How does unsold inventory affect taxes?

How can managing inventory levels affect taxable income? What are some good strategies for optimizing financial performance while staying tax-efficient? We offer key insights to navigate the complex relationship between inventory management and taxation.

Ioana Neamt

When the end of the year is fast approaching, that’s when you might start worrying about any leftover stock you have sitting around in your warehouse facility. That’s because leftover stock will have a direct impact on your taxes.

f you have too many unsold products when New Year’s Eve drops, it will affect your bottom line when tax season comes around. To learn how unsold inventory affects taxes and what measures you can take to prevent this from hurting your business, keep reading.

What is unsold inventory?

Unsold inventory basically means goods or products that your business has manufactured or purchased but has been unable to sell. Unsold products collecting dust in your warehouse can be the result of overstocking, changes in consumer demand or market conditions, seasonality, or poor marketing decisions. Goods and products that you’re unable to sell within a desired time frame can hurt you in more ways than one.

These products take up storage space, they could meet their expiration dates and spoil, and may lead to financial losses. You could be forced to sell these items at a discounted price to clear up storage space or be stuck with unsold inventory that you have to write off as a loss.

The importance of managing unsold inventory effectively

Effective inventory management can help you steer clear of any issues related to unsold inventory. Implementing a reliable inventory management software solution can help you avoid overstocking and ensure that you maintain optimal inventory levels depending on consumer demand.

Such a solution can ensure you never run out of your best-selling products and that you don’t overstock your slow-moving items, which can result in unsold inventory at the end of the year.

Tax implications of unsold inventory

You might be tempted to think that unsold inventory is not a big deal when it comes to the success of your business. After all, it’s just boxes of stuff sitting on a shelf, so what harm can it do? In reality, stuff sitting on a shelf can have a significant impact on your bottom line. That’s because, for tax purposes, unsold inventory is considered an asset and one that you have to pay taxes for.

Impact of unsold inventory on taxable income

The total impact that unsold inventory can have on a business’ taxable income will depend on the method used to calculate taxes. More often than not, businesses will use the cost of goods sold (COGS) method to calculate their taxes. The cost of goods sold is deductible from a business’ revenue, and it includes the costs involved in producing or purchasing products that have been sold during a specific timeframe.

Calculation of cost of goods sold and its relation to taxes

When a business is faced with unsold inventory, then this inventory will not contribute to the calculation of COGS. Consequently, taxable income could be higher since the costs of producing or purchasing these unsold items will not be deducted.

This is how the cost of goods sold is calculated:

COGS = Beginning inventory + net purchases – ending inventory

Understating or overstating your COGS could lead to irregularities in your tax calculations. Overstating your ending inventory means you’ll be understating COGS, meaning you’ll end up with a higher taxable income and, consequently, higher taxes to pay.

Equally, understating your ending inventory means you’ll be overstating your COGS, resulting in a lower taxable income and lower taxes. It’s crucial that you calculate your COGS correctly to ensure that your tax balance reflects the realities in your warehouse inventory management.

Inventory valuation methods and taxation

The way your unsold inventory will affect your taxes depends on how you choose to manufacture or purchase the goods in your warehouse.

There are different methods to calculate the value of your inventory for tax purposes. The method that gives you greater tax gains will also produce a lower value of inventory stock. As a result, the lower the value assigned to your unsold inventory, the less it will contribute to your taxable income, potentially reducing your overall tax liability.

There are three main methods used to calculate the value of your inventory for tax purposes. We’ll review each one to see what it entails and what advantages it can bring to your business.

How businesses can benefit from donating unsold inventory for tax purposes

To offset some of those higher taxes you have to shell out at the end of the year, you might be able to donate some of your unsold inventory to get a tax deduction. The procedure and requirements vary from country to country and state to state, but in most cases, you’ll be able to donate some of the unsold goods in your stock to charities in order to get a deduction.

You can’t donate inventory that is in large quantities, unfortunately. At the same time, you can only donate inventory that is in line with the mission statement of the charitable organization of your choice, such as food, clothing, furniture, and other essential goods. The charity you pick has to be listed as a 501(c)(3) organization, such as a school or hospital.

If you have unsold inventory that has become obsolete, damaged, or no longer serves the purpose of your business, you might also be able to claim a tax deduction. You can list part of your inventory as a write-off if you purchased goods that you intended to sell but that have become obsolete in the meantime and have lost all value.

State of Inventory Management: A Review of Rising Costs

Businesses worldwide have faced challenges from supply chain volatility and may continue to experience hardships going into 2024. Download the report and see how omnichannel selling has helped Katana customers increase sales orders despite economic uncertainty.

Avoiding tax penalties and fines

Besides making sure all your ducks are in a row when it comes to your inventory at the end of the year, you also want to take all necessary steps to avoid tax penalties and fines. Miscalculating taxes on unsold inventory can lead to financial losses and legal troubles, and that’s definitely something nobody wants to experience when it comes to running a business.

One way to make sure that you avoid tax penalties is to keep up-to-date, accurate records of all your inventory, sold or unsold.

A reliable inventory management software solution can help you keep track of all your products and their characteristics, from cost and market value to quantity, batch numbers, and any other features relevant to your business. Moreover, implementing effective and modern accounting solutions can provide transparency in your daily operations and keep your records up-to-date and ready for tax season.

Another thing you can do is to stay up to speed with any relevant new tax regulations that might impact your business and make sure you employ the most advantageous tax solutions for your specific needs.

A good idea would be to work with a tax expert, legal advisor, or professional accountant to make sure you’re always up-to-date with changes in regulations. Such experts can also advise you on changing market conditions and alert you when you need to shift the way you evaluate your inventory or calculate your taxes.

How to properly manage your unsold inventory with Katana

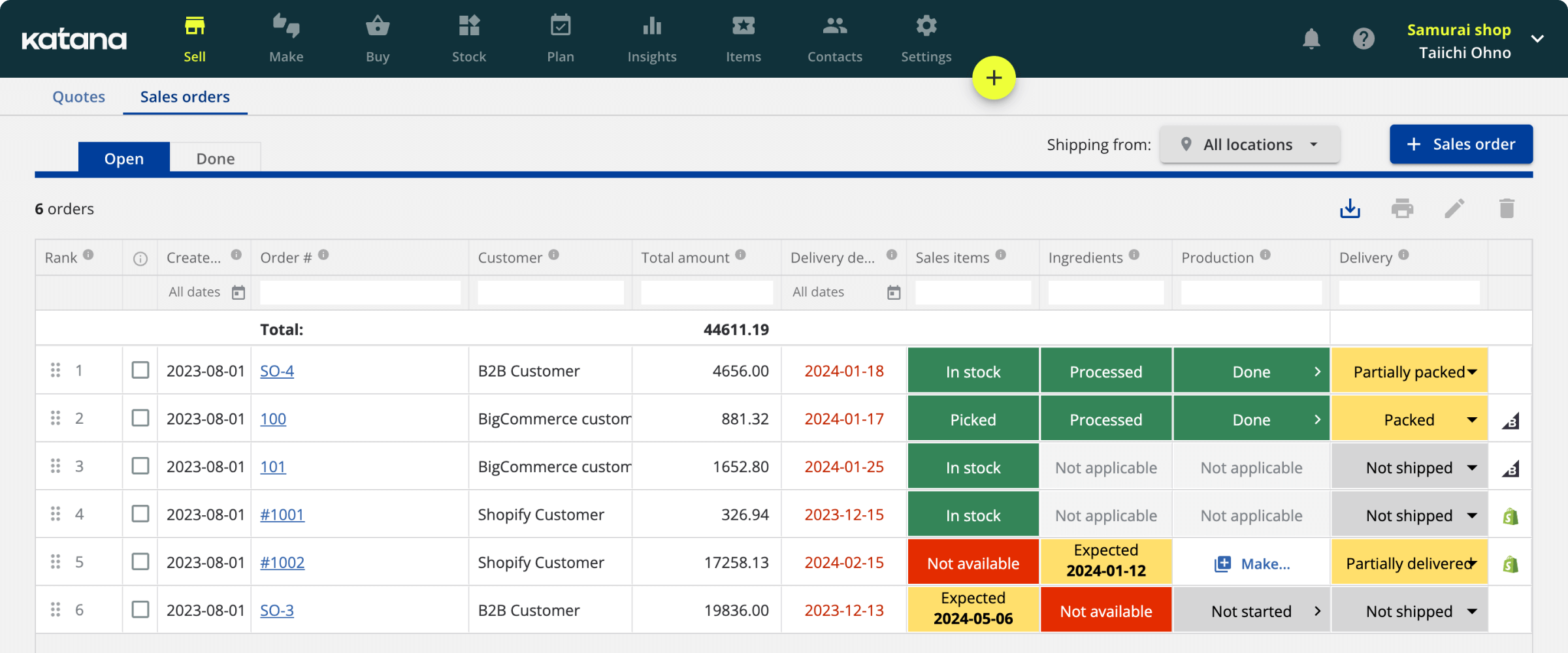

Properly managing and accounting for unsold inventory is crucial to any business, whether large or small. Keeping track of all your stock in real time and enabling transparency in the supply chain can help you keep accurate records of your finances and ensure you comply with tax regulations. With Katana, you have complete transparency into the products you have in stock, at any given time, as well as crucial data into sales trends. Knowing which are your best-selling and your slowest-moving products makes it easy for you to avoid overstocking, which can result in unsold inventory at the end of the year.

Unsold inventory FAQs

What are some common mistakes businesses make regarding unsold inventory and taxes?

Some common mistakes business owners make when it comes to unsold inventory and taxes include:

- Inaccurate inventory management, which leads to overstocking or stockouts

- Failure to tweak pricing strategies for obsolete or slow-moving inventory

- Miscalculating the cost of goods sold which can lead to financial losses or inaccurate tax statements

- Failure to apply for available tax deductions to dispose of unsold or obsolete inventory

Is it better to have more or less inventory at the end of the year for taxes?

The optimal amount of inventory a business should have at the end of the year depends on the method used to calculate the cost of goods sold (COGS). If you overstate your ending inventory, your COGS will be understated, leading to more taxable income and higher taxes to pay. If, on the other hand, you understate your ending inventory and overstate your COGS, you’ll end up with lower taxes but also lower revenue.

Ioana Neamt

Table of contents

Get inventory trends, news, and tips every month

Get visibility over your sales and stock

Wave goodbye to uncertainty by using Katana Cloud Inventory for total inventory control