What is inventory revaluation and how does it help your business?

Learn all about inventory revaluation for businesses and how it works. This crucial step enhances accuracy in reporting, informs decision-making, and paves the way for increased profitability.

Ioana Neamt

For businesses that have substantial inventory needs, closely monitoring the value of that inventory should be a top priority. That’s because failing to properly value your existing inventory can do a lot of damage to your bottom line, especially when the dreaded tax season comes around.

On a lighter note, there is no need to despair over such bleak financial scenarios. Instead, you can take action, and ensure that you set time aside for inventory revaluation on a regular basis. Why should you do that?

Inventory value represents the net total value of all the products you currently have in stock. Keeping close tabs on this value is essential to running a profitable, successful business, helping you make informed decisions and avoid things like overstocking, stockouts, or unsold inventory at the end of the year.

This is where inventory revaluation comes to save the day! The revaluation process implies adjusting your inventory costs to reflect changes in standard market costs, which can result from supply chain disruptions, transportation errors, product damage, exchange rate fluctuations, or major economic events, you know, like a global pandemic or something crazy like that.

What is standard cost revaluation?

As a business operating with high inventory volumes, you’ll want to go through the inventory revaluation process for tax purposes, financial reports, or important business decisions. Standard cost revaluation is part of this process. If you notice that initially set standard costs are significantly higher or lower when compared to your actual costs of production or procurement, then it might be time to revaluate your standard costs to match the new market reality.

This process of standard cost revaluation implies updating the fixed, standard cost of a product in your inventory, taking into account relevant cost changes caused by market trends, economic shifts, industry benchmarks, and so on.

Making this update helps businesses keep better and more accurate track of their inventory costs, which in turn allows them to make informed decisions, keep accurate financial records, deal with taxes, and much more. It also enables businesses to adapt to shifting market trends or economic events, making sure that the standard costs used for inventory valuation reflect current business conditions.

How does inventory revaluation affect your balance sheets?

Regularly evaluating your inventory costs will have a direct impact on your balance sheet. If you’re selling or producing a high-demand product, such as face masks during flu season or, say, a global pandemic, the value of your inventory will be on the rise. At the same time, if you’re selling wool socks, the value of your product will go down during the summer months.

Or, if you’re stuck with unsold inventory that has become obsolete or isn’t trending anymore, that will obviously also impact your bottom line. The value of your inventory will not only go down but you’ll also be stuck paying taxes for products that are sitting in your warehouse, taking up valuable space.

What is a net realizable value (NRV)?

One of the metrics used in the inventory revaluation process is net realizable value. This metric represents the expected selling price for the products in your inventory, taking into account selling, manufacturing, and other miscellaneous costs. The resulting number could be higher or lower than the actual cost of the products, and it’s a good way of predicting potential losses.

By calculating the NRV, a business can mitigate risks and make necessary adjustments in inventory valuation, updating standard costs to match the reality of the market.

Regardless of the scenario you find yourself in, calculating your NRV will help you figure out how fluctuating inventory values are impacting your balance sheet. Here’s how to calculate it:

NRV = Market value of your product – manufacturing and selling costs

If you end up with a positive NRV, it’s a good indicator that your inventory has high value and will bring profit. A negative NRV indicates that your product is not quite as valuable when compared to the costs you’re paying for it, in which case you will classify this as a loss on inventory.

Unfortunately, this means a lower-value inventory and lower income. But you still have to account for these losses and create separate entries for them on your balance sheet for tax purposes and to avoid overstating your inventory.

Three scenarios where inventory revaluation is critical

Now, let’s go over and look at some potential situations that trigger the need for inventory revaluation. If you should find yourself in any of these situations, you might want to take a closer look at your inventory, its value, and the costs it incurs to make sure you’re not missing something. It’s better to pinpoint these things ahead of time and start disposing of unsold, obsolete, or outdated inventory to make room for products that are in demand and can bring you profit.

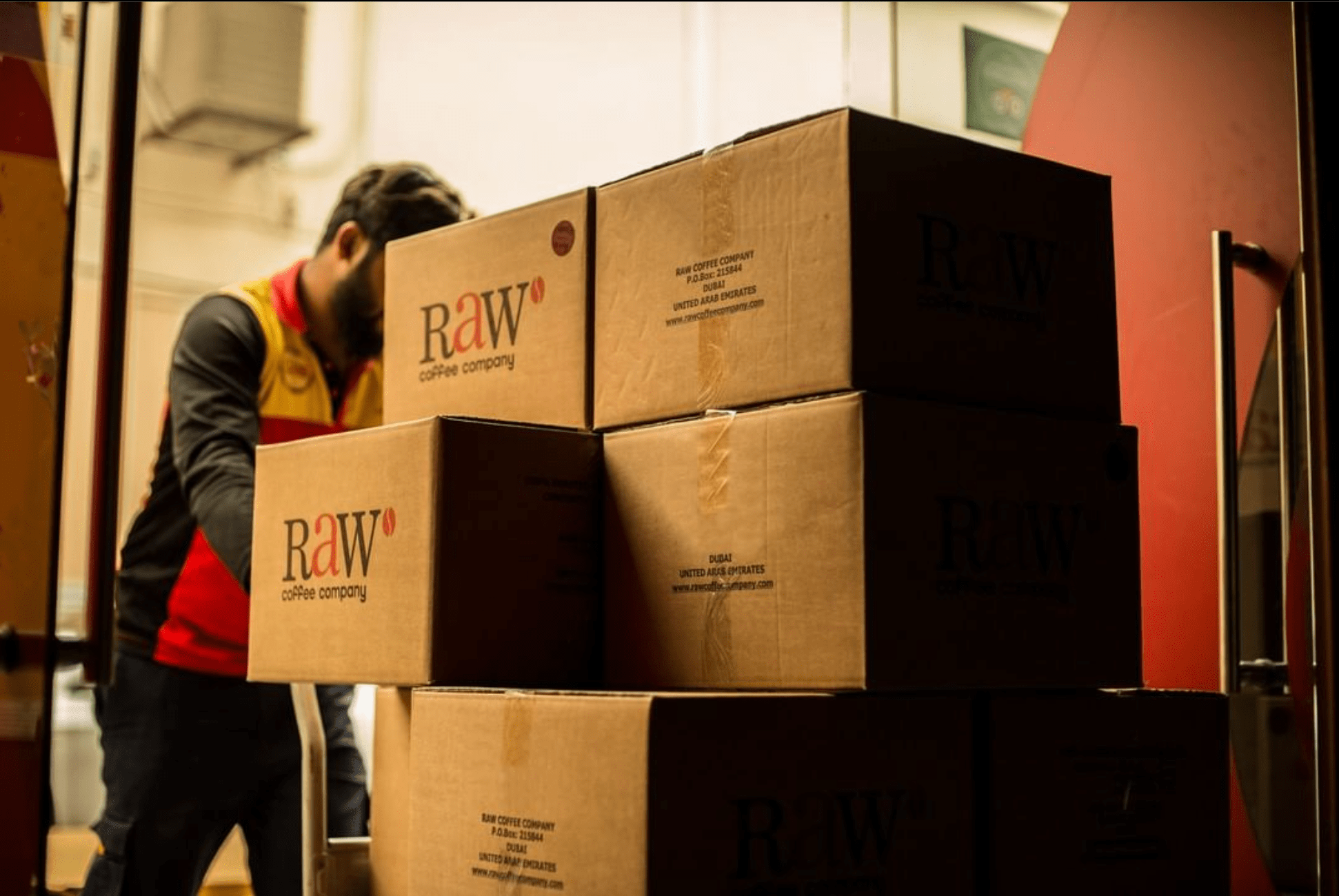

1. Supply chain disruptions

One of the most common situations that calls for inventory revaluation is related to supply chain disruptions. If you manufacture or sell products that require raw materials or ingredients, you’ll have to accept that you’re vulnerable to shifts in the supply chain if these materials are unavailable or scarce.

If you’re relying on a certain type of hardwood to produce a certain product in your inventory, and that type of hardwood is becoming scarce and increasingly expensive, this will cause your inventory costs to rise.

Or, perhaps one of your suppliers runs out of an ingredient or material that you need to be able to sell your products. It’s always a good idea to keep your options open and have multiple sources to rely on for everything you need to ensure that you won’t run out of options. If you don’t, then you’ll have to revaluate your inventory to reflect the actual costs that result from supply chain disruptions.

State of Inventory Management — Access the full report

Download the full report based on data from real businesses using Katana to explore key trends and actionable insights that will help you navigate an uncertain 2024.

2. Changes in your output

Another potential situation that requires you to have a close look at your inventory and the costs related to it has to do with changes in your output. To make sure you don’t overproduce something that is about to go out of style or become obsolete, you need to constantly evaluate your inventory, analyze market trends, and keep a close eye on consumer behavior to predict shifts in trends.

You also want to make sure you’re keeping up with demand — if there is high demand for a certain product, you don’t want to run out of it and lose momentum, so you need to find the balance between overstocking and understocking. In other words, you want to run a lean inventory and constantly be on the lookout for changes in demand and sales trends to anticipate customer needs.

3. Obsolete inventory

Another common situation that businesses go through that requires inventory revaluation is when products become obsolete or unwanted. Yes, very sad, we know, but it happens a lot. Think about it. During the pandemic, sales of face masks and disinfectants went through the roof, so much so that manufacturers were struggling to keep up with the demand. Nowadays, demand for these items has stabilized, but many companies might still have boxes upon boxes of disinfectants sitting around in their warehouses.

The bad news is that some of these products have a shelf life and are in danger of becoming obsolete.

That happens every now and then because we can’t predict the future (not yet anyways), but it can significantly impact a business’ bottom line. If you’ve incurred the costs of producing these products, there’s no way of getting that money back, and this will impact your profit. Inventory revaluation can help you mitigate some of the risks, and by tracking different factors, you might be able to predict the future just a little bit, and it might be enough to keep you afloat and profitable.

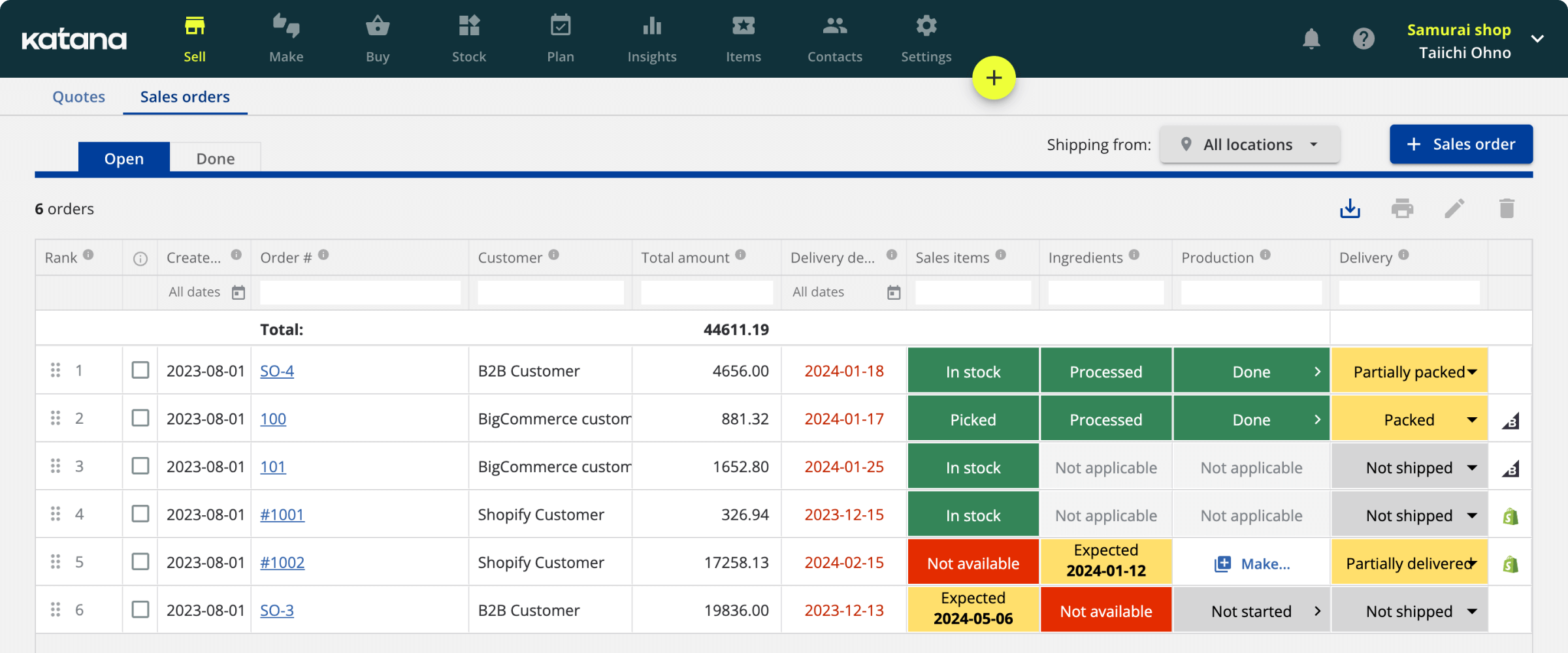

Inventory revaluation with Katana

Implementing a company-wide, reliable inventory management software can help you mitigate the risks that come with unprecedented situations like supply chain disruptions, shifts in output, manufacturing costs, raw materials availability, and so on.

With Katana, you can keep track of your inventory and the costs related to it in real time, allowing you to have a clear picture of how your business is going and how much product you have — and need to have — in stock. Preventing overstocking and stockouts is crucial to running a successful business, and Katana can help you find a sustainable balance that reflects the current conditions of the market and follows trends in consumer demand.

For more information on how Katana can help you streamline your inventory revaluation needs, reach out to us and request a demo to see our product in action!

Ioana Neamt

Table of contents

Get inventory trends, news, and tips every month

Get visibility over your sales and stock

Wave goodbye to uncertainty by using Katana Cloud Inventory for total inventory control