Black Friday and Cyber Monday trends and statistics

Here are the Black Friday and Cyber Monday trends and statistics businesses need to know to prepare their storefronts for the biggest shopping events.

James Humphreys

It’s the most wonderful time of the year!

Well, that’s unless you’re a manager or owner who didn’t get their business ready in time for the flood of sales that usually come during this period. In a scenario like that, this is probably a period of unrelenting suffering. But it doesn’t have to be!

In this article, we explore Black Friday trends using historical data from Katana customers, supplemented by some external sources, to help you optimize your sales and inventory management for Black Friday, Cyber Monday, and beyond.

Black Friday and Cyber Monday in numbers

- Online sales orders in the US increased by 10.2% on Black Friday to $10.8 billion¹

- Cyber Monday online sales reached $13.3 billion in 2024, a 7.2% increase¹

- During Thanksgiving through Cyber Monday, 197 million shoppers visited both physical stores and online retail websites in 2024²

- Amazon had a 14% lower prices during BFCM, on average, compared to other leading US retailers³

- Walmart saw a modest 3% increase in customer spending compared to the previous year⁴

- 72% of orders made during Thanksgiving were from mobile devices⁵

Spending trends from 2022 to 2024

If there’s one thing that jumps out from the numbers, it’s how much shoppers leaned into spending between 2022 and 2024. Across those three years, purchases didn’t just increase — they surged. In 2022, around 3.4 million orders rolled in, bringing in close to $2 billion. Fast-forward to 2024, and that figure shot up to 5.5 million orders, generating over $3.2 billion. That’s a 61% boost in dollars spent, which feels less like an incremental gain and more like shoppers doubling down.

Seasonal shifts that stand out

While spending climbed year-over-year, one constant held true — November and its famous shopping frenzy stole the spotlight. Each year, the fourth quarter, buoyed by Black Friday and Cyber Monday, carried much of the year’s shopping momentum. What’s interesting, though, is the growing strength of other parts of the year. Sales growth wasn’t exclusive to the holiday season, hinting that consumers are starting to spread out their purchases rather than saving them for a single shopping sprint.

Daily head-to-head

Black Friday and Cyber Monday have become household names for shoppers, but they play to different strengths. Black Friday thrives as the all-rounder — bringing in huge numbers of transactions both online and in stores. In contrast, Cyber Monday leans into its role as the internet’s time to shine, with fewer but often higher-value purchases.

In 2024, Black Friday brought in 60,103 orders and $15.1 million in sales — impressive numbers by any standard. But Cyber Monday took the trophy for most revenue, raking in $27.4 million from 42,069 orders.

This pattern isn’t new, either. Black Friday excels in sheer volume, with shoppers piling their carts with smaller items. Cyber Monday, on the other hand, is where people seem to pull the trigger on those pricier, wish-list-worthy buys. Take 2024, for example — Black Friday’s average order value hovered at $251, while Cyber Monday hit a whopping $651.

How it’s all changing

Over the years, both events have grown, but Cyber Monday has carved out a distinct identity. Back in 2022, Cyber Monday generated $6.5 million in revenue, but by 2024, that number had climbed over four times higher. Black Friday, though still a powerhouse, is evolving into a volume-first event, while Cyber Monday is solidifying its reputation as the place to snag higher-end deals.

What the average order says about us

If there’s one figure that tells a story, it’s the average order value (AOV). In 2022, the AOV during November was $1,124, but that number dropped significantly in 2023 to $180. Fast-forward to 2024, the AVO climbed quite a bit from 2023, but was still far off from the 2024 levels, sitting at $534.

At first glance, this might seem like people are spending less. But it’s more nuanced. Smaller transactions have become the norm, possibly due to the ease of buying things online without feeling the need to pile everything into one mega-order. Combine that with free shipping, and people don’t feel the need to gather all their wish list items into one order.

How shopping habits shifted over three years

Cyber Monday stands out as a shopping event that has significantly evolved over time. Its average order value (AOV) started at $270 in 2022, grew to $311 in 2023, and then surged dramatically to $651 in 2024. This steady upward climb suggests that shoppers are increasingly using Cyber Monday for more significant, higher-value purchases, such as premium gadgets, bundled deals, or other big-ticket items.

Black Friday, in contrast, tells a different story. Its AOV began at $344 in 2022, dipped to $201 in 2023, and recovered slightly to $251 in 2024. These numbers suggest that Black Friday continues to appeal to those looking for everyday deals or smaller-ticket items, making it more of a volume-driven day compared to the focused, higher-value purchasing behavior seen on Cyber Monday.

Together, these two shopping days have transformed from simple deal-hunting events into distinct, almost ritualistic occasions. Black Friday caters to the broad, casual shopper, while Cyber Monday increasingly feels like the go-to moment for more deliberate, splurge-worthy purchases.

Industries thriving during BFCM

When you think of Black Friday and Cyber Monday, it’s easy to imagine a blur of shopping carts filled with clothes, tech gadgets, and a few perishables to round things out. But digging into the actual numbers from 2022 to 2024, some industries shine brighter than others, and a few have seen dramatic shifts that reshape the story.

Apparel: Consistent growth with a strong finish

Apparel remains a fan favorite, clocking in 644,823 sales orders in 2022, climbing to 726,770 in 2023, a 12.7% increase, and reaching 865,625 in 2024, up another 19.1%. This steady upward trend suggests that clothing and accessories have solidified their place as staples of the holiday shopping season, likely driven by steep discounts and an endless variety of options.

Furniture: A meteoric rise followed by a sharp dip

The furniture sector offers one of the most fascinating narratives. In 2022, it barely registered among Katana users with 5,863 orders. Then came 2023, when sales skyrocketed to 108,521 — a jaw-dropping 1,750% increase. But in 2024, the category cooled down significantly, dropping to 48,896 orders — a 54.9% decline. This rollercoaster ride might reflect shifting consumer priorities, with 2023 seeing a post-pandemic interest in home upgrades that tapered off as budgets refocused.

Industrial and technology: A mixed bag

This category saw solid growth in 2023, with a 65.1% jump from 221,450 orders in 2022 to 365,700. However, 2024 brought a 15.9% decline, pulling sales down to 307,635. While still a popular choice, this dip might suggest that shoppers are becoming more selective, focusing on higher-end or bundled deals rather than smaller tech purchases.

Drawing conclusions

While apparel continues its steady climb, categories like furniture and tech show just how quickly trends can shift. Some industries see long-term growth, while others experience dramatic booms that quickly fade. What’s clear is that Black Friday and Cyber Monday are more than just “big tech and clothing” events — they’re a reflection of how people’s priorities and habits evolve year after year.

Preferred ecommerce platforms

Looking at Katana users, we can see Shopify reigns supreme, handling an impressive 77% of all sales orders through integrations. It’s clearly the preferred platform, offering widespread compatibility and simplicity for businesses.

WooCommerce, while much smaller ranging between 5-8% is quietly making its mark. While the share is still modest, it has shown a steady climb within the last year.

How business sizes respond to Black Friday and Cyber Monday

If there’s one thing certain about Black Friday and Cyber Monday, it’s their undeniable ability to stir up excitement across different types of businesses. But not all companies respond to this retail frenzy in the same way. Looking at medium-sized SMBs and smaller-sized SMBs we see some compelling patterns that highlight how distinct groups approach these key shopping days.

Who wins the spending spree?

When it comes to percentage growth, medium-sized SMBs are having their moment. Between 2022 and 2024, their revenue surged by an impressive 370%. For comparison, the smaller SMBs still grew — by about 23% over the same period — but their starting figures in our sample were already much higher, making their growth more incremental than explosive.

This difference in pace might hint at untapped potential in medium-sized businesses. As they refine their strategies, they’re clearly capitalizing on opportunities that allow them to scale during these key shopping windows.

Trends that matter

What’s interesting is how these businesses are growing not just in revenue but also in order volume. Medium-sized SMBs increased their order counts by over 60% from 2022 to 2024, indicating that they’re selling more, not just charging more. For smaller SMBs, order volumes rose around 72% over the same period, showing they’ve been able to both sustain and grow their loyal customer base.

The key difference seems to lie in their approach. Smaller businesses might lean on agility, offering unique deals or products that attract a steady stream of buyers year after year. Medium-sized businesses, however, appear to be leveraging scale and improving operational efficiency, which might explain their higher revenue growth relative to order volume increases.

Raw material prices throughout the years

As businesses strategize to handle growing order volumes and meet customer expectations, one underlying factor quietly shaping the landscape is raw material costs. While many businesses offer steep discounts during Black Friday and Cyber Monday, raw material prices have experienced some intense swings. The stats below highlight how these shifts have played out across various commodities, covering trends from 2021 through November 2024.

Changes in raw material prices

- Cocoa prices remained stable around $2.40 per kg in 2021-2022 but rose to $7.89⁶

- Arabica coffee prices climbed from $5.63 per kg to $6.72⁶

- The price of Robusta coffee started from $1.98 per kg, reaching a high of $4.98 in 2024⁶

- Cotton prices saw a drop from $2.23 per kg to $1.80⁶

- Rubber prices increased from $2.07 per kg to $2.29⁶

- The price of copper decreased from $9,317 per metric ton to $8,500⁶

- The price of soybeans declined from $583 per metric ton to $436⁶

Food prices

The supply chain issues largely caused by COVID-19 greatly impacted the food prices. Luckily, it seems that the effects have finally subdued, and a lot of prices have decreased after these astronomical jumps.

The total average increase for all food prices since 2021 sits at 9.03%, down about 15.9% since their peak in 2022. Here are some of the outliers that have seen significant price changes since 2021.

Top 3 increases:

- Oranges: 295.38%

- Palmkernel oil: 31.44%

- Beef: 15.73%

Top 3 decreases:

- Lamb: -32.68%

- Soybeans: -25.21%

- Bananas, U.S.: -24.79%

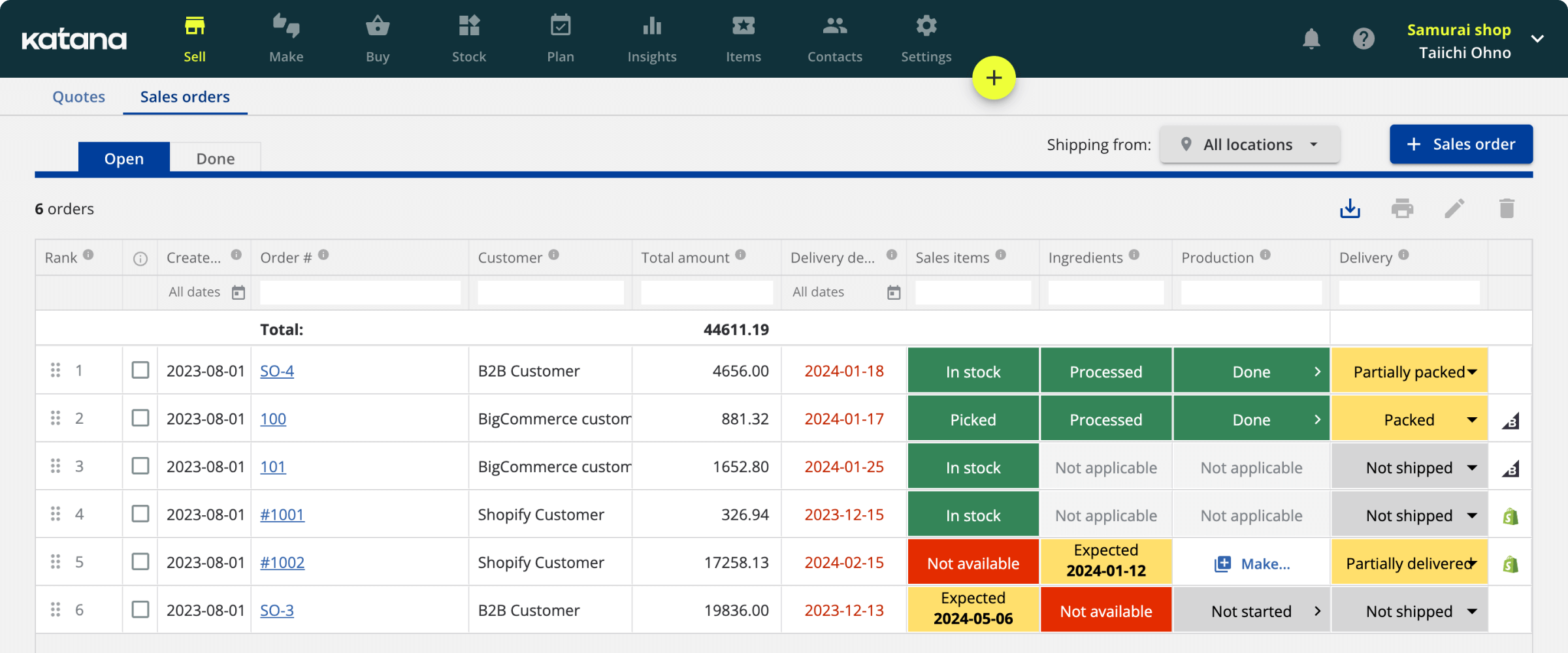

Using Katana Cloud Inventory to manage your BFCM sales

Katana is primarily designed to help businesses manage inventory, production, and order fulfillment.

It can play a significant role in helping businesses prepare for high-demand shopping events like Black Friday and Cyber Monday in these key areas:

- Inventory management — Ensure adequate stock by monitoring inventory levels in real time. This helps businesses make sure that they have enough products in stock to meet the increased demand during BFCM.

- Demand forecasting — Data analysis with access to historical sales data to provide insights into expected demand during the holiday season. This helps businesses decide how much inventory to produce or order.

- Production planning — Businesses can plan and schedule production efficiently. This ensures products are ready and available for sale before BFCM.

- Order processing — Automate order processing so orders are fulfilled accurately and quickly. This is crucial during high-traffic periods.

- Omnichannel sales integration — Integrate with various ecommerce platforms and marketplaces, allowing businesses to manage omnichannel orders and inventory from a central platform.

While Katana may not be a dedicated Black Friday or Cyber Monday tool, its core functionalities related to inventory, production, and order management can greatly contribute to a business’ ability to handle the increased demand and sales volume during these peak shopping events. See for yourself. Get a demo.

Sources

¹D2C Manufacturing in a Recession: A 2022 Review of Peak Holiday Sales Periods, Katana (2023)

²Online discounts forecast during the holiday season worldwide in 2022, by product category, Statista (2023)

³Why Food Prices May Be Peaking, Morgan Stanley (2023)

⁴Inflation continues to rise—and gas prices are up nearly 50% since last year, CNBC (2022)

⁵You shop online at work. We all know it. And this research proves it, Fast Company (2023)

⁶Cyber Monday Drove $11.3 Billion in Online Spending, Breaking E-Commerce Record, Adobe (2022)

Black Friday and Cyber Monday FAQs

According to Retail Drive, during the extended shopping extravaganza spanning Thanksgiving through Cyber Monday, a staggering 189.6 million shoppers in the US hit both physical stores and online retail websites. This marked a 14% increase compared to the previous year, as per a National Retail Federation and Prosper Insights & Analytics report:

- Out of this shopping frenzy, 124 million opted for the in-store experience, while 142.2 million chose the convenience of online shopping

- And some savvy shoppers (75.7 million, to be precise) decided to enjoy the best of both worlds by shopping both in-store and online

When it comes to pinpointing the busiest shopping days, Black Friday takes the crown with a whopping 84.2 million shoppers, closely followed by Small Business Saturday with 59.9 million enthusiasts. Thanksgiving Day attracted 37.8 million shoppers, Sunday saw 29.2 million, and Cyber Monday brought in 21.8 million eager shoppers.

Black Friday stole the limelight as the busiest digital shopping day, welcoming a whopping 93.2 million online shoppers, surpassing Cyber Monday’s 83.3 million.

Cyber Monday reeled in a staggering $11.3 billion in online sales, as reported by Adobe Analytics.

This figure represents a 5.8% increase compared to the previous year’s Cyber Monday, which had recorded $10.7 billion in sales (a slight dip from 2020’s $10.8 billion).

What’s more, this achievement marks a record-breaking day and sets the bar high for the entire year.

Typically, Cyber Monday shines as the peak of the extended holiday weekend. Part of its charm is that it falls when folks have returned to work, but the sales momentum continues unabated. This five-day shopping spree outperformed initial estimates. Thanksgiving saw a robust $5.29 billion in sales, while Black Friday notched up an impressive $9.12 billion — both surpassing earlier forecasts. The weekend sandwiched in between these two big days contributed another $9.55 billion to the grand total.

James Humphreys

Table of contents

Get inventory trends, news, and tips every month

Get visibility over your sales and stock

Wave goodbye to uncertainty by using Katana Cloud Inventory for total inventory control