E-commerce accounting: the most straightforward guide

It’s time to digitalize your manufacturing and set up your e-commerce store on platforms such as Shopify or BigCommerce.

However, as exciting as these times might be, there’s always that dreaded thought lingering in the back of the mind of any sensible manufacturer. How am I going to handle the financial aspect involved with selling online? And that’s why we’ve put together this article to dispel any of your worries.

Here, you’ll learn everything you need to know about e-commerce accounting, how to handle it, and the responsibilities you’ll need to consider.

Without further ado, let’s begin.

What is e-commerce accounting?

E-commerce accounting is the process of tracking, managing, and analyzing financial transactions within an online business. It involves thoroughly recording revenue, expenses, taxes, and profit margins unique to digital commerce.

Proper e-commerce accounting ensures accurate financial insights, compliance, and informed decision-making. It provides a clear picture of the business’s financial health.

By properly managing your e-commerce bookkeeping, you can make informed decisions about your business’s future and identify areas where you can improve profitability.

E-commerce business accounting software, such as QuickBooks Online or Xero, is recommended to help manage the financial aspects of your e-commerce business.

Additionally, consulting with a professional accountant can help ensure you adhere to tax regulations and optimize your financial management practices.

Accounting vs. bookkeeping

Bookkeeping involves recording and tracking financial transactions of a business, including purchases, sales, receipts, and payments, to create accurate financial reports such as balance sheets and income statements.

Accounting involves interpreting and analyzing financial information to make strategic decisions such as budgeting, forecasting, and financial planning to identify trends, opportunities, and risks for developing strategies.

How do you record e-commerce sales?

When recording e-commerce sales, it’s important to have a system in place to track each transaction’s details accurately. Here are the steps you can follow to record e-commerce sales:

- Choose an accounting software — Select a bookkeeping solution that fits the needs of your e-commerce business, whether that’s a simple spreadsheet or a more robust accounting software.

- Record sales transactions — Once you’ve chosen your software, record each sales transaction as it occurs. Include details such as the date of the sale, the customer’s name and contact information, the product or service sold, the sale price, any discounts applied, shipping charges, and any taxes collected.

- Track inventory — If you’re selling physical products, keep track of your inventory levels so you know when to reorder. Make sure to record each item sold and adjust your inventory levels accordingly.

- Reconcile payments — If you’re using a payment gateway or third-party processor, reconcile each payment to ensure you’ve received the full amount due. Also, keep track of any fees associated with the payment processing.

- Record refunds and returns — Keep track of any refunds or returns and adjust your records accordingly. Make sure to record the date, the customer’s name and contact information, the reason for the return, and any additional fees associated.

- Generate reports — Use your accounting software to generate reports that show your sales, expenses, and profit margins. These reports can help you make informed business decisions and plan for the future.

Recording e-commerce sales accurately is crucial for managing your finances and making informed business decisions. By following these steps, you can ensure that you have accurate records of your transactions and can manage your finances effectively.

How do you handle accounting when selling online?

When selling online, you will need to keep track of your sales and expenses to calculate your profits and pay taxes accurately. Here are some tips and tricks to help you handle accounting for your e-commerce business.

Set up a separate bank account for your online sales

This will make tracking your income and expenses easier and ensure that you don’t mix your personal finances with your business finances.

Ideally, you want to set up a business bank account because it might be necessary for tax and legal regulations. There are other benefits too — like having revenue from your online sales going into a specific account will make your bookkeeping efforts a lot easier. Plus, using a business bank account looks more professional and will make your company appear more legitimate to customers.

Keep detailed records of your sales and expenses

You can use accounting for e-commerce software, spreadsheets, or pen and paper to track your transactions — although choosing the manual options comes with its own challenges to overcome.

Be sure to record all income, including fees from the online marketplace or payment processor, and any expenses related to the sale, such as shipping and advertising expenses and the cost of goods sold. Getting this process down to a T will not only make your business compliant with tax and legal requirements but will also help:

- Adopt a culture that gives you accurate financial management

- Improve investor and lender relations when fundraising

- Stabilize business growth with invaluable data on your finances

Determine your profit or loss for each sale

Subtract the cost of goods sold and any expenses from the total revenue to determine your net income for each sale.

It goes without saying why this is important. However, some other benefits, such as getting an advantage over your competition, aren’t so tangible. With information on your profits and losses, you can calculate your selling prices more appropriately, improve profitability, and stand out from competitors.

Monitor your cash flow

Keep track of when payments are received and when expenses are due to ensure you have enough cash to cover your costs.

Here are some reasons why monitoring your cash flow is essential for online sales:

- Cash flow planning

- Financial management

- Budgeting

- Tax compliance

- Business growth

Set aside money for taxes

You’ll likely be obligated to collect sales tax or pay income tax on your profits depending on your area and the things you sell. Speak with a tax expert to ascertain your tax requirements and save money accordingly.

It’s better to nip this in the bud now than to later find out that you were supposed to be recording and paying tax on something and now have to find essential information retroactively.

Katana x QBO for e-commerce

Looking for a tool that integrates with QuickBooks Online? Get Katana’s cloud inventory software that provides total visibility over accounting and production.

9 common e-commerce accounting tasks

Here are nine common e-commerce accounting tasks and how to perform them:

- Record sales transactions — Record all transactions in your accounting system, including the date, amount, customer name, and payment method.

- Track inventory — Keep track of inventory levels and update the system when new products are added or sold. Use a perpetual inventory system to track inventory in real time.

- Manage accounts payable and accounts receivable — Record all customer payments and payments made to suppliers. Follow up with customers who haven’t paid their invoices.

- Reconcile bank accounts — Reconcile bank statements regularly to ensure all transactions are accurately recorded and to spot inconsistencies.

- Manage sales tax — Keep note of the sales tax rates and use them while making purchases. Send sales tax to the proper taxing body.

- Prepare financial statements — To assess the company’s financial health, prepare financial statements such as balance sheets, income statements, and cash flow statements.

- Forecast cash flow — Use financial statements to forecast cash flow and plan for future expenses.

- Perform audits — Conduct regular audits of financial statements to ensure accuracy and identify any errors or fraud.

- Monitor key performance indicators (KPIs) — Track KPIs such as revenue, profit margins, and customer acquisition cost to understand the business’s performance and identify improvement areas.

Performing these tasks requires a thorough understanding of accounting principles and the tools and systems used for e-commerce accounting. Working with a professional accountant or using specialized accounting software is recommended to ensure accuracy and efficiency.

Challenges of accounting for e-commerce businesses

Accounting for e-commerce businesses comes with its unique set of challenges.

Sales tax compliance complexity

E-commerce businesses often struggle with understanding and complying with complex sales tax regulations, especially when selling products to customers in different states or countries. Managing tax rates, collecting and remitting taxes, and staying up-to-date with changing tax laws can be challenging and have quite extreme consequences when not handled correctly.

Inventory management complexity

Managing inventory efficiently is a common challenge for e-commerce businesses, especially those dealing with physical products. Accurate tracking of stock levels, optimizing reorder points, and accounting for seasonality or demand fluctuations are critical for preventing stockouts and overstock situations.

Multichannel sales tracking

Many e-commerce businesses sell products through multiple channels, such as their website, third-party marketplaces (e.g., Amazon, eBay), and social media platforms. Keeping track of sales and inventory across these diverse platforms while maintaining accurate records can be daunting.

Payment processing complexity

E-commerce businesses often accept payments through various methods and payment gateways. Managing payment processing fees, handling chargebacks, and accounting for currency conversions can complicate financial record-keeping.

Customer returns and refunds

Handling customer returns and refunds can be a significant challenge for e-commerce businesses. Accurately tracking return requests, processing refunds, updating inventory, and managing the associated financial transactions require efficient systems and processes.

These challenges are common among e-commerce businesses of all sizes and can impact financial stability and compliance if not managed effectively.

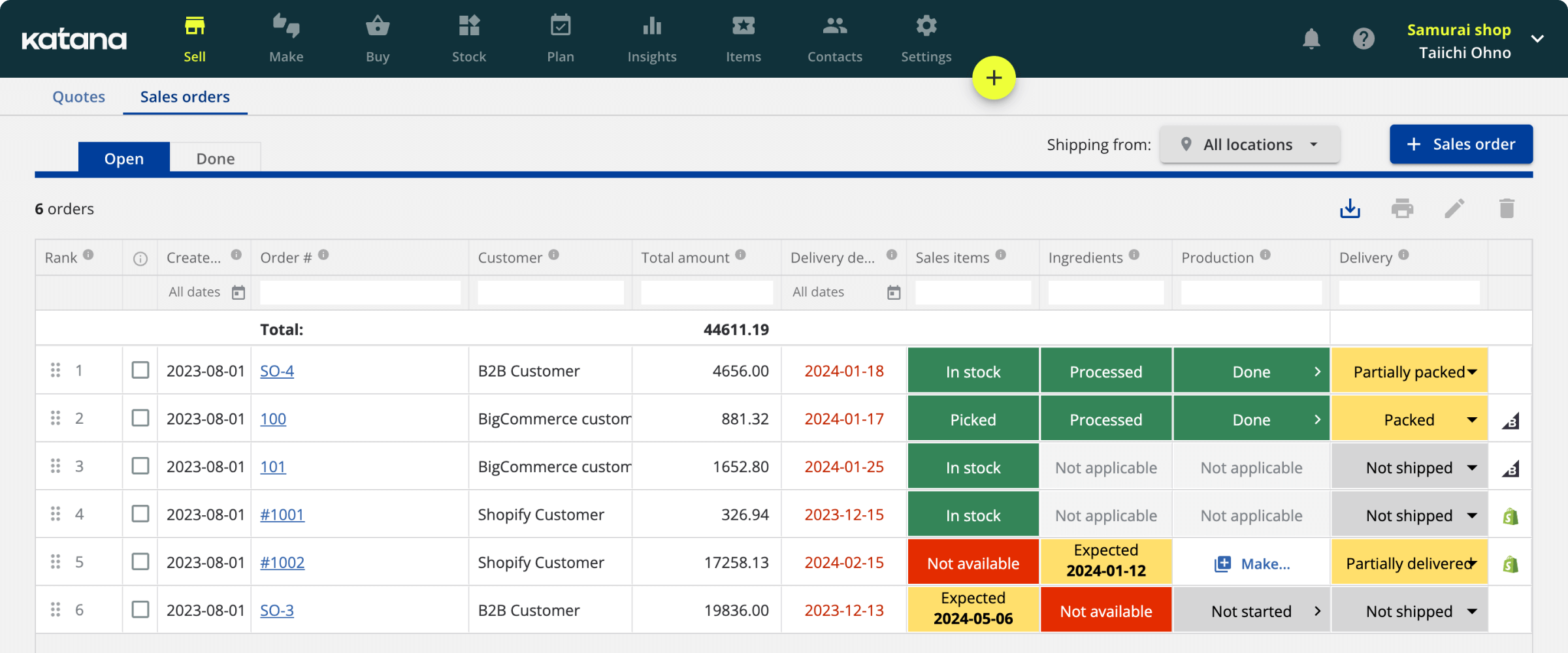

Accounting for e-commerce companies with Katana

If you’re a manufacturer looking for e-commerce accounting software, remember that many are built to track finances and finished goods, not the more complicated manufacturing processes such as managing raw materials inventory and monitoring manufacturing operations.

When looking for an accounting system, find one that can easily integrate with manufacturing software such as Katana Cloud Inventory.

Connect Katana with your favorite accounting and business tools to easily sync your accounting, sales, and inventory. Automating the data transfer between your accounting and cloud manufacturing software saves you time while ensuring accuracy. Get a demo and see why thousands of manufacturers entrust Katana with running their businesses.

We hope you found this article useful, and if you have any questions, please feel free to reach out. And, until next time, happy accounting.

Table of contents

Accounting Guide

Get visibility over your sales and stock

Wave goodbye to uncertainty by using Katana Cloud Inventory for total inventory control