From balance sheet to shop floor: Weighted average cost in inventory valuation

The weighted average cost inventory valuation method is a key accounting tool that helps you accurately value your inventory and make informed decisions about pricing and profit margins.

Ioana Neamt

It’s early April, and a shopper enters your sportswear store. Their eyes stop on a pair of sneakers they’ve wanted since the previous summer. The price tag says $40 (well, $39.99 really — you know your way around psychology), but there’s a clearance sale to free up the shelves for the new collection. The shoes are now $25. It’s a no-brainer.

Yet, as they wait in line, they start to wonder: did you knock $15 off the original price, just like that? Can you do that and still make money? This answer lies buried deep in your balance sheets. More specifically, in the weighted average cost (WAC), the method you use to value your inventory.

When is the weighted average cost used?

Suppose you’re running a retail store. The weighted average cost method is a pretty important part of your inventory management. It’s all about figuring out the value of your inventory and getting an accurate overview without too much complication. Two key metrics factor in here: the cost of goods sold (COGS) that helps you gauge your profitability, and the value of your inventory on hand, which is important for financial reporting and tax calculations.

Now, if you tend to stock up from several different sources at different times and price points, things get complicated quickly. Grocery stores, convenience stores, or clothing retailers are prone to have this issue because of their high-volume and frequently changing inventory. The situation has weighted average cost written all over it.

Note: Companies are required by law to use consistent and transparent inventory valuation methods. Weighted average cost is widely used across the globe, and it’s compliant with both the generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS) standards.

How to calculate weighted average cost

To calculate your weighted average cost, start by gathering your data. Collect the following information for each item in your inventory:

- The number of products you have in your inventory (units available for sale)

- The total purchase price of the items in your inventory

Once you have these, the weighted average cost formula is as simple as it gets:

WAC = COGS / units available for sale

Example calculations

Say your apparel store started the year with 20 pairs of last year’s sneakers for a total cost of $600, or $30 per pair. You quickly sold half of them in January, so the next month, you bought another 5 pairs for $125 ($25 each) from a different supplier.

However, February was a particularly slow month, and you didn’t sell any. Sales had picked up by March, and you managed to move 15 pairs out the door, so at the end of the month, you went back to the second supplier to get another 20 pairs. They gave you a 10% discount for the larger order, so you got that batch for $450 ($22.5 per pair).

Condensing it all down — by the end of the first quarter, your figures look like this:

| January | February | March | |

| Starting inventory | 20 x $30 = $600 | 10 | 15 |

| Purchased | 0 | 5 x $25 = $125 | 20 x $22.5 = $450 |

| Sold | 10 | 0 | 15 |

Your COGS at the end of the first quarter is $600 + $125 + $450 = $1,175

Meanwhile, your units available for sale add up to 20 + 5 + 20 = 45

WAC = 1,175 / 45 = $26.11

For the 25 pairs of sneakers that you sold in Q1, you will allocate $26.11 per unit. The remaining 20 pairs will be your opening inventory for Q2. So, you’ll start April with these figures:

- 20 units x $26.11 WAC = $522.2 in COGS

- $1,175 – $522.2 = $652.8 in opening inventory

To satisfy your customer’s curiosity, you’re not making any profit on your sneakers sold in the clearance sale. You’re actually losing $1.11 per pair, but it helps you recover most of your investment, and the small loss certainly beats keeping dead stock on your shelves.

Besides, your first quarter was profitable when you were selling the sneakers for $40, so you’re not in the red at the end of the day.

Benefits of the weighted average cost method

The weighted average cost inventory valuation method offers several advantages:

- Ease of use — The concept is easy to understand, and the calculation doesn’t require complex math or long and detailed records. It’s also easy to implement in tracking software, so it’s updated automatically as your inventory levels change.

- Accuracy — It reflects the current cost of inventory, which can be more accurate than using historical cost methods like FIFO or LIFO.

Disadvantages of the weighted average cost method

While weighted average cost is simple, accurate, and widely used, it does have its limitations:

- Sensitivity to price volatility — WAC assumes that all inventory items are identical, regardless of their age or features. This can make it inaccurate when inventory prices fluctuate widely. This drawback is particularly evident when older inventory is nearing its expiration date, in the case of businesses with a diverse inventory or markets with volatile prices.

- Difficult to calculate in some circumstances — WAC can be difficult to calculate for periods of high inflation or for companies with large and complex inventories, especially if the inventory has seen radical changes.

Weighted average cost vs. simple average cost

The only difference between the simple and weighted average cost methods is that the simple average doesn’t take into account the individual price of each item. If the sneakers in the example above were to cost between $25-$27 a pair regardless of supplier, time of year, etc., you could probably get away with allocating a $26 simple average each time you value your inventory, especially at a low volume.

The higher the volume and the wider the price gaps, the more WAC starts to shine.

WAC vs. first in – first out (FIFO)

While in weighted average costing, you treat your current inventory as a whole, treating all purchases at different price points differently, the FIFO method assumes that the first items purchased were and will be the first items sold. This means that your COGS is also based on the oldest inventory costs, which will be reported in your income statement, too.

FIFO can be more accurate than WAC, for example, when inventory costs are generally rising. In this scenario, FIFO will result in lower COGS and higher income in your reporting. It’s also the preferred inventory management method when dealing with perishable goods.

WAC vs. last in – first out (LIFO)

The LIFO method is the opposite of FIFO, in that it assumes that the last items purchased are always the first items sold. Your COGS is also based on the most recent inventory costs. This can come in handy if tax rates are high because your reported costs will be higher, and you’ll pay less income tax.

Confirm with your accountant

The International Financial Reporting Standards (IFRS) and The Accounting Standards for Private Enterprises (ASPE) prohibit the use of the last in, first out (LIFO) method, as it may misrepresent a company’s financial performance. However, the use of LIFO is permissible under Generally Accepted Accounting Principles (GAAP).

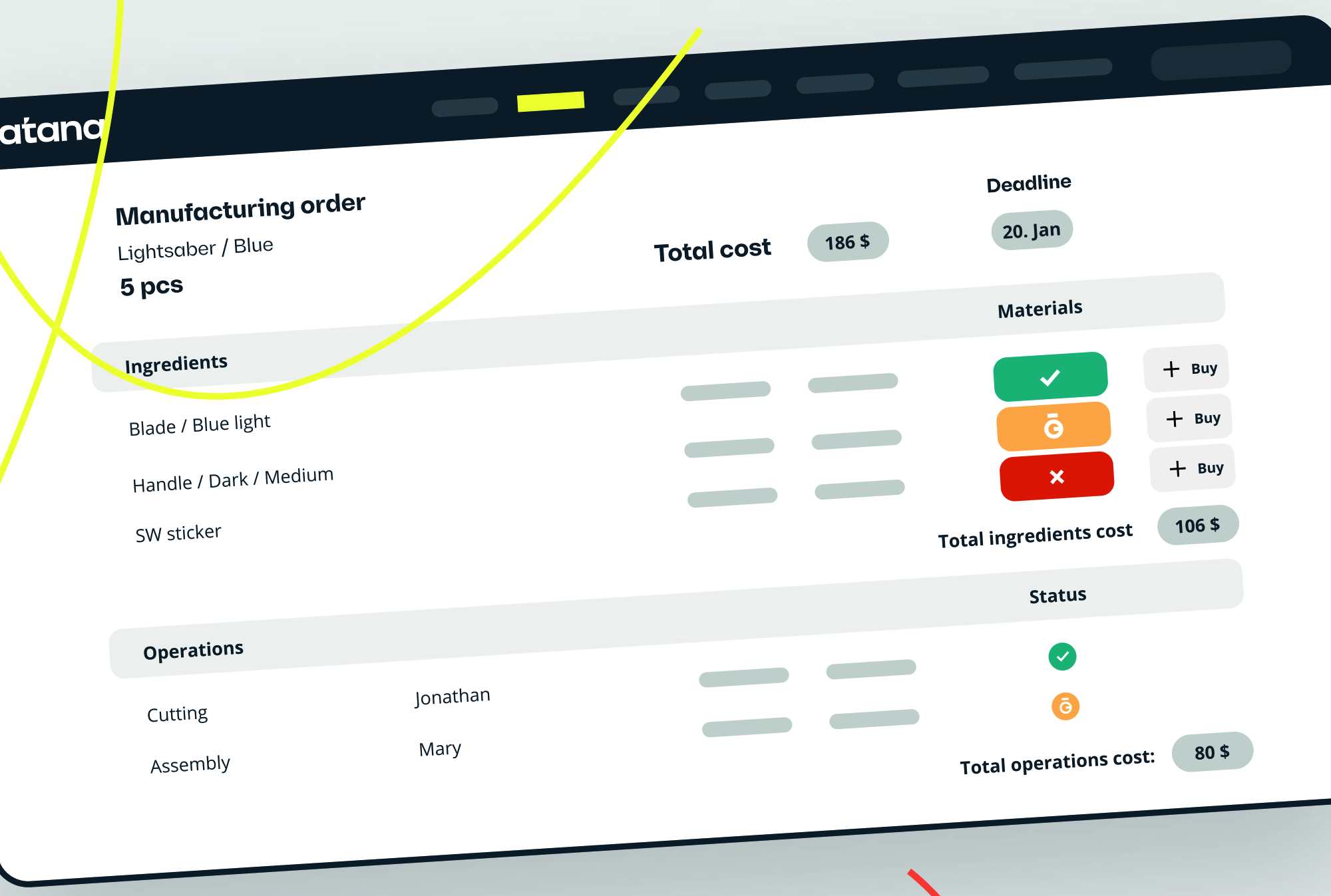

Weighted average cost inventory valuation powered by Katana

Katana is a cloud-based platform used by thousands of businesses to manage their inventory. It comes with features for:

- Real-time inventory tracking — Get live updates on stock levels to streamline your reporting and help prevent stockouts and overstocking.

- COGS tracking — See your COGS at a glance and make data-driven decisions to maintain profitability and improve efficiency.

- Financial insights — Track your business performance to ensure maximum efficiency and profitability,

- Integrations — Katana integrates with your existing systems, such as your e-commerce store and accounting software, to save you time and money by eliminating manual data entry.

If you want to see the product in action, feel free to drop us a line to book a demo.

Ioana Neamt

Table of contents

Get inventory trends, news, and tips every month

Get visibility over your sales and stock

Wave goodbye to uncertainty with Katana Cloud Inventory — AI-powered for total inventory control