How to sell a manufacturing business

You’ll want to make sure you get all your books in order, get a valuation of your business and negotiate with your potential buyers. This article will go through the steps you need to take to sell your manufacturing business.

Erik Väli

There might be many reasons behind the decision to sell a manufacturing business — it’s time to retire, you have the chance to sell it for a profit, it’s just time to move on to new things, or maybe even start a new business. Regardless of the reason behind the sale, you’ll want to ensure two things:

- That the process will go as smoothly as possible

- That you will get the best possible deal

To achieve this, you will need to know how to value a manufacturing business before selling it and what you need to do to prepare before you start contacting buyers. Then, you’ll still need to figure out how to find a trustworthy buyer who will offer the best price for your business and know what to expect during the negotiation process.

Due to all of this, selling a manufacturing business is a lengthy process that can often take a long time — on average, around 7 months but in some cases more. As such, it’s a good idea to prepare ahead of time and know what you’re getting into. This article will give you an overview of the steps you’ll likely face along the way.

Get your business back on track

If you’re not ready to part ways with your business, then Katana is here to support your business with everything you need to optimize your operations.

Sale of stock vs. sale of assets

There are generally two ways to sell a manufacturing business:

Stock sales and asset sales

A stock sale involves the buyer purchasing the owner’s shares of the company (if your business is an LLC) or the buyer purchasing the seller’s stocks (if your business is a corporation). Stock sales cannot be done if you operate your business as a sole trader or partnership, as the ownership of your business would not be tied to stocks.

An asset sale, on the other hand, involves the buyer purchasing specific assets from the seller.

Which path to selling your business is better for you will depend on the type of business you run and what you are trying to accomplish with the sale.

Stock Sales

When a buyer purchases the owner’s share of a company, they take over as the owner. This includes the assets of the company, the legal entity of the company itself, and any liabilities. Therefore, if there are any assets you don’t want to sell to the buyer will have to be distributed first. Any liabilities that you don’t think your buyer would be happy to take over should also be paid off before the sale.

One of the main advantages from the seller’s point of view is that there’s a bit less paperwork to do on your end, as it’s usually a simpler transaction. Stock sales are normally not taxed as heavily as asset sales. You are also less likely to end up responsible for any potential liabilities in the future.

Asset Sales

An asset sale involves selling either individual or multiple assets of your business. The buyer does not directly take over ownership of your business entity in the case of an asset sale.

The “asset” in the sale can be anything from inventory assets to patents and intellectual property. This means a more detailed agreement is generally required compared to stock sales, as you’ll need to clarify exactly which assets and liabilities are included in the sale. Asset sales might also require a bit more work, depending on the assets involved. For example, getting third-party consent to sell some of your assets.

Asset sales tend to be taxed more than stock sales. They are, however, often preferred by many buyers due to the tax benefits they can gain on their end and due to the fact that you won’t necessarily have to transfer all the liabilities of your business to the buyer (which can also be time-consuming on your end).

How to prepare for the sale

Let’s start by going over some of the steps you’ll want to go over before you start talking with buyers and openly marketing your business. This includes steps such as figuring out what price you’ll aim for your business and getting your financial affairs ready before the sale.

It’s good to ensure all of these steps are in order before you start talking with your potential buyers. This will help speed up the negotiating process and build trust between you and the buyer.

Pricing your manufacturing business

Before you start negotiating with buyers, you’ll want to get a fair estimate for the price you can sell your business for. But how do you price a manufacturing business to sell it for the right amount? To do this, you will need to evaluate your business.

A valuation essentially estimates how much a potential buyer will be willing to pay for your business. It is recommended you hire a professional (or even multiple advisors to cover all aspects of your business, from accounting to legal) to give an accurate appraisal of your manufacturing business.

The results of the valuation will depend on factors such as:

- The net value of your assets

- Your sales numbers

- Your growth forecasts

- Your staff and their skills

All of this might inform the final pricing of your business and the details of your final deal. For example, if your business is no longer growing or your sales are low, you might still get a decent price based on the value of your assets or the experience of your staff.

Preparing the necessary documentation

Getting all the necessary documentation for your business ready and organized is important before you start talking to buyers. This is to avoid delays and ensure you have all the necessary information your buyer might need in a clear and accurate form.

You’ll want to prepare:

- Your financial records (tax returns, 3 years of financial statements, credit history, bank statements, etc.)

- Articles of incorporation and other documents related to your business formation

- Business licenses, employment agreements, leases, and/or deeds on equipment and buildings

- Inventory lists, product information, lists, and contacts for suppliers/distributors

Keep in mind that this list is not comprehensive. The exact documents you will need will depend on the nature of your manufacturing business. But, to cut a long story short, you’ll essentially want to prepare all the documentation required to run your business because your buyer will need them once they take over.

Getting your physical locations in order

Finally, before starting the selling process, it’s a good idea to clean up your business in a literal sense. You’ll want your manufacturing business to be running like a well-oiled machine before handing it over.

Make sure:

- Your manufacturing processes are running as efficiently as possible

- Your warehouses are well-organized and tidy

- You are complying with environmental and waste management regulations

All of this will leave a good impression on your buyer and let them know they are taking over a business that is organized and functional.

Selling your business

Now that we’ve covered all of the preparations needed before selling a manufacturing business let’s take a look at how to actually go through with the sale.

Marketing your business

Marketing your manufacturing business to potential buyers is a little different from marketing most other things you want to sell. You don’t want to give out sensitive information about your business to anyone unnecessarily. Therefore, you’re not really aiming to reach as many people as possible — rather, you’re looking to reach out to a relatively small amount of the right people.

This is why it’s important to get a clear idea of your target market. You’ll want to consider questions such as whether you’re more likely to sell to a current competitor, an investment fund, or someone else, what kind of resources and qualifications your buyer will need, etc.

Finding the right buyer

After figuring out your target market, it is a good idea to make a list of businesses, individuals, and/or funds that might be interested in purchasing your business.

Consider who might be willing (and able) to pay the most for your business, who would be the best fit for taking over your business in terms of culture/future plans/values, the reputation of the potential buyers on your list, etc.

Once you’ve narrowed down and prioritized your list, it’s finally time to start reaching out to start the negotiating process.

Negotiating with your buyer

As mentioned earlier, you don’t want to risk unnecessarily giving out sensitive and detailed information about the inner workings of your business unnecessarily. Therefore, while you’ll want to be transparent and build trust with the buyer, you won’t want to give them everything before ensuring they’re interested and have signed a non-disclosure agreement.

Letter of Intent (LOI)

The next step is signing a Letter of Intent (LOI) with your buyer. The LOI is a document that will include elements such as the proposed price, the timeline for the deal, the form of payment used, to what extent you, as the seller, will remain involved in the business going forward, etc.

However, the LOI is not a binding contract, so the deal might still fall through after it has been signed.

Buyer’s Due Diligence

Naturally, the buyer will want to do due diligence on your company before they complete the purchase. This process can take up to a couple of months, as the buyer double-checks that everything you have told them so far is accurate and there aren’t any extra impediments to the deal.

This is also part of the negotiation where you’ll be thankful for having prepared all the necessary documentation ahead of time, as this will help speed up the process.

The Sales Agreement

The Sales Agreement (sometimes called by different names, such as Purchase & Sale Agreement or Asset Purchase Agreement) will be sent to you by the buyer once they’re satisfied with the due diligence process.

The Sales Agreement should be fairly close to what you and the buyer agreed to through the LOI. However, unlike the LOI, it is legally binding.

Closing the deal

Once the Sales Agreement has been signed and the purchase is complete, you will often still be needed to oversee and advise the new owner during the transition period of the business.

When handing over to the new management, you’ll need to clear up any third-party consents required, provide the buyer with closing documents and help transfer your employees, customers, suppliers, etc. This process can often take quite a long time (sometimes up to a year).

Not ready to sell your business?

Perhaps all your business needs is a helping hand. Katana supports manufacturers with the essential tools to optimize their business and keep up with orders while you get things under control.

Manage your manufacturing business with Katana

Selling your business is a long and complicated process that often takes years to fully finalize. And as mentioned, you’ll want to make sure your business is running as smoothly as possible before entering negotiations. After all, it is best to sell a manufacturing business when it is worth the most while it is most productive and profitable.

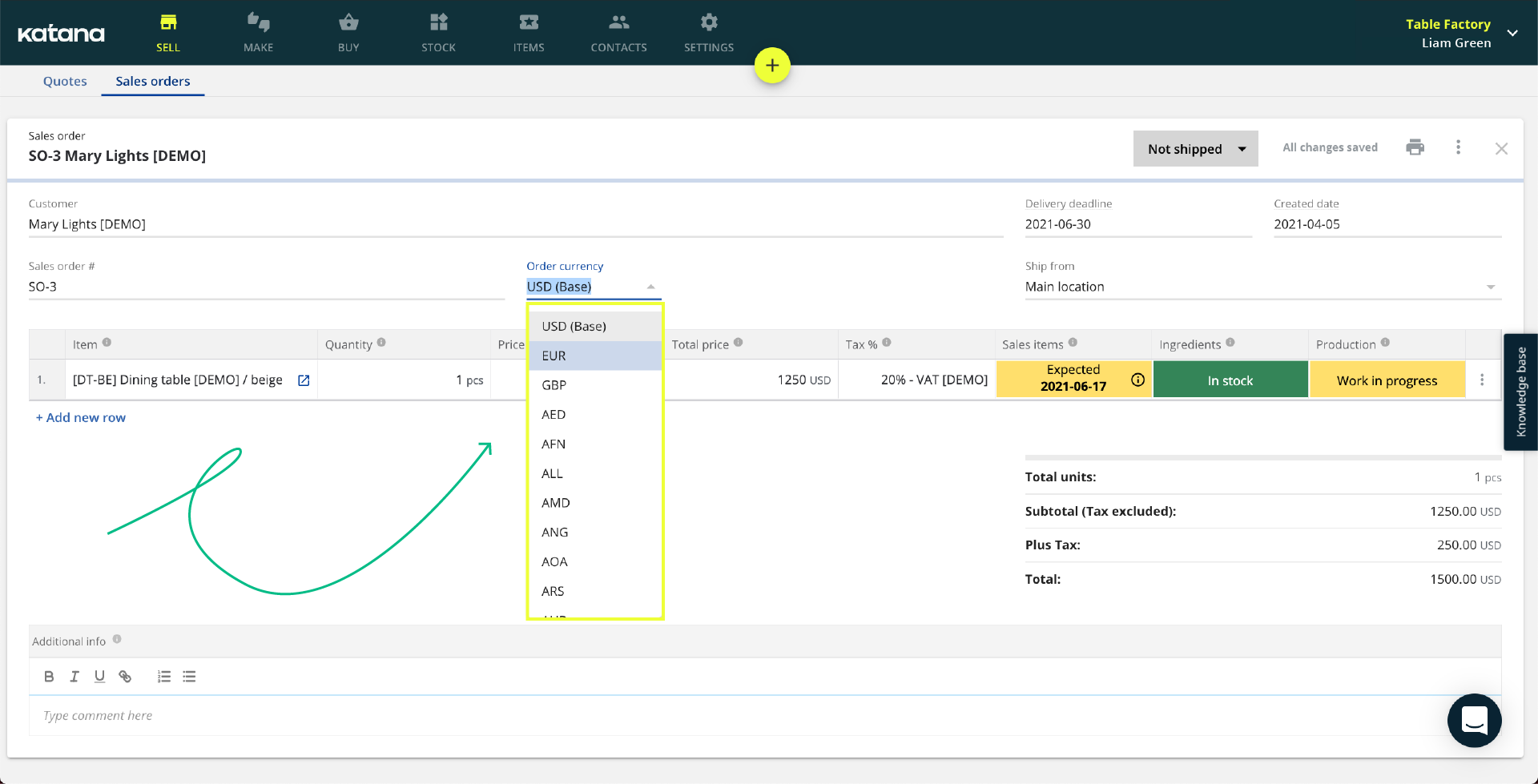

Katana’s cloud inventory software can help you with this. You can ensure the productivity of your business and get a clear overview of your manufacturing process with features such as:

- Live inventory tracking

- Integration with the best e-commerce, accounting, CRM, and reporting tools on the market

- Sales order insights

- Accurate costing

- And so much more

Reach out to our sales team and request a demo to see Katana in action.

Erik Väli

Table of contents

Get inventory trends, news, and tips every month

Get visibility over your sales and stock

Wave goodbye to uncertainty with Katana Cloud Inventory — AI-powered for total inventory control