Navigating 2025 tariffs

A manufacturer’s guide to managing costs and protecting profits

As of 2025, businesses across the world are waking up to a new reality of tariffs affecting their supply chains. Manufacturers and inventory managers must quickly reassess their strategies.

Navigating tariffs

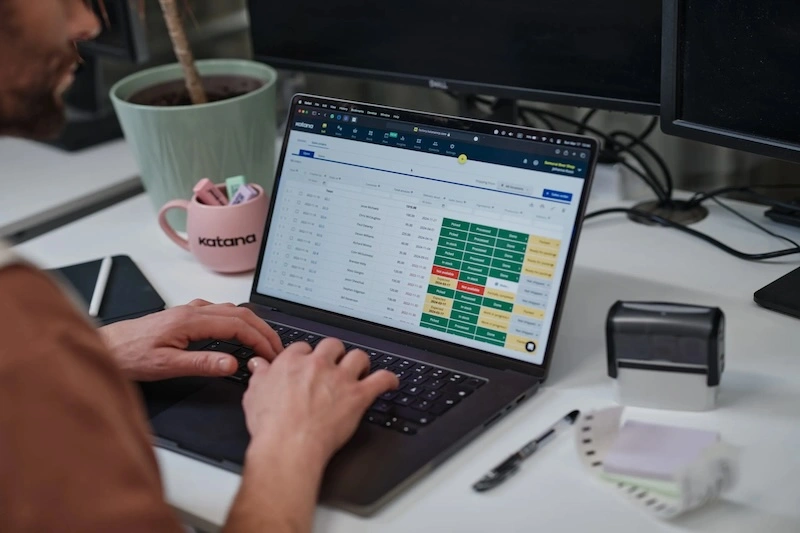

Tariffs impact more than just raw material costs from your suppliers — they affect where you manufacture, where you assemble, and where you sell. To protect your profit margins and adapt, you need to plan and forecast accurately, which is why real-time visibility into demand and supply is crucial. Integrated tools for monitoring demand fluctuation on all sales channels will give a competitive advantage and allow rapid adjustments.

Where to focus to protect your profit in 2025

Right now short and mid-term tactics will help in securing sufficient cash flow and ensure profitable growth also in rapidly changing circumstances.

Supplier management and cost control

By reevaluating sourcing strategies and considering local suppliers, companies can mitigate reliance on taxed imports and potential supply chain disruptions. Additionally, analyzing purchase orders to assess raw materials sourced from these countries helps estimate cost increases for both total inventory and individual products, enabling informed decision-making to maintain profitability.

- Track supplier country data — Quickly filter and assess which of your suppliers are impacted by tariffs.

- Reevaluate sourcing strategies — Identify potential local suppliers to reduce reliance on taxed imports.

- Analyze purchase orders — Review raw materials sourced from countries subject to US tariffs to estimate cost increases of total inventory as well as individual products.

SKU-based cost analysis and visibility

Businesses should quickly conduct scenario planning by applying these tariffs to their current inventory values to assess potential cost increases. It’s also crucial to evaluate the impact of tariffs on purchase orders at various stages, whether pending, partially received, or fully received — to ensure accurate cost tracking and anticipate near-future financial implications. By incorporating these potential added costs into manufacturing planning, companies can maintain profitability and avoid selling products at a loss.

- Scenario planning with current inventory — Apply tariffs to current inventory value to get an idea of the impact added costs would have.

- Apply tariffs to current order statuses — Whether your purchase orders are not received, partially received, or fully received, estimate the near-future impact and ensure accurate cost tracking.

- Profit margin calculations — Factor potential tariffs into bill of materials costs to ensure you won’t unknowingly sell any products at a loss.

Demand forecasting and pricing adjustments

Right now, the most accurate method is to leverage historical data to forecast the financial impact of increased costs and adjust safety stock levels accordingly. Analyzing the effect of these tariffs on each product enables companies to identify which finished goods may experience price shifts and assess potential changes in demand.

- Use historical data for predictive planning — Forecast the financial impact of increased costs so you can rapidly adjust safety stock levels.

- Understand impact per SKU — Analyze which finished goods will experience price shifts due to new tariffs and evaluate the impact on demand.

- Evaluate cost-plus pricing — Update purchase prices to reflect new tariff-inclusive material costs and adjust selling prices to maintain profitability.

Integrated sales and inventory adjustments

Optimized replenishment planning by adjusting production schedules to manage purchase volumes and prevent overstocking of costly materials is prudent in this situation. Maintaining real-time visibility across sales channels is crucial to monitor demand trends and focus on more profitable markets. Regularly exporting and analyzing sales order reports, filtered by country or currency, can help assess both immediate and long-term financial risks.

- Optimize replenishment planning — Plan SKU-based replenishment schedules to adjust purchase volume and prevent overstocking expensive materials.

- Real-time visibility across sales channels — Understand the inventory needs of each sales channel to monitor demand trends and shift focus to profitable markets.

- Export reports for quick analysis — Export sales orders regularly and filter by country/currency to assess immediate and long-term financial risks.

Taking action: What should you do next?

Manufacturers should audit suppliers to identify raw materials at risk of cost increases, estimate tariff impacts on the cost of goods sold (COGS), and adjust pricing to maintain profitability. By optimizing purchasing strategies, automating sales order flow, and using real-time inventory monitoring, companies can proactively manage demand fluctuations and mitigate financial risks.

Review your suppliers

Audit suppliers to determine which raw materials are at risk of cost increases.

Estimate cost changes

Input tariffs as added costs to inventory to see how they affect COGS and profit margins.

Plan price adjustments

Adjust selling prices to reflect rising costs and protect your profit margins.

Optimize purchasing strategies

Seek alternative suppliers or increase stock levels before tariffs take full effect to avoid price hikes.

Automate sales order flow

Connect sales orders with your inventory system for real-time demand insights.

Monitor inventory in real time

Use Katana’s tools to stay ahead of potential fluctuations in demand and stock.

Webinar recording

Navigating Tariffs: Inventory Insights From 1500 SMBs

Join Katana as we explore how the potential tariffs will change the game specifically for SMBs, and what you can do now to prepare.

Protect your profits with tariff management

With tariffs expected to shift over the next four years, businesses must adopt flexible, data-driven inventory management. Katana provides real-time insights, automated cost tracking, and smart forecasting to help you navigate the impact of tariffs efficiently.

Stay ahead of supply chain disruptions — optimize your operations with Katana today!