Backflushing inventory without backlash

The success of backflushing inventory depends on how closely standard costs match actual costs, ultimately ensuring accurate inventory costs. Unlike conventional methods that track and record costs during production, backflushing counts expenses only after production has ended or a service has been rendered. We dive into how backflushing allows for an accurate, consolidated allocation of all costs at the end of a product’s manufacture or service delivery.

Ioana Neamt

Backflushing inventory is a simplified approach to assigning production costs to products.

Simple, right? Wrong.

Backflushing is a challenging and complex method — though some businesses might call it a saving grace — of handling the technicalities of accounting for products and inventory. But let’s take it from the top.

The backflushing strategy involves recording inventory transactions after the completion of the production process. The term describes the retrospective incorporation of costs into the system. That’s because the costs associated with the manufacturing of goods are calculated only after production is complete.

Pompous etymology aside, the advantages of backflushing inventory range from reduced transaction costs to more timely financial reporting to an improved cash flow. And, just like Céline Dion’s heart, the list of backflushing benefits will go on.

If you’re looking to find out why Rose didn’t make room for Jack on that floating door, we don’t know. But if you’re looking for answers to questions like “What exactly is backflushing inventory? How to manage backflushing inventory? And what’s the big deal anyway?”, you’re in the right place.

What is backflushing inventory?

Backflushing inventory comes under different names, such as backflushing accounting or backflushing costing. But no matter what you call it in-house, this inventory management method is the way to go for many businesses.

Backflushing inventory is an accounting technique used in manufacturing. Long story short, it helps manage costs and inventory more efficiently. But what really makes backflushing inventory unique is that it records costs only once production finishes or service has been provided. This makes it different from traditional methods that record costs during the production phase.

Since it doesn’t involve complex real-time reporting of costs, backflushing inventory helps allocate all costs in one go once a service or a product’s production concludes. However, while it enhances efficiency, some businesses may note that the method does not provide detailed enough tracking during production as traditional costing methods do.

How does backflushing inventory work?

Simply put, all production management costs are compiled into a single entry at the end of the production process instead of real-time expense reporting. Backflushing inventory simplifies expense tracking by consolidating costs at the end of the production run. This means that the total costs of a production run are basically recorded in one go at the conclusion of the process.

Typically, the cost of a product or service is calculated through various stages of production. Backflush inventory or costing, on the other hand, eliminates work-in-process (WIP) accounts, aiming to simplify the accounting process and reduce costs for businesses. This is done by applying standard costs to products or services after they have been sold or delivered. It’s important to keep in mind that differences between these standard costs and actual costs happen often — but more on that when we get to the section on the challenges of backflushing.

Costs captured at the end of production provide a better analysis of cost structures. And the fact that it leads to less paperwork only makes it more popular. Better yet, businesses or companies that employ backflushing inventory count on it because of key benefits that become clearer the more you use the method.

Benefits of backflushing inventory

All in all, backflushing inventory simplifies the costly and complex process of real-time expense reporting. Ultimately, it can boost production efficiency and help in managing costs and inventory.

Backflush inventory is a versatile concept that can be integrated into a hybrid costing system. This means companies can employ multiple methods of production costing at the same time. Not only is this a great opportunity for businesses to experiment with the strategy, but to use it only in cases most likely to benefit from it.

Here’s a quick breakdown of the advantages of backflushing inventory:

- Simplifies the process and reduces costs in terms of time and resources. Companies deal with fewer journal entries and transactions, leading to less paperwork and administrative work. Wins all around!

- Provides more timely financial reporting and an accurate image of product costs. Can also prove beneficial for informed long-term decision-making.

- Enhances efficiency within the process by allowing for faster and more efficient production and sales processes.

Potential backflush disadvantages

If you’re not in the mood for backflushing backlash, you should know straight off the bat that the method is not for everyone.

Backflushing inventory has gained significant traction in recent years. However, implementing backflush costing techniques requires careful consideration of your firm’s unique needs and production processes. Experts will tell you that, for example, backflushing inventory is unsuitable for extensive production processes or the manufacturing of tailored products.

The backflushing inventory method is best applicable when dealing with short production cycles, commoditized items or standardized services, and steady or low inventory levels. As it caters to specific circumstances, some companies might find it challenging to implement. Others might find out it’s not the way to go at all.

So, let’s dive into why backflushing inventory may not be the one for a business.

- Unsuitable for companies with slow inventory turnover. Since it records costs only at the end of the production process, this strategy may not align well with organizations with a slow-moving inventory. This delayed cost recognition might lead to challenges in forecasting accuracy, assessing the profitability, and overall efficiency of inventory turnover.

- Backflushing inventory may be unsuitable for companies requiring strict GAAP conformity. It’s important to note that the method often doesn’t align with the Generally Accepted Accounting Principles that companies must follow for financial reporting.

- Backflushing inventory may actually complicate the auditing process. Auditing involves a detailed examination of financial records for accuracy and compliance. So, backflushing inventory may not be the way to go, as it fails to provide a detailed breakdown of specific products.

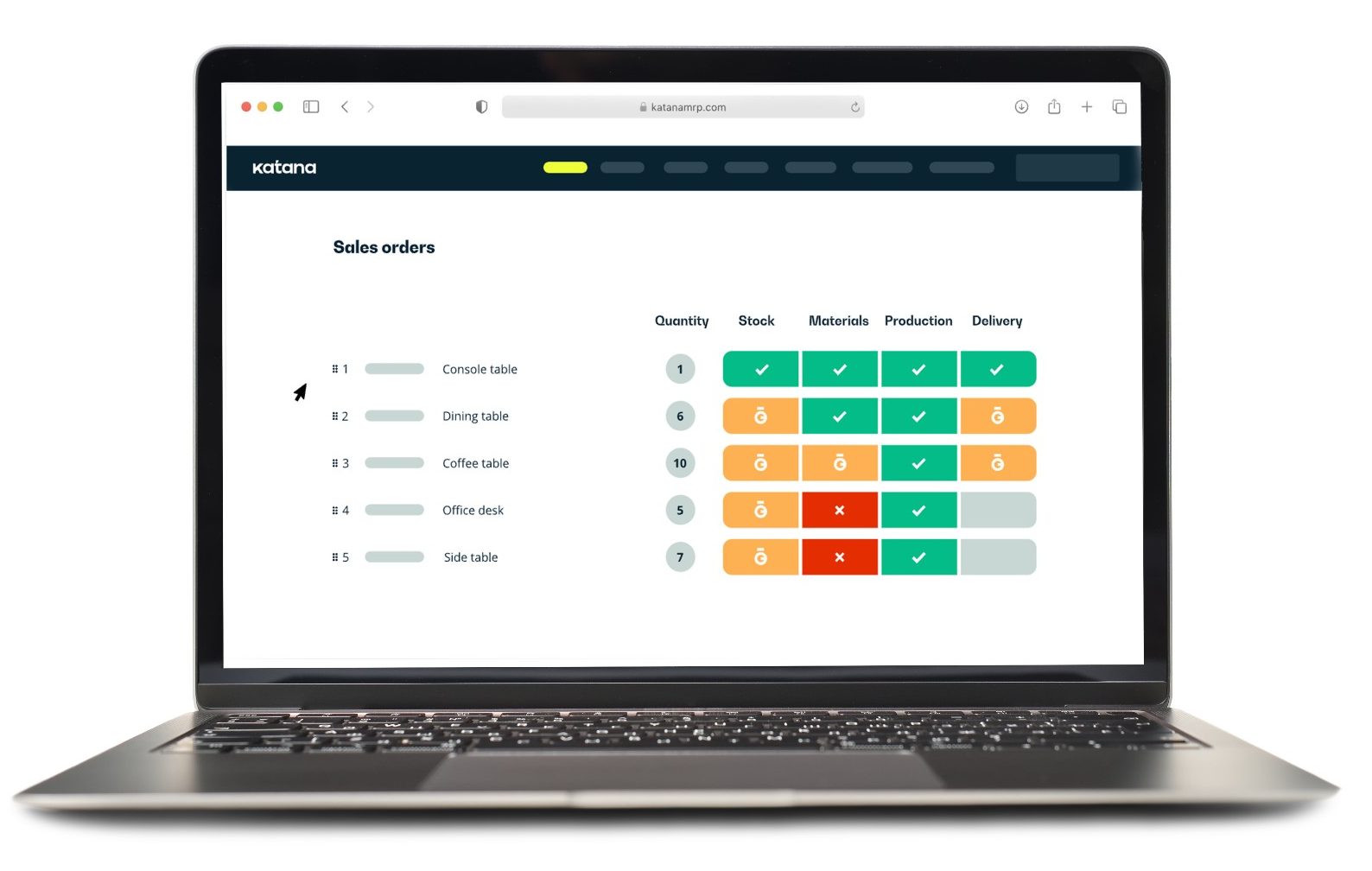

Backflushing inventory done right with Katana

So, there you have it. Backflushing inventory is used to record costs related to product manufacturing after completion or sale. It also leads to more efficient production and sales while supporting educated decisions on pricing, profitability, and resource allocation. Achieving efficiency, business sustainability, and profit maximization is something Katana knows a thing or two about.

When it comes to acing backflushing inventory, think of Katana as your go-to source. From production schedules to real-time insights, through all the nitty-gritty details of inventory management, Katana is here to smooth out all the wrinkles in your processes and take your inventory management services to the next level. Booke a demo to learn more about how Katana can help.

Ioana Neamt

Table of contents

Get inventory trends, news, and tips every month

Get visibility over your sales and stock

Wave goodbye to uncertainty with Katana Cloud Inventory — AI-powered for total inventory control