to complete by your cost accountants. In such cases, it becomes crucial to assess whether the increased accuracy justifies the investment required.

Finding the right balance between precision and efficiency in calculating indirect costs will enable you to accurately determine your product prices while avoiding any unexpected financial setbacks.

To determine the best costing method, you need to know how these hidden costs are calculated. So, let’s quickly go over the basics.

How to calculate overheads

Out of all the expenses mentioned, manufacturing overheads can be the most difficult to calculate. Overheads are all the indirect costs incurred in running a business, such as rent, utilities, and insurance.

Overheads are indirect costs since these can’t be directly linked to the production of goods.

The five main types of overheads in manufacturing:

- Indirect labor — The cost of all the workers who are not directly involved in manufacturing the product, such as supervisors, office staff, and janitors

- Indirect materials — Materials used in the production process but are not directly involved in the production of the final product, such as packaging and labels

- Utilities — The cost of electricity, water, and gas used in production

- Physical costs — All the costs related to maintaining your factory, such as rent, insurance, and property taxes

- Financial costs — Any legal, accounting, and banking charges

To calculate the total cost for the overheads, you need to add up all the indirect costs.

The important thing to remember is that overheads can be fixed or variable:

- Fixed overheads — Costs that stay the same regardless of how much is produced, such as rent

- Variable overheads — Costs that change in relation to production, such as electricity

In order to calculate the overhead cost per unit, you need to divide the total overhead cost by the number of units produced.

Overhead cost per unit = Total overhead cost / number of units produced

For example, if the total overhead cost is $100,000 for 2,000 units, the overhead cost per unit will be $50.

If you’re manufacturing different products, you need to calculate each product’s overhead cost per unit. This is because each product will have different production costs, so the overhead cost per unit won’t be the same.

The decision of how to allocate overheads is an important one. This is because overheads can have a big impact on the profitability of a product. If overheads are not allocated correctly, it can lead to products being priced too low or too high.

Now that you understand the costs involved and how to calculate these let’s take a closer look at the costing methodologies to see the advantages and disadvantages of each method.

Most widely used costing methods

There are many different methods available, but most are based on job and process costing. The six most used methods of costing are:

- Standard costing

- Job costing

- Process costing

- Direct costing

- Target costing

- Activity-based costing (ABC)

Let’s explore each one more closely.

1. Standard costing

Standard costing uses predetermined costs for materials and labor.

This type of costing is probably the most common method due to its simplicity. The predetermined costs are derived from the company’s historical experience and are updated periodically to reflect changing conditions.

The advantage of this approach is that it is relatively easy to compute, making it the least time-consuming. It also provides a consistent basis that determines the cost of the product.

The disadvantages of standard costing are that it can be inaccurate if circumstances change significantly from the time the business established the standards. It can also be challenging to update the standards on a timely basis.

In addition, this method does not provide information about where cost variances occur.

2. Job costing

Job costing is for tracking the costs when every project is different, and the cost of each job varies. This method looks at both direct and indirect costs.

To calculate the cost of a job, you first add all the direct costs. Then, you allocate a portion of the indirect costs based on how many resources are consumed for the assignment. For example, if a job took up 50% of the factory space for a day, you would allocate 50% of the day’s rent to that task.

The advantage of this method is that it gives a relatively accurate picture of the cost of each job because it considers all the associated costs.

The disadvantage of job costing is that it can be time-consuming since you need to track and allocate all the different expenses accordingly.

3. Process costing

Process costing, a process referring to a particular stage in manufacturing, helps mass producers with slight product variations track costs. For example, the first stage might be cutting the fabric for manufacturing, and the second stage might be sewing the garment.

To calculate the cost of a process, you add up all the direct expenses incurred in that specific production stage — including the materials used and wages of your operators. You then allocate a portion of the indirect costs based on how much the process uses the resources.

The advantage of this method is that it’s less time-consuming than job costing since you don’t need to track and allocate costs for each individual job.

The disadvantage is that it can lead to inaccuracies since it doesn’t consider all the costs involved in manufacturing. For example, if one process takes longer than usual, that will increase the indirect costs, which won’t appear in the final cost.

Automate your cost calculations

Having a clear overview of your processes and related costs is vital for any business. Learn how cloud inventory software can help you to keep your finger on the pulse.

4. Direct costing

Direct costing, also called variable costing, is a method that only includes variable production costs.

The variable costs are those that vary with the level of production, such as raw materials and labor. The fixed costs, such as rent and insurance, are not included in the product cost. This approach provides a better understanding of the variable costs and those that are fixed.

It also makes decision-making easier since the effect of changes in production levels on costs is more transparent. What’s more, this method is more straightforward to compute than others since you only need to consider the variable costs.

The disadvantage is that it can lead to distorted decision-making since it doesn’t take into account all the costs involved in manufacturing. For example, if a company is considering shutting down its operation, it might make that decision based only on direct costs. But if they considered fixed costs, the decision might be different.

5. Target costing

Target costing is a method used to ensure that products are designed and priced to meet customer needs.

With this method, you know what the sale price needs to be, so you start with that in mind. Then, you work backward to ascertain the cost of manufacturing it. To calculate the cost of a product, you first need to determine the target price.

This is the price that the product needs to be sold at in order for the company to make a profit. Then, you work out the manufacturing cost to meet the target price.

The advantage of target costing is that it ensures that products are designed and priced to meet customer needs because the focus is on the sale price, not on the cost of manufacturing.

This method mainly focuses on controlling costs, which can cause issues if the production turns out to be more expensive than expected. If the target price is not met, manufacturers have few options, but most of these are at the expense of product quality, such as:

- Test out several different product designs to find the cheapest option

- Use lower-quality materials

- Use cheaper manufacturing practices

- Reduce profit margins

- Raise price

- Drop the product if the target price is unachievable

6. Activity-based costing (ABC)

Activity-based costing looks into the cost of each unit from mass production runs depending on the activities involved in making it — ABC is a more sophisticated version of job costing.

In activity-based costing, overhead costs are assigned to activities rather than products. This is done by first allocating indirect costs to cost pools. A cost pool is a group of related costs incurred when performing a particular activity.

For example, the cost of setting up a production line would be allocated to a cost pool. The total overhead costs in the cost pool are then divided by the number of units of activity. The resulting figure is known as the activity rate. This activity rate is then applied to the number of units of activity used by each product to calculate its individual overhead cost.

Since ABC considers all manufacturing activities, it provides a very accurate picture of the unit cost.

The disadvantage of ABC is that it can be expensive to implement. With ABC, you need to identify all the activities involved in the production process. Once that’s done, you need to allocate a portion of these costs to every activity.

When choosing a cost system, you need to consider the nature of your business and the products you manufacture.

Once you’ve decided on the costing method to use, you need to start gathering cost data and analyzing it.

Depending on your exact business, this process can be very time-consuming and resource-heavy. Luckily, there are platforms to help you with cost management.

Costing methods for every weather

There are additional costing methods not mentioned in this list. Mostly since these are only slight variations of the ones already listed. However, you may still wish to have a closer look, so here are a few more that you may want to look into:

- Someone using mass production processes might use batch costing

- Businesses dealing with large-scale construction projects may want to use contract costing or terminal costing

- Manufacturers producing similar products through a single process usually opt for output costing

- When multiple different processed parts are used, manufacturers can use multiple or composite costing

Choosing the right method for you

As you can see, it’s not going to be an easy task to choose the best costing method for your business, and it’s not made easier by the number of different methods and techniques. But below, you’ll find a short summary to help you make the right choice:

- Process costing may be the most suitable method if you’re producing large quantities of standardized products

- If you’re manufacturing bespoke items or small batches of products, job costing may be more appropriate

- If you want to ensure that your products are designed and priced to meet customer needs, target costing may be the best option

- And if you’re mass-producing products where the cost of each unit can vary depending on the activities involved in making it, activity-based costing could be the right choice

Ultimately, it’s important to choose the type of costing method that meets the needs of your business and provides the information you need to make informed decisions.

Using software to calculate the costs

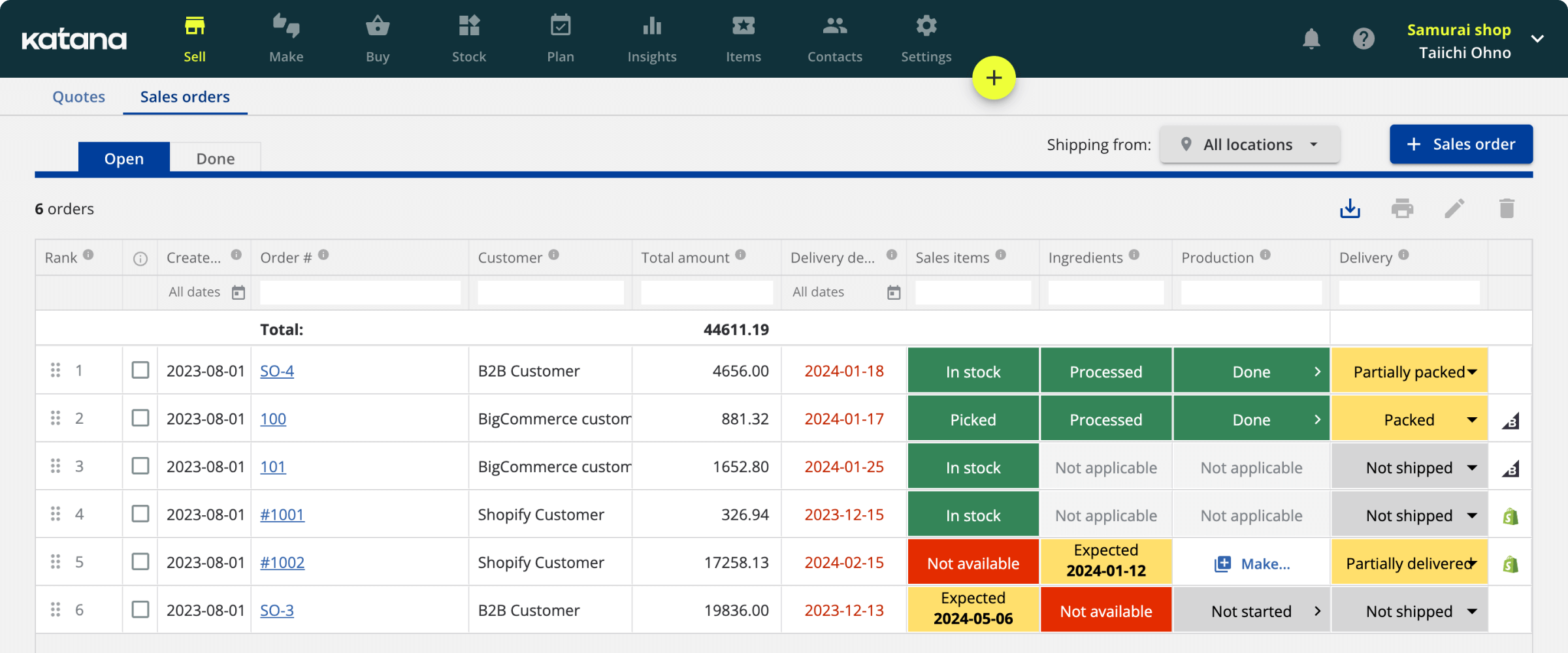

Managing costs effectively is crucial for any manufacturing business. To simplify and optimize your costing processes, cloud inventory software like Katana can be a game-changer. Katana offers a comprehensive set of features designed to provide valuable insights and streamline your costing activities, helping you make informed decisions and enhance your bottom line.

Sales and manufacturing insights

Katana’s intuitive Insights dashboard provides a clear overview of your sales and manufacturing costs. By consolidating data from various sources, it offers real-time visibility into your production and sales. This holistic view allows you to identify trends, spot bottlenecks, and optimize your costing strategies accordingly.

Inventory costing

Accurate inventory costing is essential for determining the true cost of your products. Katana enables you to assign costs to your raw materials, components, and finished goods, ensuring that your inventory valuation reflects the actual expenses incurred. It uses moving average cost (MAC) for the most accurate valuation. With better cost visibility, you can make pricing decisions that align with your desired profit margins.

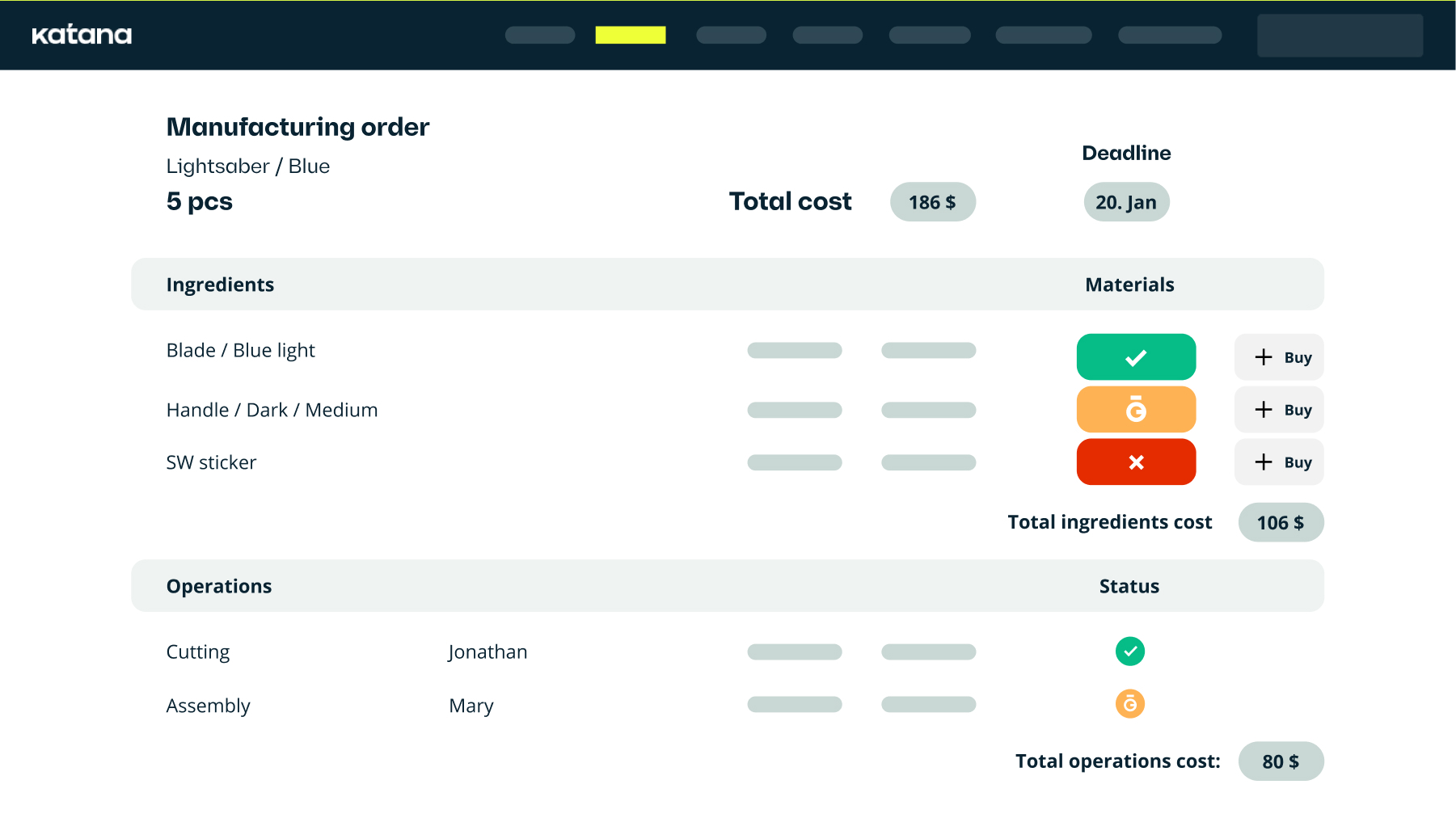

Production costing

Katana simplifies the process of calculating production costs. By tracking labor and material expenses, the software helps you accurately determine the cost of each manufactured item. This information empowers you to evaluate profitability, identify cost-saving opportunities, and make data-driven decisions to optimize your operations.

Equipped with the right tools, figuring out the costs allows you to reallocate resources to focus on scaling your business. Book a demo with Katana, and get your costs in order.

Table of contents

Accounting Guide

Readers also liked

Get visibility over your sales and stock

Wave goodbye to uncertainty by using Katana Cloud Inventory for total inventory control