Job order costing done right

Getting your costing and accounting right is important when you are in the customized manufacturing space. Since your jobs are unique and customized to specific customers, your invoices and costing also need to be done on a per-job basis.

Job order costing allows you to do just that.

In this article, we will look at how job order costing works and understand it in detail with the help of examples.

So let’s dive right in.

Table of contents

What is job order costing?

Job order costing method is used to determine the cost of manufacturing products. It is employed when your business manufactures bespoke products customized to specific customers instead of delivering standardized products. This implies that for every job order, you need to account for all the costs incurred for that specific order separately, ranging from direct raw materials and labor to overheads.

For example, let’s assume that you are in the business of producing bespoke premium furniture. Every piece in your furniture inventory you produce is unique and custom-made for your customers. Since every job is unique, you have to cost each of your jobs separately. This is exactly what job order costing is.

To make the idea clearer, Let’s look at the opposite end of this spectrum by looking at IKEA and its furniture. IKEA produces standardized and identical furniture in huge quantities. Given the standardization and also IKEA’s make-to-stock workflow, the costing would likely have standard costs associated with each manufacturing process step. So, it doesn’t need to approach costing on a per-job basis, but instead, it can do its accounting with the process costing approach.

Job order costing vs. process costing

Job order costing is employed for custom or unique products and involves tracking costs for each individual job or project. Process costing, on the other hand, is used for standardized mass production, where costs are averaged over processes or departments.

Job order costing:

- Unique products

- Relatively small quantities

- Every job is different

- Ex: Bespoke furniture shops, Cabinet makers, etc

Process costing:

- Identical and standard products

- Generally large quantities

- Each product undergoes a specific set of processes

- Ex: IKEA, Coca-cola, etc.

Cost accumulation in job order costing

There are three main components that go into cost accumulation when you run your business with a job order costing method. As a running example, we will consider a lawyer’s firm placing an order for a large Partner’s desk made of Bocote wood with your business.

Direct materials

All the raw materials that are required to create the finished product are accounted for in this.

For the Partner’s desk, all the Bocote wood, and the metal furnishings, such as handles and rails for the drawers, would be part of the direct raw materials.

Direct Labor

The direct effort to turn raw materials into finished products is accounted for under direct labor. This also includes the machining costs.

For the desk, it would imply the amount of time and effort that your carpenters spend on skillfully turning the Bocote wood into its luxurious final form.

Overheads

Since running a manufacturing business is not simply putting together raw materials and labor. Your business will also have plenty of running expenses that are not directly related to the jobs.

For instance, you will incur rent for the workshop, maintenance, upkeep, and other manufacturing overheads in accounting, bookkeeping, etc., and other functions necessary to keep your business running. These account for overheads.

These components are grouped according to orders and are placed in job cost sheets.

What is a job cost sheet?

A job order cost sheet is simply the cost sheet that accumulates the costs incurred for each order. Each job order cost sheet has a unique job order number that identifies a specific job. Additionally, each job order cost sheet should correspond to a record in the work-in-progress (WIP) inventory file. This allows you to keep track of raw materials and inventories.

However, the most important aspect of a job order cost sheet is that it should be able to accurately identify the costs of direct raw materials, labor, as well as overheads. The direct raw materials and labor generally are easy to track and account for. Tracking overheads is more challenging, however.

If your business underestimates the overheads and you constantly underreport your costs, you risk making losses. At the same time, you can’t simply charge ridiculous amounts for overheads just to keep your business profitable. That will drive potential customers to your competitors.

There are two main approaches to estimating the overheads and, consequently, to job order costing itself.

Actual costing

With actual costing, the idea is to track the actual costs incurred for every job. As usual, the raw material and direct labor do not pose any challenges in this approach. But for overheads to be calculated, the job has to be completed. This implies that job costs can’t be calculated until the end.

Due to this challenge of timing, and customers’ need to know cost estimates before placing the orders, actual costing is rarely used.

Normal costing

In contrast to actual costing, normal costing involves using a predetermined or budgeted overhead rate to estimate the overheads.

Although normal costing is quicker, it is also trickier because you have to hit the sweet spot between underestimating and overestimating the overheads. As discussed earlier, underestimating and overestimating the overheads pose the risk of making losses or making your competitors look a lot better, respectively.

To avoid these estimation problems, the actual costing approach generally uses the number of hours spent on the job as a proxy to determine the overheads. Intuitively, this means that if a job takes 1 hour to complete and another takes 2 hours, then the job that took 2 hours will have twice the overhead. But let’s get a little more technical and dive into the mathematical formula for it.

Overhead estimation in normal costing

The first step when it comes to calculating overheads is to estimate the overhead rate:

Overhead rate = Estimated manufacturing overhead / estimated cost allocation base

Here, the estimated cost allocation base could be the estimated machine hours or labor hours.

Sticking to our previous example of a premium furniture business, let’s say that you have a workforce of 10 people, and at 40 hours/week, for 50 weeks/year, you get a total of 20,000 labor hours/year. Now you estimate that your overheads will be about $100,000 for the entire year.

This implies that your overhead rate will be:

$100,000/20,000h = $5/hour

Job order costing example

With the overhead estimate calculated, it now becomes easy for your business to provide job cost estimates. Since labor hours are a lot easier to track, they now act as a proxy for the overheads.

With the estimate in place, accumulating costs for an order that you cater to becomes as simple as tracking the raw material costs and the number of hours spent on the order.

Job order cost formula

Total job cost = Direct materials cost + direct labor cost + overhead cost

So, for example, if an order of a custom work desk for a lawyer’s office required $2,000 of raw materials and $1000 for 100 hours of labor at $10/hour. The overheads would amount to $500 at the estimated $5/hour. The total cost of the work desk is:

$2000 + $1000 + $500 = $3500

All you need to do is add your profit margin and send the quote to the customer.

Now you know where lawyers spend all their money.

3 advantages of job order costing

Now that we understand how job order costing works, here are 3 advantages to having a job order costing system.

1. Tracking profitability of jobs

Since every job is cost separately, it becomes easy to figure out which jobs were profitable and which ones weren’t. Hopefully, if your overhead estimation is correct, you will have minimized the risk of losses.

2. Monitor machinery and productivity

Job sheets allow you to keep an eye on how your machinery functions and also monitor the productivity of your employees. Keeping you one step ahead of the maintenance cycles for your expensive machinery and allowing you to take necessary steps to boost employee productivity.

3. Optimizing your operations based on job data

Every job sheet ideally has the number of hours and machinery that was used for that specific job. Such data can be extremely valuable when you go looking to optimize your operations since it allows you to identify bottlenecks and places where you can reduce waste.

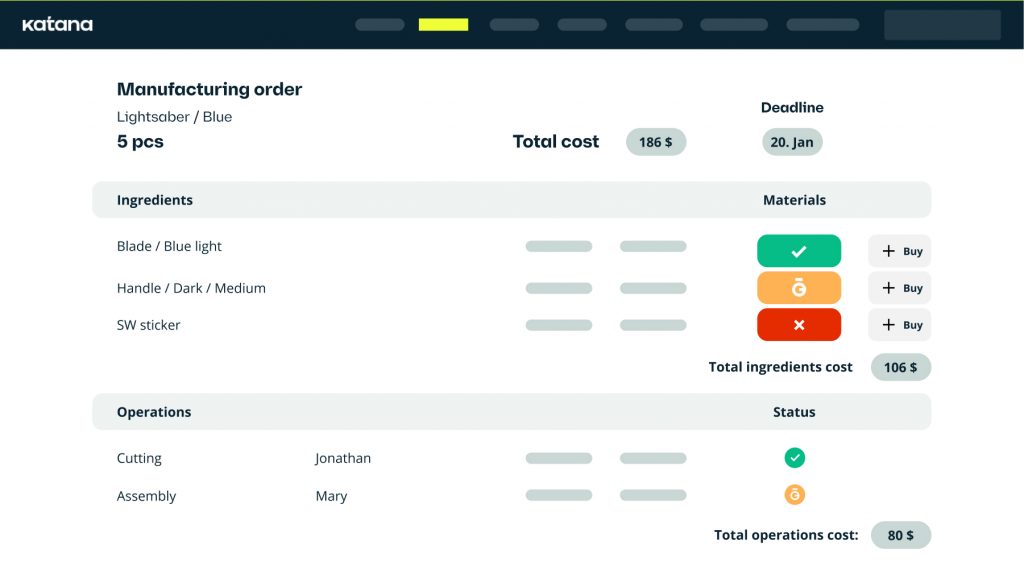

Streamlined costing with Katana

Katana is live inventory management software that offers several features to streamline and enhance costing processes for businesses. By integrating various cost-related functions into one unified platform, Katana provides a comprehensive solution to improve costing accuracy, efficiency, and decision-making. Here’s how Katana can significantly contribute to cost improvement:

- Simplified workflow — Katana streamlines intricate job tracking and cost allocation, mitigating complexities and reducing the likelihood of errors.

- Real-time insights — With Katana’s live updates, businesses gain instant visibility into cost changes, empowering agile decisions and accurate cost prediction.

- Resource efficiency — Effective resource allocation, facilitated by Katana’s integrated inventory and production management, guarantees optimal utilization of materials and labor, curtailing waste and boosting profitability.

- Shop floor control — Katana empowers shop floor management, enabling precise control over production processes, enhancing efficiency, and ensuring seamless job progression.

- Scalability —As your enterprise expands, Katana seamlessly scales to accommodate heightened job intricacies and larger production volumes, ensuring sustained precision in cost tracking and management.

- Forecasting and planning — Katana’s data-driven analytics enable demand projection, production scheduling, and resource allocation, optimizing job order costing strategies.

- Integration and automation — Katana effortlessly integrates with vital business tools, automating data transfer, diminishing manual input, and resulting in fewer errors and expedited workflows.

Incorporating Katana elevates job order costing processes, presenting not only precise cost insights but also an array of features that streamline workflows, foster efficient decision-making, and propel overall business expansion.

Thousands of manufacturers have used Katana to build better businesses. Get started by booking a demo with Katana today.

Job order costing FAQs

What is the difference between job order costing and process costing?

Job order costing is used for customized or unique products/services, tracking costs per job, while process costing is for standardized mass production, averaging costs over processes.

- Job order — Specific jobs, detailed cost

- Process — Departments, generalized cost

What are the advantages and disadvantages of job order costing?

Advantages of job order costing include accurate cost allocation for unique projects, enabling informed pricing decisions. However, it can be complex and time-consuming, and may not be suitable for high-volume production due to its focus on individualized tracking.

How do you calculate job order costing?

To calculate job order costing, add up the direct materials cost, direct labor cost, and allocated overhead cost specific to a particular job or project. This formula provides the total cost incurred for that job, aiding in accurate pricing and resource allocation

Readers also liked