Product costing methods for business success

Have you ever opened your banking app and been struck with a wave of panic? Or found yourself staring at your phone screen in utter bewilderment, wondering where all your money went? These are all-too-common experiences that can be easily remedied with a well-implemented product costing system.

While personal finance can be daunting, the stakes are even higher when it comes to running a successful business. Without a solid understanding of where your expenses are going, you risk losing money and valuable resources.

That’s why product costing is a vital component of any thriving business. This article delves into the intricacies of product costing to help you gain a deeper understanding of its importance.

Table of contents

What is product costing?

Product costing is the process of calculating the comprehensive expenses associated with creating or acquiring a product, including direct costs like raw materials and labor, as well as indirect costs such as overhead and administrative expenses. By meticulously accounting for all cost components, product costing provides a holistic understanding of the true production expenses, allowing companies to set appropriate prices that cover costs and generate a profit.

Having precise and up-to-date product costing information empowers companies to make well-informed decisions about pricing strategies, production quantities, and resource allocation. With this valuable insight, businesses can determine the most cost-effective ways to produce goods, identify areas for cost reduction, and optimize their operations to drive profitability and competitiveness in the market.

Additionally, product costing plays a crucial role in budgeting, financial forecasting, and assessing the financial viability of product lines or projects, giving businesses a comprehensive view of their financial health and aiding in long-term planning.

Let’s take a closer look at the importance of product costing and the benefits it brings.

Importance of product costing

Product costing plays a pivotal role in the success and financial health of any business, regardless of its size or industry. It serves as a critical tool that enables companies to make informed and strategic decisions that can directly impact profitability and overall business performance. Here are some key reasons why product costing is of paramount importance:

- Accurate pricing — Product costing allows businesses to determine the true cost of manufacturing or acquiring a product. With precise cost data, companies can set appropriate prices that cover production expenses and provide a reasonable profit margin. This prevents underpricing, which can lead to losses, or overpricing, which may deter potential customers.

- Cost control and efficiency — By analyzing the detailed costs involved in the production process, companies can identify areas of inefficiency and take measures to control expenses. Whether it’s optimizing raw material usage, streamlining production processes, or reducing overhead costs, product costing provides insights that drive cost-saving initiatives and boost overall efficiency.

- Resource allocation — Understanding the cost breakdown of each product helps companies allocate their resources wisely. They can focus on high-margin products or those with strong market demand while phasing out less profitable ones. This strategic allocation ensures that resources are channeled where they can yield the highest returns, maximizing the company’s profitability.

- Budgeting and financial planning — Product costing provides a solid foundation for creating budgets and forecasting financial performance. Accurate cost estimates help businesses set realistic revenue targets, plan investments, and assess the financial feasibility of new product developments or business expansions.

- Competitive advantage — In a highly competitive market, having a comprehensive understanding of product costs can be a significant differentiator. Businesses that are adept at managing costs can offer competitive prices while maintaining healthy profit margins, positioning themselves favorably in the market.

- Decision-making — Product costing empowers management with valuable insights when making critical decisions. Whether it’s choosing between in-house production and outsourcing, introducing new product lines, or discontinuing unprofitable ones, the data-driven decision-making facilitated by product costing ensures well-considered choices that align with business objectives.

- Performance evaluation — Comparing actual costs to estimated costs helps in evaluating the performance of different product lines or production processes. Businesses can identify areas that need improvement, set performance benchmarks, and incentivize teams to achieve cost-saving goals.

- Financial transparency — Accurate product costing enhances financial transparency within the organization. It enables stakeholders, investors, and lenders to have a clear picture of the company’s financial health, fostering trust and confidence in the business.

In conclusion, product costing is not merely a financial exercise but a fundamental business practice that guides sound decision-making, cost control, and resource optimization.

It empowers companies to stay competitive, achieve sustainable growth, and navigate the complexities of the market with confidence, all while ensuring the efficient and profitable delivery of products to customers. By investing in robust product costing practices, businesses position themselves for success and create a strong foundation for long-term prosperity.

Product costing methods

Businesses of all shapes and sizes aim to produce high-quality products that meet customer needs while ensuring profitability. In this quest for success, product costing plays a vital role. It helps determine the cost of goods sold, which eventually determines the price of a product. While there are various types of product costing, we will delve into the four main categories that businesses typically use to categorize their expenses.

Job costing

Job costing is used to calculate the cost of producing a specific product or service. This method takes into account the labor, material, and overhead costs associated with the job. It’s commonly used in industries such as construction, where each project is unique and requires custom pricing.

Process costing

Process costing is used to calculate the cost of producing a large number of identical products. This method is typically used in manufacturing environments where products are made in large batches. The total cost of production is divided by the number of units produced to arrive at the cost per unit.

Activity-based costing

Activity-based costing, or ABC costing, allocates indirect costs to specific products or services based on the activities involved in producing them. This method is useful when many indirect costs are associated with a product, and it’s difficult to determine how to allocate those costs. By identifying the activities involved in producing a product, it becomes easier to determine how much of the indirect costs should be allocated to that product.

Standard costing

Standard costing uses predetermined standard costs for materials, labor, and overhead. The actual costs are then compared to the predetermined costs to identify variances and make adjustments. This method is useful when a company wants to identify areas of inefficiency and reduce costs.

How to find product cost?

Wondering how to calculate product cost? Finding out the product cost of your business is as simple as applying a quick product cost formula. All you have to do is add up the costs associated with the item’s production and divide them by the total number of units.

The following formula can be used to calculate the product unit cost of your business:

Product unit cost = (Direct labor + direct materials + consumable production supplies + factory overhead) / number of units produced

Product costing examples

Now that you know the formula, let’s take a look at some practical examples of what a product cost analysis looks like:

- A company manufactures 2,000 chairs, and the total cost of producing them is $20,000. This means that each chair has a product unit cost of $10 ($20,000/2,000).

- A toy manufacturer produces 2,500 toys, and the total cost for materials and labor is $50,000. Thus, the result is a product unit cost of $20 ($50,000/2,500).

It’s important to include all related costs of manufacturing the product when you calculate product cost. For the chair example, this would include the wood, nails, glue, and labor, among other costs. If these costs exceed the selling price of the chair, then your business is undoubtedly making a loss and needs to re-evaluate the product costing system immediately.

Activity-based costing vs. product costing

A more intricate way of calculating your costs is known as activity-based costing. It’s a step deeper into understanding your costs. Activity-based costing looks at the activities that go into making a product and assigns costs to those activities rather than the product itself.

For example, let’s say you manufacture computers as your main product. Your activity-based cost analysis might consider the following activities: design, assembly, testing, and shipping. Each of these activities has its own associated cost, which is then added together for an accurate total unit cost for each computer produced.

Nevertheless, every company should at least know their product cost as a bare minimum, as this knowledge alone can be used to make effective pricing decisions. When combined with activity-based costing, product costing can be a powerful tool for running an even more efficient business.

Accounting for product cost

This wasn’t meant to be a pun, but product costs are also accounted for in accounting. They are essentially categorized as inventory on the balance sheet and can be tracked in the inventory account (which is often referred to as a current asset).

The total product costs you have incurred for any given period should be reported on the income statement only when sold. This will give you an accurate view of your cost structure, and it’s also essential information when calculating taxes owed or other financial statements.

How Katana helps with product costing

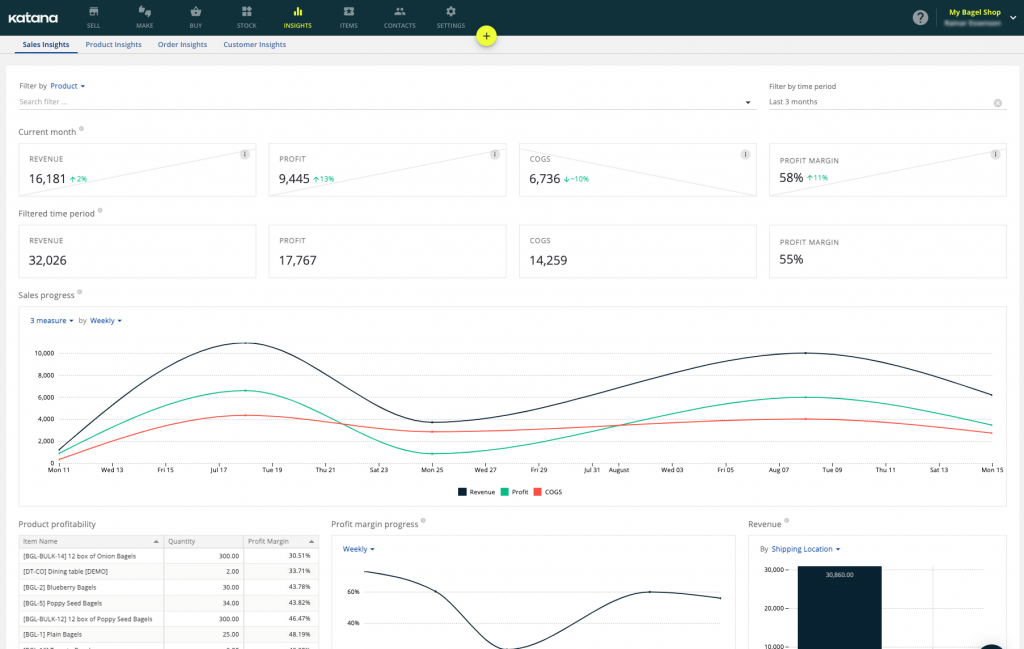

Managing the financial aspect of your business can be daunting, but with Katana’s cloud inventory platform, you can say goodbye to the hassle and embrace seamless product cost accounting. The software provides an array of tools that simplify the cost-tracking process and allow you to focus on what really matters — your business.

One of the standout features of Katana is the automated production orders system. From the moment an order is placed, the system tracks all costs associated with each product. This ensures that you have access to real-time cost data, enabling you to make informed decisions about pricing and other financial matters quickly and with ease.

With the inventory management feature, you can monitor your stock levels in real time. At the same time, Katana provides accurate information on how much it will cost to produce or purchase more products if needed. This feature helps you to optimize your inventory levels and improve your cash flow.

Katana’s reporting tools offer insights into your company’s financial performance, giving you a clear picture of where your money is heading and where it should be heading in the future. With this information, you can make data-driven decisions about your product costing and confidently take your business to new heights. Book a demo with Katana today!

Product costing FAQs

What is product costing?

Product costing is a system used by businesses to determine the total expenses associated with manufacturing a product, which includes direct costs (like materials and labor) and indirect costs (such as overhead and administrative expenses). This information helps in setting appropriate prices and making informed business decisions.

How to find product cost?

Product cost can be calculated by summing up all the direct costs (materials, labor) and indirect costs (overhead, administrative expenses) incurred in manufacturing a product.

What are product costing examples?

Examples of product costing include determining the total expenses to produce a smartphone (materials, assembly labor, factory overhead) or calculating the cost of producing a handmade artisanal chair (wood, varnish, craftsman’s labor).

What are the four types of costing?

The four types of costing are

- Job costing — Used for customized products or services

- Process costing — For mass-produced items

- Activity-based costing — Allocating costs based on activities

- Standard costing — Compares actual costs to predetermined standards

How is product costing done?

Product costing involves identifying and accumulating all costs associated with producing a specific product, usually through cost accounting systems, allocation methods, and cost allocation bases to ensure accurate cost calculations.